What are market makers and takers?

Markets are made up of both makers and takers. The makers create buy or sell orders that aren't executed immediately; this generates liquidity. And those who buy or sell instantly are referred to as "takers." In other words, the takers carry out the orders created by the makers.

Before we delve into the topic of makers and takers, let's first understand what liquidity means

It's important to understand that when you hear someone say an asset is liquid or illiquid, they are referring to how easily and quickly one asset can be traded for another.

A significant volume of trading, a large number of market participants, and sizable demand and supply on the market are all indicators of a liquid asset. This makes it easier for buyers and sellers to find each other and reduces the chances of a single order causing a sharp price change.

However, an asset may be considered illiquid if there are few participants and little trading activity. Due to the lack of demand, it will be difficult to sell an asset at a fair price. You will therefore have to wait for a long time for an order with the desired price to appear, or you will have to sell the asset at a lower price.

When trading, it's critical to understand whether you're a maker or a taker in terms of liquidity, as this affects the commission on a centralized exchange (CEX).

What are market makers and takers?

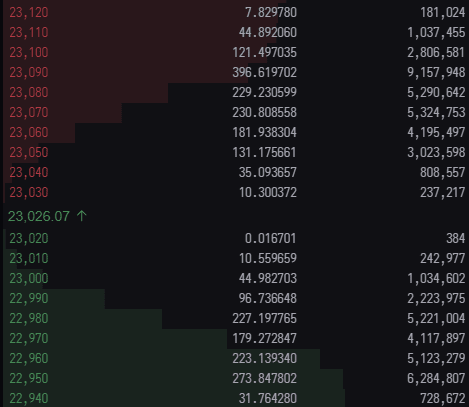

Every exchange has an order book for each trading pair. Users who have orders in it are referred to as "makers." They generate buy or sell orders that are only carried out when a specific price is reached. Such orders are known as limit orders.

In this way, makers create liquidity by providing demand for buying or selling an asset at a certain price. The makers “make” markets, while the takers create orders that are immediately executed at the market price. These are known as market orders, where the takers meet the demand for the purchase or sale of an asset produced by the makers. It is the takers who move the market by changing the price of the asset.

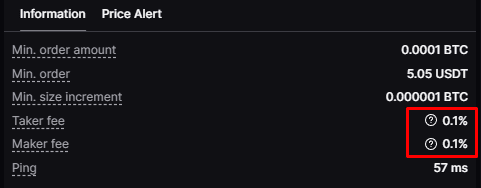

This is why the commissions for these two market participants differ. The maker's commission is always lower than or equal to the taker's commission. This is done to encourage trading since the maker creates the asset's liquidity while the taker, on the contrary, removes liquidity from the market.

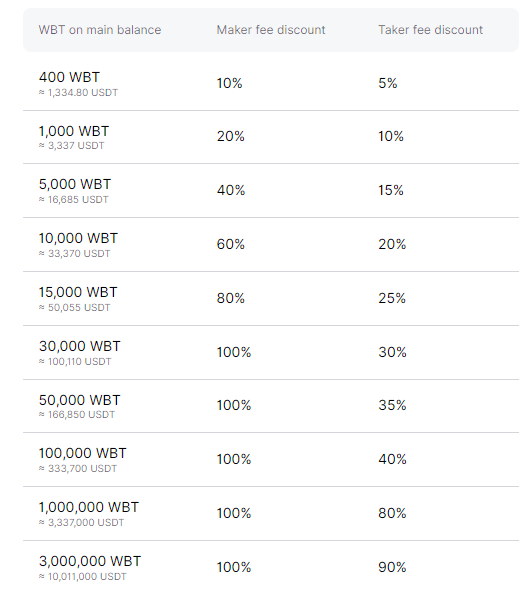

You can save money on trading fees by storing the WBT tokens on the crypto exchange WhiteBIT.

You can find promising market conditions, trade correctly, and make informed trading decisions if you are aware of your liquidity status and the order book's current state.

Recommended