Who Benefited the Most from the Bitcoin Rally?

With the crypto market unexpectedly painting green and Bitcoin racing towards $35,500, the burning question arises: Who's profited the most from this remarkable rally?

The first name that comes to mind is Michael Saylor's MicroStrategy, known as the largest public Bitcoin investor globally. In July, MicroStrategy augmented its Bitcoin holdings with an additional purchase of 467 BTC at an average price of $30,835, going to the extent of selling company stocks to finance the acquisition.

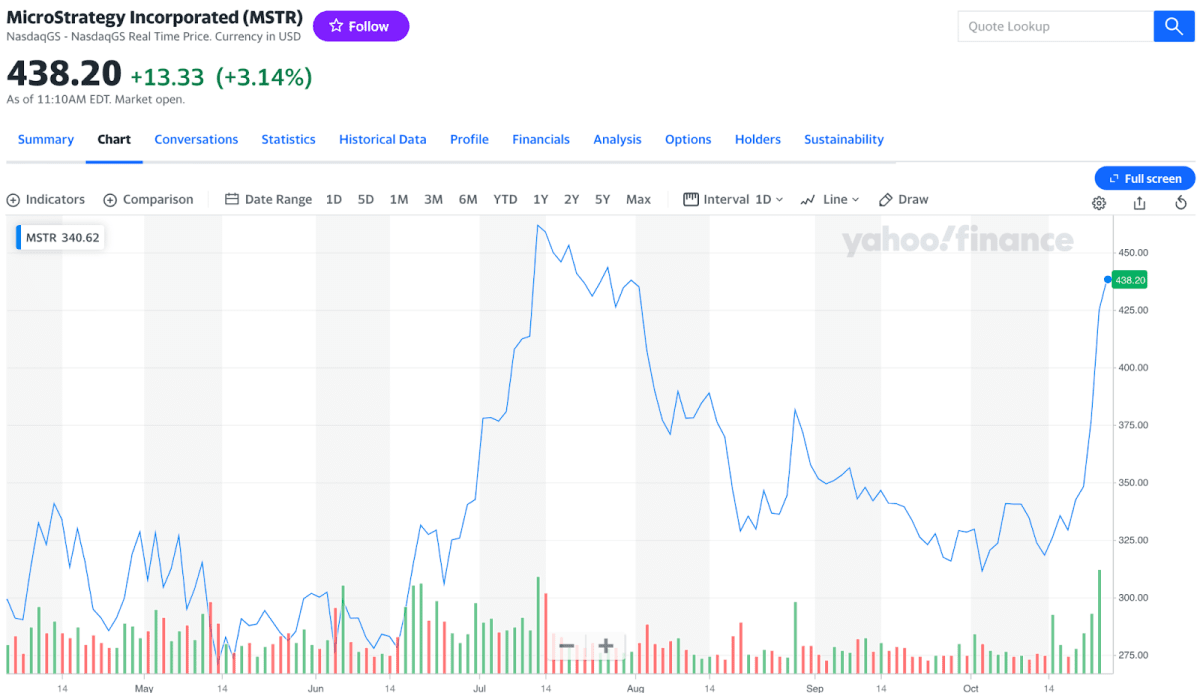

As of now, the company's stock has surged by 13.3% in value, and profits from the appreciating asset are now at $900 million, with this figure still climbing. According to the Fear and Greed Index, buyers are gearing up for more, setting the stage for a potential uptick in MicroStrategy's Bitcoin portfolio, which currently stands at 158,245 BTC.

MicroStrategy’s Stocks Witness Rapid Growth. Source: finance.yahoo

Saylor's company isn't the only one savoring victory right now.

Grayscale has emerged as a prominent winner in the bullish market, boasting a substantial 624,947 BTC in its portfolio, as confirmed by data from bitcointreasurys.

The company’s founders, who recently introduced the GBTC fund tailored for institutional investors, now have every reason to toast with a bottle of the exquisite "Gout de Diamants" champagne, carrying a staggering price tag of $1.5 million per bottle.

Their celebration might have even begun a few weeks ago when they secured a legal victory over the SEC, paving the way for the transformation of the Grayscale Bitcoin Trust into a spot ETF.

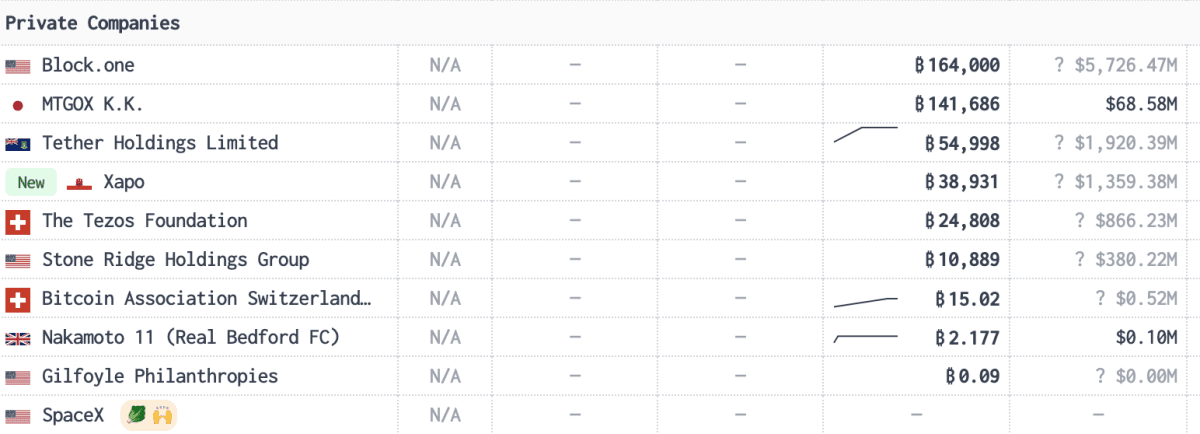

Block.one, a company that filed for bankruptcy last November, is not to be left out of the celebrations. They hold 164,000 BTC, surpassing MicroStrategy’s holdings. This unforeseen rally could potentially resolve all outstanding disputes with the EOS Network Foundation. It’s worth noting that Block.one attracted $4.1 billion during the EOS token sale from 2017 to 2018, marking one of the most significant Initial Coin Offerings in history.

Nevertheless, this ICO has consistently been a source of controversy. The SEC has accused Block.one of manipulative practices significantly impacting the token’s price, while the EOS community has criticized them for failing to meet investment commitments totaling $1 billion.

Block.One Holds 164,000 BTC. Source: bitcointreasurie

However, the companies mentioned above only represent the tip of the iceberg. The crypto market landscape is shaped by an additional dozen players:

- MT GOX holds 141,686 BTC

- Tether owns 54,998 BTC

- Ukraine possesses 46,351 BTC

- The USA has 41,491 BTC

- Gibraltar's Xapo Bank is sitting on 38,931 BTC

- The Tezos Foundation fund amounts to 24,808 BT

Yet, the citizens of El Salvador, where Bitcoin has been recognized as legal tender, are the ones celebrating the most. Their incomes have dramatically increased in just a few days, and the streets of San Salvador are filled with lively commotion. If the market continues to thrive at this pace, the country’s President, Nayib Bukele, stands a great chance of being re-elected for a second term in February 2024.

Recommended