What are the bid and ask prices?

What differentiates the ask and bid prices? What is a spread, and what factors determine its size? How can the trading book and order book be used to predict the future direction of price movement?

Let's use a typical currency exchange booth (also known as a "bureau de change") as an example to better understand ask and bid prices. The most common response at the teller station to the question "How much is a dollar worth?" is "Do you want to buy or sell?" In other words, each fiat has two prices: the buy price and the sell price.

Therefore, the buy price of a currency at the bureau de change may be regarded as the bid price. Under this offer, the client is free to sell any money he has. And the price at which the client can purchase currency is the sell price or the ask price. A spread is a difference between the sell and buy prices. The size of the spread represents the earnings of the exchange booth.

Exchange rates

For instance, if you purchase $1,000 and sell it right away at the exchange rate, as in the example, you will automatically lose $180. The income of the exchange point also rises by $180 at the same time.

(Note that since it is a mirror operation for the bureau de change, the buy price for the client is shown in the "WE SELL AT" section and the sale price is shown in the "WE BUY AT" section in the image above.)

A stockbroker serves as an intermediary on platforms offering margin trading, where buying and selling occur without physical delivery of an asset and require a reverse transaction. Even though the spread's size is fixed, the ask and bid prices fluctuate based on the asset's market value. The spread is usually expressed in points and is calculated separately for each trading pair. An exchange that offers a smaller spread is more appealing to traders, as it allows for more competitive pricing and increased trading volume.

The spread is usually expressed in points and is calculated separately for each trading pair. An exchange that offers a smaller spread is more appealing to traders, as it allows for more competitive pricing and increased trading volume.

When trading on a platform involves physical delivery of an asset, the exchange acts as an intermediary, but it does not profit from the spread in this scenario. Instead, the exchange earns a commission based on a fixed percentage of the transaction value. However, ask and bid prices are still in effect. The primary types of orders must first be defined in order to comprehend how they are formed. A trader can use limit or market orders to buy or sell an asset.

A market order is a request to buy or sell an asset at the price that has been set on the market at the time. This type of order is immediately executed at the best market price.

A limit order is a trader's request to sell or buy an asset at a specific price. If no buyers are willing to buy or sell the asset at the specified price, information about the order is entered into the order book.

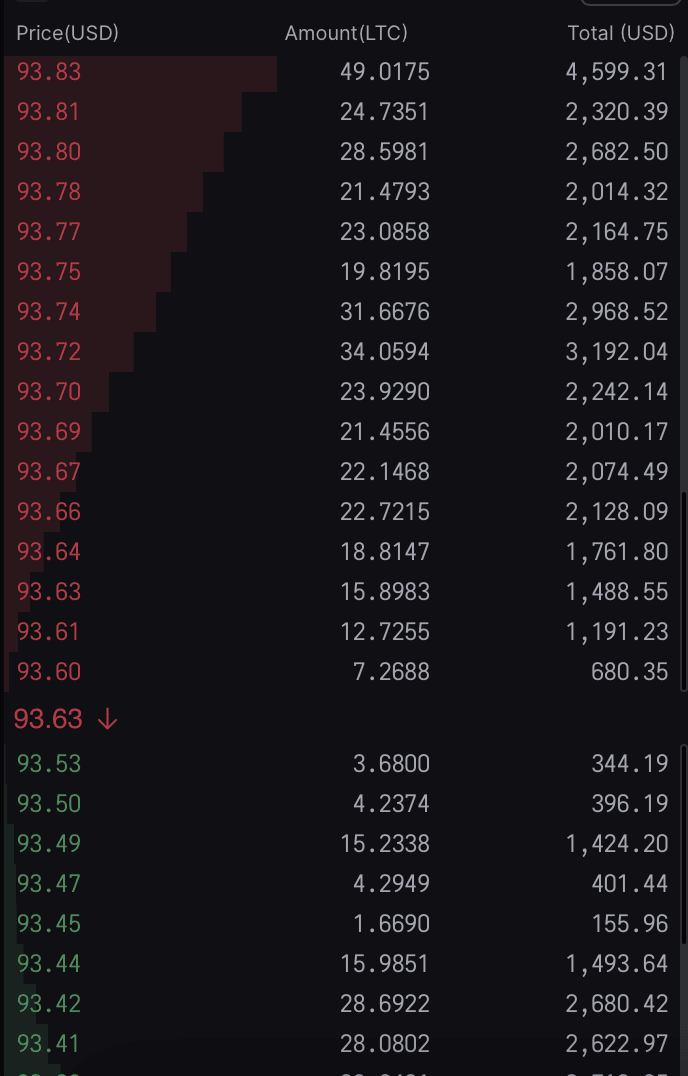

In limit orders, the buy price and the sale price do not match because everyone wants to buy cheaper and sell more expensive. These orders are pending execution in the order books. This is an illustration of the LTC buy/sell order book on the WhiteBIT exchange.

Order book

The ask prices in the image are highlighted in red, indicating the prices at which sellers are looking to sell Litecoin. LTC sales volume is shown alongside its equivalent in dollars. The volume value is repeated in the form of histogram bars for clarity.

Bid prices are indicated in green. These are the highest prices at which users are willing to buy LTC.

The price with an arrow between the ask and bid prices shows the price at which the last buy/sell transaction was completed. If the previous transaction was made at a higher price, the color of the price with an arrow will be red, indicating a decrease in the asset's price. However, if it was made at a lower price, it would be green. When the price of the asset rises, the green arrow will point upward.

The spread in this case will be the difference between the lowest ask price and the highest bid price. The spread's size will be determined by the asset's liquidity as well as the activity of market participants placing orders.

Trades can be modified and deleted while orders are still pending. A buy/sell trade is executed when:

- The ask price matches the bid price in limit orders;

- The buy order appears on the market and is executed at the best ask price;

- The sell order appears on the market and is executed at the best bid price.

A trading book keeps track of completed trades separately. A combined analysis of the trading book and the book of orders along with volume indicators aids the trader in navigating the current market situation and reveals whether bulls or bears will control the market in the near future.

Recommended