What does a price chart consist of, and how to read it?

Price charts may seem incomprehensible and complicated, but that’s only at first glance. Also, a beginner should understand the functionality of the exchange and master the basic tools to understand what is happening on the chart. Let us analyze some points in detail.

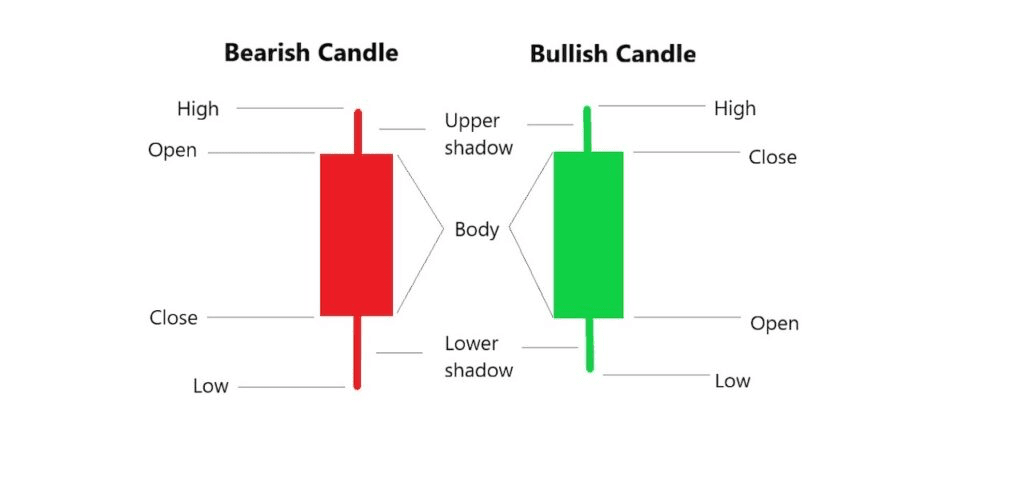

Japanese candlesticks

When you open any exchange website, you will come across the so-called “Japanese candlesticks”. These red-green rectangles are the main price indicator. Each candlestick represents the price activity of an asset at a specific time frame (5 minutes, 1 hour, day, week).

Candlesticks consist of two basic elements: The “body” and the “wick” (many call it the “shadow of the candle”). The body (the central part of the candle) shows the opening and closing prices for the corresponding period. The wick, in turn, shows the highest and lowest price points at which the asset was traded.

A green candlestick (or “bullish candle”) is a candlestick with a higher closing price than the opening one. In contrast, a red candle (or “bearish candle”) has a lower closing price than the opening one.

Understanding the market trend

“The trend is your best friend,” many professional traders say. Why so? The answer is pretty simple: it’s easier to trade that way. Trading against the trend is much riskier and less promising. It’s like walking against the wind.

