What is a market depth chart, and how to read it?

Every cryptocurrency exchange has several tools that allow traders to make better trades. One of these tools is the market depth chart. It enables you to assess the current state of a token in terms of volatility and helps many traders to make the right strategy.

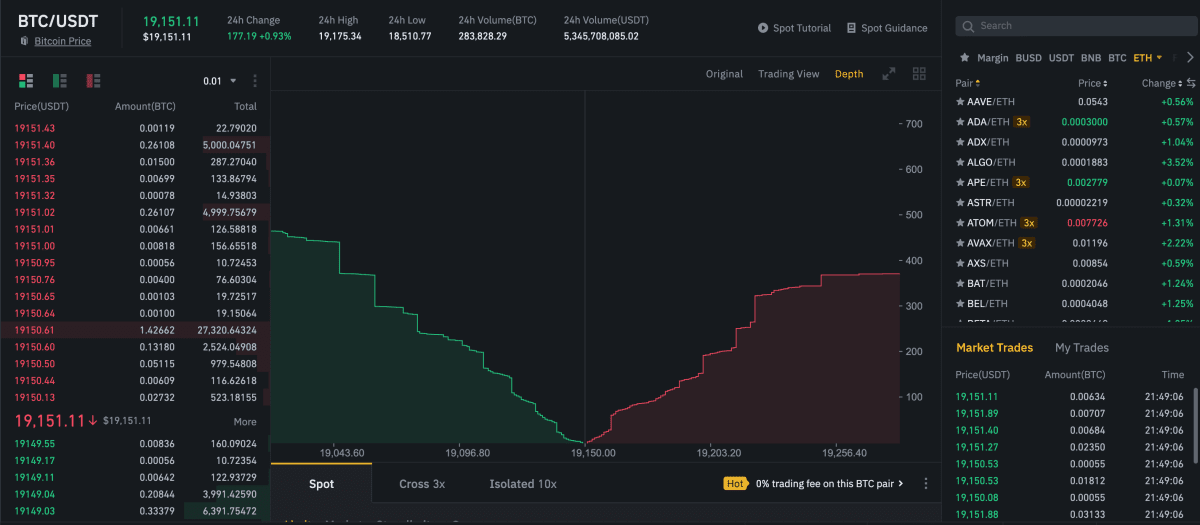

The depth chart is a way to represent the volume of pending buy and sell orders visually. It is a real-time format for displaying the order book, allowing you to see the market reaction to a particular order. In simple words, it is a curve of supply and demand. This tool clearly describes the state of the market at the moment and shows its depth.

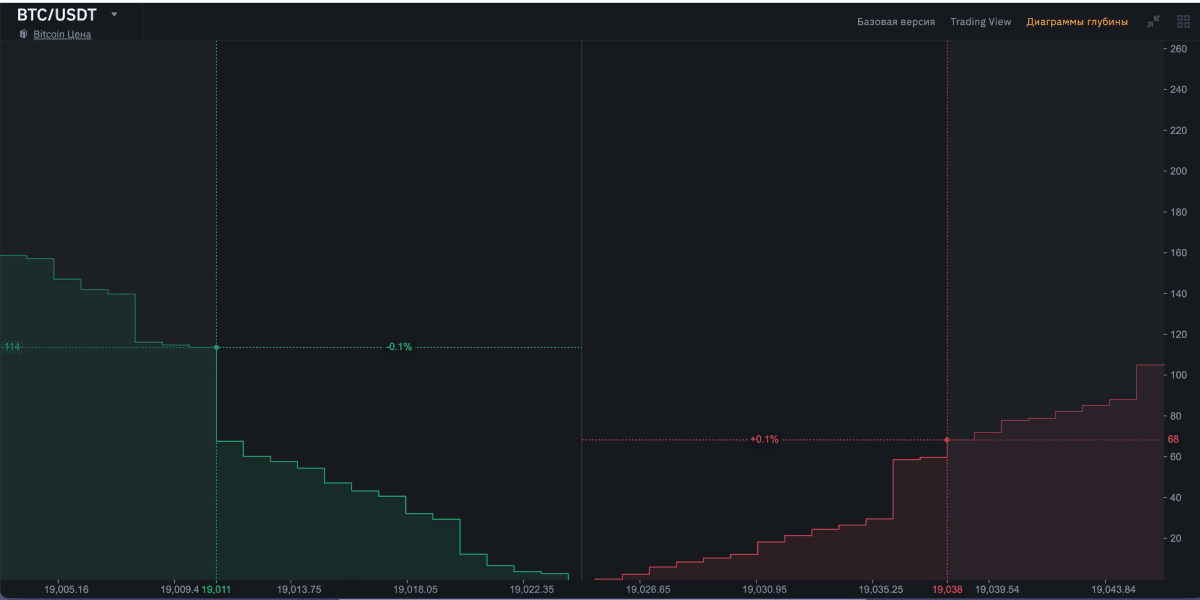

A low one indicates that there are not enough orders for one or another currency pair. A high depth demonstrates that there are enough orders. Analysis of these data helps the trader to make more profitable deals. For example, high depth allows the trader to make a deal of a larger volume without affecting its price in the future. Opening an order with a large volume at a low depth can cause a price spike.

The vertical line shows the number of coins the trader puts in his order, and the horizontal line shows the desired price. The buy requests on the left side of the chart are colored green. Correspondingly, sell requests are displayed in red in the right corner. The gap between these areas (in the center of the chart) shows the latest transaction price.

The number of coins on the vertical is not built from the X-axis but the previous level. Thus, small walls can be formed. This indicates that there is an order (or several orders) for many coins at a given price. They can be created by a single trader or a market maker. Most traders form requests based on these walls.

High buy walls can mean traders are confident in the stability of a coin. And the frequent appearance of high sell walls indicates the opposite. But don’t trust only that data. The depth chart is just one tool to use when choosing your strategy.

The depth chart gives a good idea of the demand and supply of the coin in the market and helps predict the situation in the near future.

Recommended