What to Do During a BTC Correction: 5 Tips

In November, Bitcoin hit a new local high at $38,000, raising questions about the sustainability of its upward trend in the absence of corrections in its trajectory. A common misconception that trends only move upward often leads to unexpected setbacks for cryptocurrency enthusiasts.

In just a month and a half, the Mother of All Crypto has surged by 40%, and since the beginning of the year, BTC's value has increased by an impressive 125%. Some altcoins have managed to outperform this, with Solana soaring by 400%, TRB by 600%, and KAS by 300%, among others.

However, this relentless growth causes anxiety among investors. They fear losing their accrued profits yet are equally apprehensive about missing out on potential gains if the trend persists.

Today, we'll delve into several savvy strategies that can help mitigate risks during a BTC correction and potentially turn a profit in a bear market.

Correction: A Peril for Altcoins

Any BTC surge and its ensuing sideways trend generally have a positive effect on other cryptocurrencies' values. Altcoins often experience growth 2-3 times greater than Bitcoin, diminishing the primary cryptocurrency's dominance and boosting the total market capitalization. However, during a downturn in BTC (whether a bearish trend or a correction), other coins tend to react much more sharply.

This heightened sensitivity stems from a combination of factors, including the disparity in market liquidity between BTC and altcoins. When the leading cryptocurrency dips by 10%, other coins can suffer a 15-25% fall, hitting investment portfolios hard. Hence, it's crucial to know more than just the basic investment strategies, like diversification; understanding certain tricks can be key to preserving your capital in unfavorable market conditions.

Hedge Your Investment Portfolio

In times of market downturns, it's advisable to have an order in place that hedges against your main portfolio. This way, a BTC correction won't drastically affect your overall financial status. You can hedge an altcoin portfolio through several methods:

- Through derivatives trading;

- In margin trading;

- Via options.

Imagine an investor who has put $10,000 into altcoins and decides to open a BTC short with a $5,000 risk (stop size). In this case, the investor stands to benefit regardless of market movement: if the uptrend persists, altcoins are likely to experience an increase more significant than BTC, compensating for any potential stop loss. Conversely, if a correction begins, each $5,000 decrease in BTC's value would result in a $5,000 gain from the BTC short, representing a 50% return on the total investment portfolio.

The hedging strategy is, however, quite nuanced and requires calculations tailored for each specific position.

Avoid Limit Orders

As previously noted, altcoins tend to plummet more severely than BTC during a correction. This leads to a breakdown of support levels in most altcoin charts under intense selling pressure, often accompanied by high trading volumes.

Such dynamics create an environment where it's challenging to pinpoint attractive buying prices for altcoins. Consequently, traders looking to leverage the correction to augment their crypto holdings are better off waiting until the market stabilizes and shows signs of reversing before making new purchases.