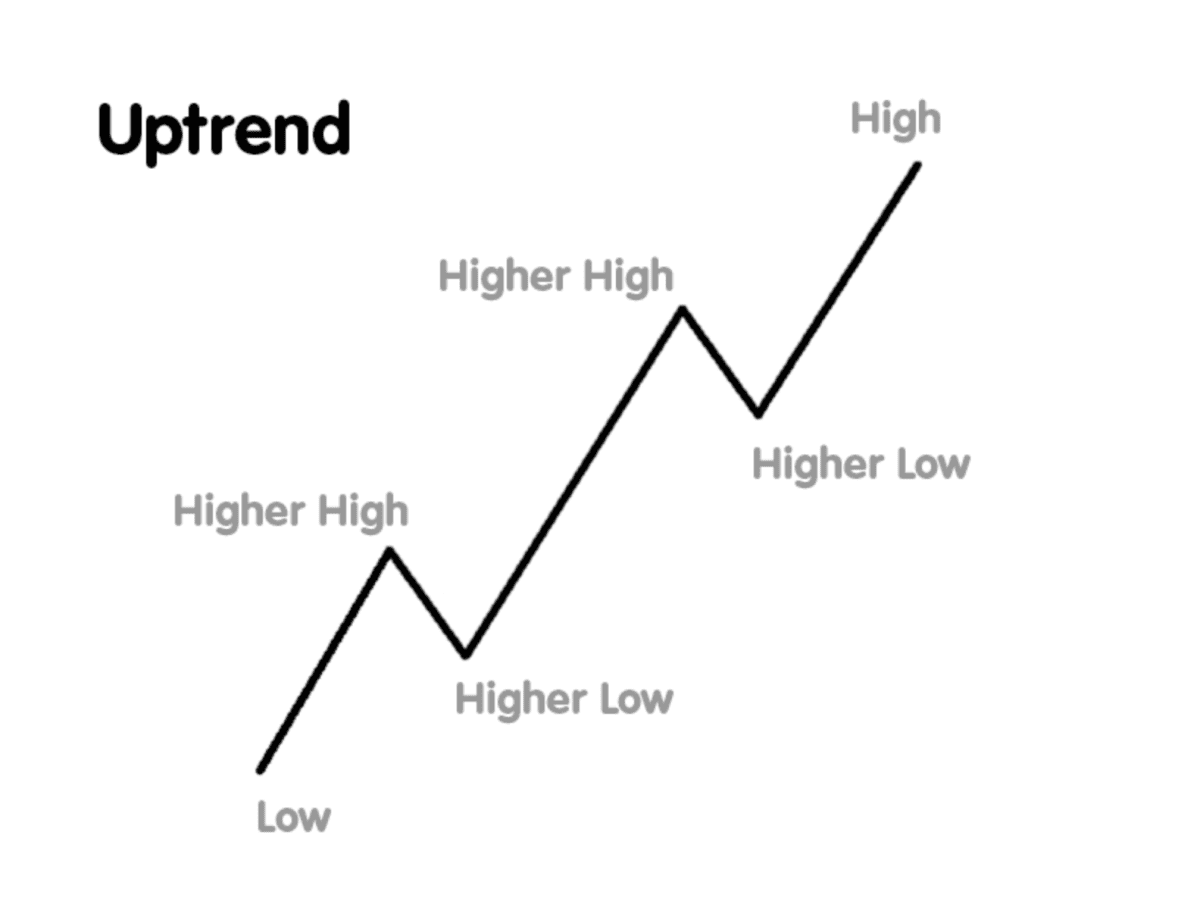

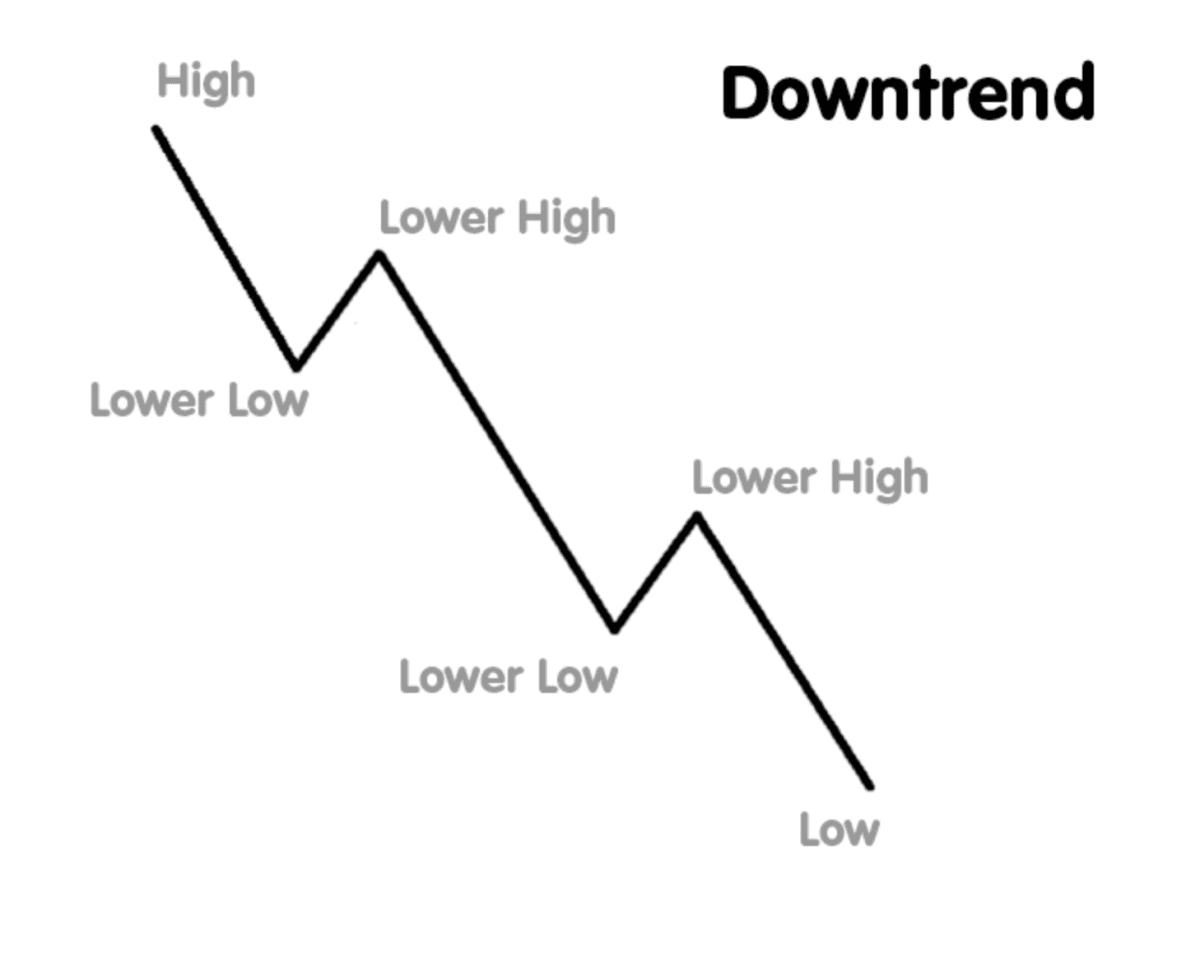

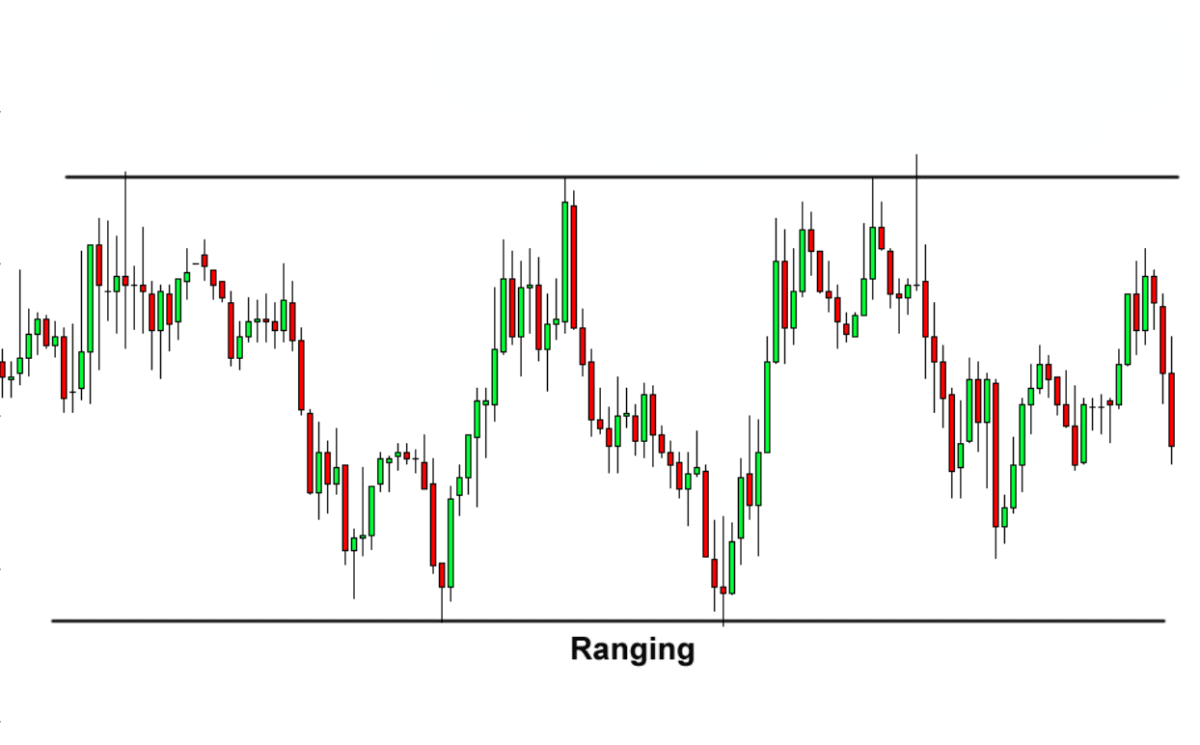

Three basic market conditions are classified: an uptrend (bullish), a downtrend (bearish), and a sideways (undirected) trend.

