Worst of Crypto Winter Could be Over, says Glassnode

In its new analysis published Monday, Glassnode’s UkuriaOC provided an overview of the crypto market, suggesting that the worst of the crypto downfall may be behind us.

Dubbed the Week OnChain Newsletter, the report contains an extensive analysis of investor behavior. The authors state that after a month of consolidation, Bitcoin prices experienced a long-awaited relief rally, closing 9% above the weekly open.

Price action opened at $20,781, rallied into a peak of $24.179, before pulling back towards the highs of the consolidation range over the weekend.the newsletter reads.

The authors add that since the market valuation of Bitcoin fell over 75% in 2022, the speculators have essentially left the crypto space, transferring their assets to “more cost insensitive HODLers who invest with longer time frames, and allow their coins to mature in cold storage.”

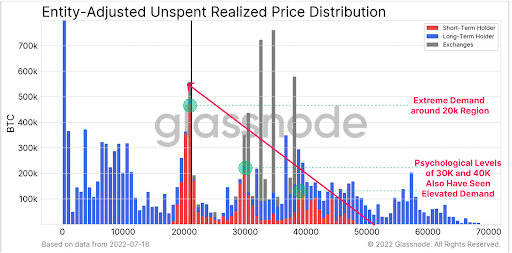

Meanwhile, the threshold of 20 thousand attracted a large cluster of Short-Term Holder coin volumes who are described as more optimistic and less likely to sell whenever there is a crash.

The fact that Short Term Holder demand nodes are also observable at the psychological price levels of $40K, $30K, and $20K is likewise a good sign, the authors say.

Source insights.glassnode.com

Overall, however, profitability has been bad for all investor classes. The long-term holder cohort, as opposed to the short-term one, is no exception, “and their spending patterns suggest a non-trivial flush out has occurred between May-June 2022.”

The analysts also state that Bitcoin as an asset is constantly maturing and has been in the limelight at both institutional and national levels in recent years. This is coupled with the fact the long-term supply dynamics are improving, as redistribution taking place, with HODLers getting more coins.

Notable supply concentrations are observable at $20K, $30K, and $40K, which tend to align with both technical and on-chain price models, making these regions significant zones of interest.the analysis reads.

Momentum in the short-term suggests a continuation of the upswing, provided the Realized Price and Long Term Holder Realized Price can hold as a support level.

Still, the authors note that while the worst of the capitulation may be behind us, a longer recovery time is necessary for the market to get back on its feet.

Recommended