What are crypto options?

Options are derivative instruments that give the holder the right to buy or sell an asset at a predetermined price.

An option is a contract, therefore, when interacting with it, the trader does not trade a real asset. This gives a certain advantage: you can earn on the volatility of crypto, without having to buy it.

Cryptocurrency options are a rather complex but very useful financial instrument that, if used correctly, will allow you to hedge open positions or earn on price fluctuations.

The difference between options and futures

The option is the right to buy or sell an asset, and not a liability, as it works in futures trading. When buying an option, a trader can choose to either activate it or not depending on the current market situation and profitability. To obtain such an option, the buyer must pay a certain amount, which is called a “premium”. The amount of the premium is relative and depends on the asset, expiration date, price, and market volatility. Futures, on the other hand, do not require any additional costs.

Structure and types of options

Each option has a direction, a strike price (the value of the underlying asset), an expiration date, and a premium.

There are two main types of options – American and European. American options do not have an expiration date and can be closed at any moment. European options are only executed at the time of expiration. It is worth mentioning that these names arose by chance and are not related to these countries.

Depending on the predicted behavior of the asset, you can buy Put or Call Options:

● A call option allows you to buy an asset at a specific price until the contract expires. This is profitable when the market is rising, but not profitable when it falls;

● A put option allows you to sell an asset at an agreed price on the expiration date. Such a contract saves money during drawdowns by allowing you to sell an asset at a predetermined price, even if the market price is already very low.

How do options work?

To better understand options, it is better to show their application in practice.

■ For instance, a trader buys a $10,000 call option on BTC for 90 days and a $1,000 premium. BTC rises to $15,000 and the trader executes the contract paying only the premium. The net profit was $4,000. If the price of Bitcoin falls to $5,000, the trader will only lose a $1,000 premium.

■ By buying a put option with the same parameters as in the example above, the trader gets the opportunity to sell BTC for $10,000 within 90 days, regardless of the market price. If the asset rises in price, say to $20,000, you can not execute an option and avoid a loss of $10,000. Instead, you want to let the option expire and pay only a $1,000 premium.

How the premium is formed

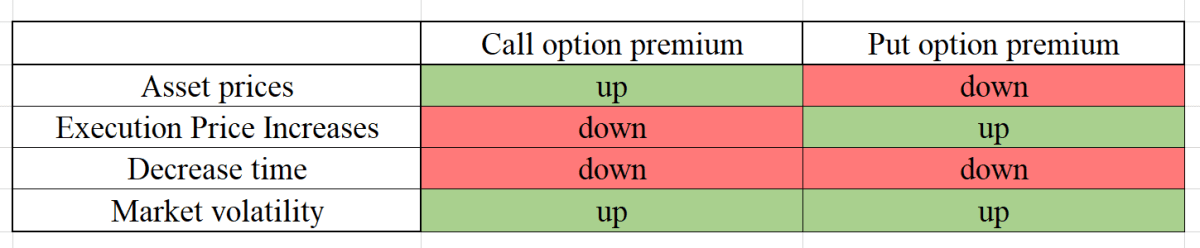

From the above, we can conclude that buyers of the option risk only the amount they pay as a premium. And the size of the premium itself is formed from several factors:

● Price of the underlying asset;

● Increase in execution price;

● Time reduction;

● Market volatility.

Each of the factors affects the puts and calls differently. You can see more details in the chart below.

How these factors affect the premium

Everything’s clear with the buyers. But what about the sellers?

Unlike the crypto options buyers, the sellers (the issuers who create this option) earn on premiums. That is, it is beneficial for them that the premium grows because their profit depends on it.

Most issuers are required to hold some amount of asset before selling the option. This allows them to minimize risks if the price of crypto goes in the wrong direction.

Pros and cons

Crypto options are used in several strategies and for different purposes.

The advantages of options:

● Possibility of hedging. By buying a put option, and having the underlying asset available, you can minimize losses in the event of a big drop;

● Speculation. For example, by buying a call option, you can buy an asset at a discount, even if its price has already risen a lot;

● Availability of several combinations of options use, with different risk/reward ratios;

● Options can be used in both bull and bear markets;

● Several options can be opened on one asset.

The disadvantages of options:

● Complex mechanism of the tool;

● High risks, especially for the options issuers, because they need to create a contract and set its configuration, and the buyer is only a "consumer";

● Complexity of trading strategies;

● Low liquidity. This emerges from the first and second factors – few traders use options, and even fewer sell them;

● High volatility of the option premium.

What exchanges offer options?

The largest volume of these contracts was previously presented on FTX. Now options can be traded on Bybit, Deribit, OKX, and Bitfinex.

Thus, cryptocurrency options are a useful tool that can minimize losses during bear markets and help the trader to earn money with the right understanding of the instrument.

Recommended