An uptrend is an upward price movement with consecutive higher highs and higher lows.

A downtrend is a downward price movement, with successive decreases in lows and highs.

A sideways trend is a state of the market in which it goes neither up nor down. “Flat” is characterized by a price movement between the same highs and lows without going beyond them.

Trading volumes

In trading, volume is the number of trades made in a certain period. Volume is a key indicator of market activity and liquidity. In many cases, the volume helps traders confirm a market trend better when viewed without the context of a price chart.

It helps determine the strength of a price movement. If a proportional increase follows a price movement in volume, it is viewed more fully and confidently. If the price change is not followed by growth of volume, then, most likely, it is “false”, resulting from manipulations or accidents.

Exchange instruments

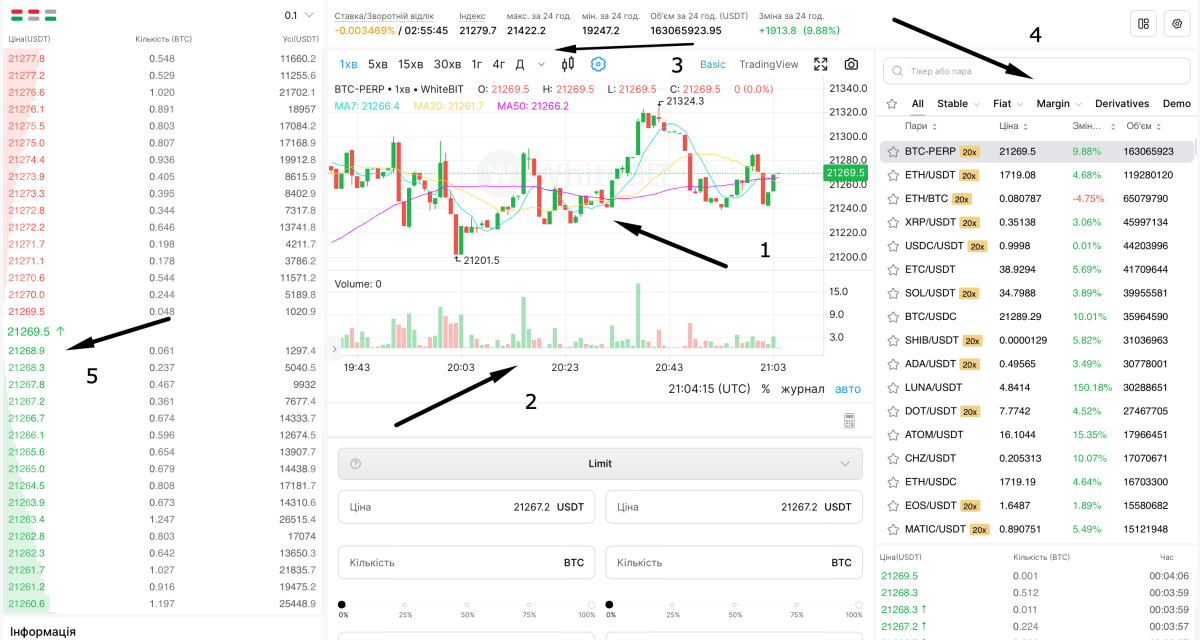

Here is the description of the basic exchange functionality (using the trading terminal of the WhiteBit exchange as an example), which is absolutely sufficient for a beginning trader.

1 – The chart shown in Japanese candlesticks.

2 – The trading volume of the selected asset.

3 – Japanese candlesticks’ time range settings.

4 – List of available quotes on exchanges.

5 – The order book (table of limit buy and sell orders).

Some tips on how to read a price chart:

Recommended