Invest in Gold

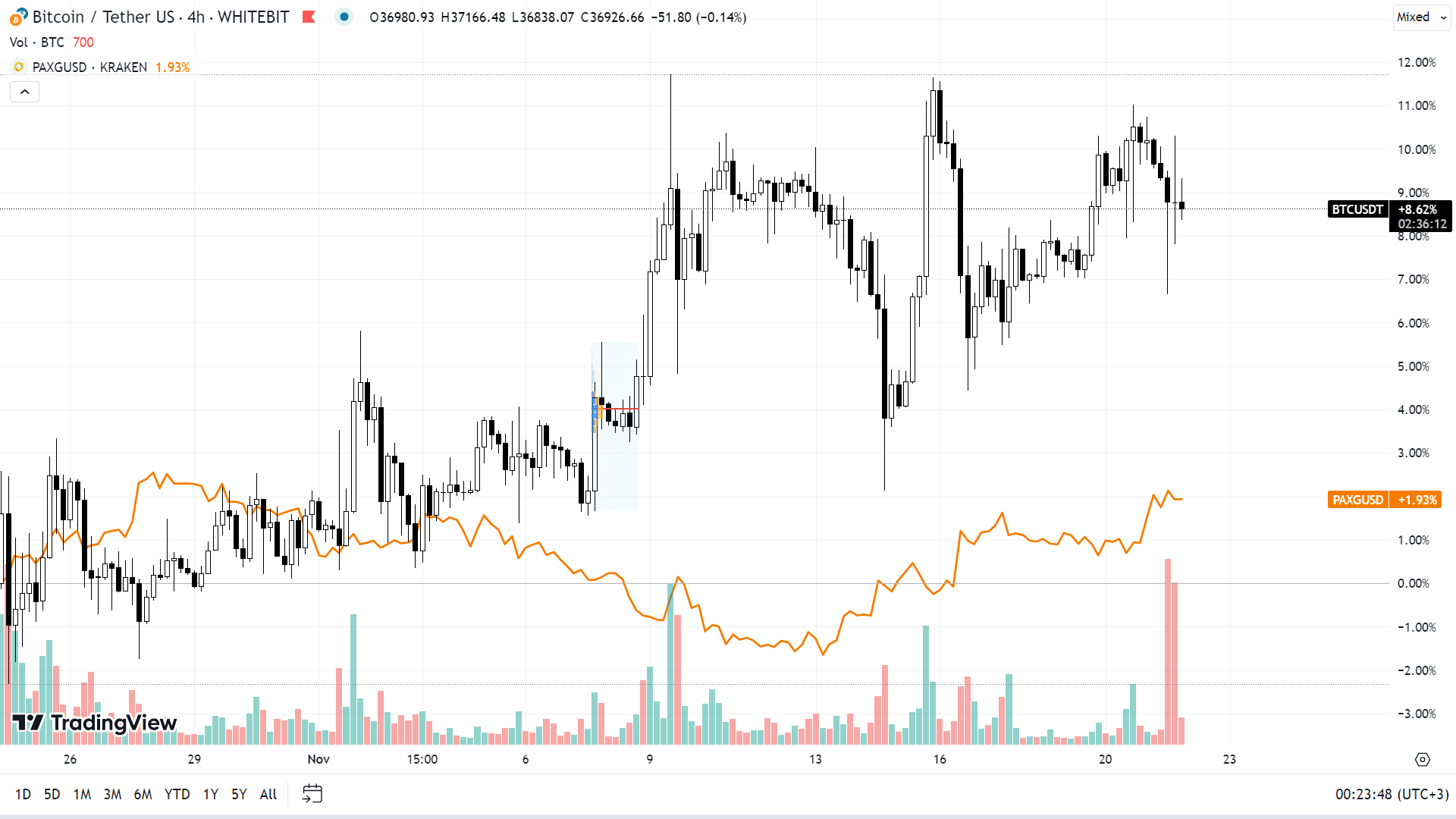

Recently, there's been a noticeable inverse correlation between Bitcoin's value and that of gold, such as the gold-pegged stablecoin PAXG. Simply put, when Bitcoin's value decreases, gold tends to increase, and vice versa. This trend is clearly visible when comparing the price charts of gold and BTC:

Correlation between PAXG and BTC cryptocurrency charts (tradingview.com)

DCA - The Optimal Earning Strategy

Dollar-Cost Averaging (DCA) is an investment strategy involving regular purchases of a fixed dollar amount of an asset, regardless of its current price. For example, by buying BTC in 4-5 installments during an overall 50-60% drop in value, an investor can secure a very favorable average price for their holdings.

This method relies on the fact that it's nearly impossible to perfectly time the market's highs and lows. Instead, it allows for gradually improving the entry point, which can lead to quicker gains during future growth periods compared to a single bulk investment. In this way, each market correction is not just a setback but an opportunity to enhance one's position at a more advantageous price.

However, many altcoins are not ideal for DCA due to high inflation, price instability, and significant volatility. Thus, this strategy is best applied to more stable investments like BTC, ETH, and traditional financial assets like stocks and precious metals.

Implement Stop-Loss Orders

Ironically, a frequent issue for traders is hesitance to take profits. Due to a token's continuous rise, a trader might hold off on selling, expecting further increases. This tactic often backfires: during a correction, the price of the altcoin can plummet well below the trader's initial entry point.

A practical solution is not only to take profits incrementally but also to establish stop-loss orders to sell coins, ideally at the same prices at which they were initially purchased. If the price continues to rise, the risk remains minimal, but if a correction occurs, these orders help to minimize potential losses.

Conclusion

The effectiveness of each piece of advice varies based on the selected asset, the amount invested, and the current market conditions. Regardless, it’s crucial to be mentally prepared for market downturns, not just upward trends.

Recommended