Wrapped Bitcoin (WBTC): the first wrapped token

Wrapped Bitcoin (WBTC) is a wrapped token, originally launched on the Ethereum network under the ERC-20 standard. As WBTC is backed by Bitcoin, its value is always determined by the Bitcoin price..

The initial idea behind Wrapped Bitcoin was to create compatibility between the first cryptocurrency and the Ethereum blockchain, as well as other networks that accept ERC-20 tokens. Currently, WBTC is also supported by the Tron network using the TRC20 standard.

Since most DEXs and other DeFi applications were developed on Ethereum, most BTC transactions occurred on centralized exchanges prior to Wrapped Bitcoin. Wrapped Bitcoin was a paradigm shift.

Bitcoin holders now had the capacity to transact with WBTC on decentralized platforms, while DeFi-platforms bolstered their liquidity and collateral reserves with a centralized copy of the iconic asset.

WBTC home page

WBTC developer revealed

Kyber Network, BitGo and Republic Protocol designed the project in 2018. As soon as it was launched in early 2019, WBTC poured onto major DeFi platforms (Compound, Dharma, dYdX).

Kyber Network is a multi-chain platform providing liquidity infrastructure for DeFi. To facilitate cryptocurrency trading at the best rates, it aggregates liquidity from a variety of sources.

BitGo has been providing crypto trust management and cybersecurity services since 2013. The company is headquartered in California and its CEO is American computer scientist and entrepreneur Mike Belshe.

Republic Protocol is a private investment platform that provides tools for raising capital and managing financing rounds.

WBTC ecosystem

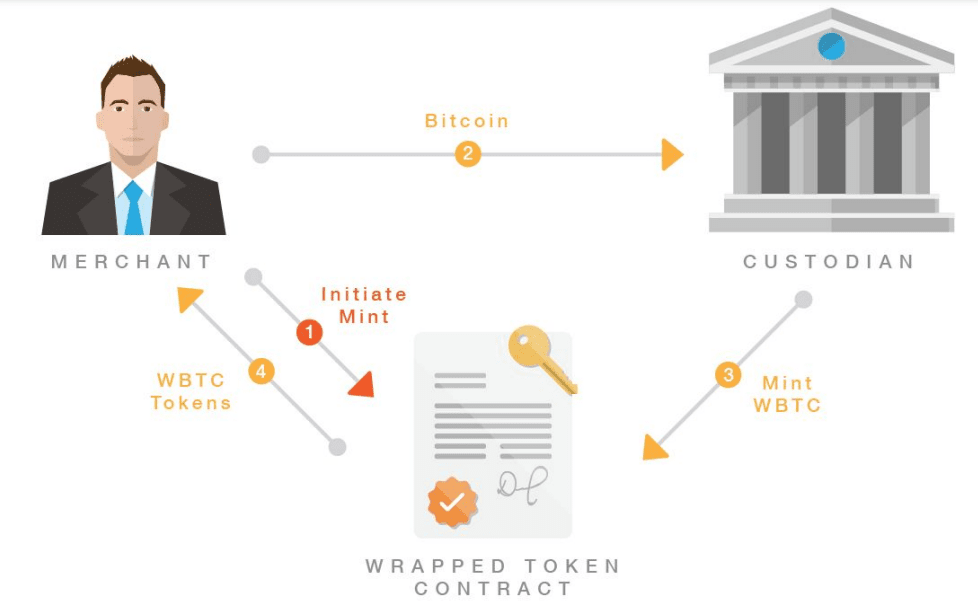

1. Custodian. BitGo acts as the custodian of WBTC, meaning they are responsible for minting the tokens, ensuring they are properly backed by Bitcoin, and maintaining transparency in the process.

2. Vendors. These are the organizations for which wrapped bitcoins are minted and burned. They are also responsible for distributing tokens. The first companies to take on this responsibility were Kyber Network and Republic Protocol. All sellers have keys to the signed contract that allow them to initiate the minting or burning of new WBTC.

3. User. Bitcoin holders seek to exchange BTC for a wrapped counterpart in order to use them for transactions within the Ethereum ecosystem.

4. WBTC DAO members. An autonomous decentralized organization includes a custodian, vendors, and a few more companies, such as MakerDAO, Blockfolio, Gnosis, and Loopring.

These institutions hold the keys to Wrapped Bitcoin's multisignature smart contract. They can also vote for adding or removing participants from the DAO.

WBTC ecosystem infographics. Source – wbtc.network

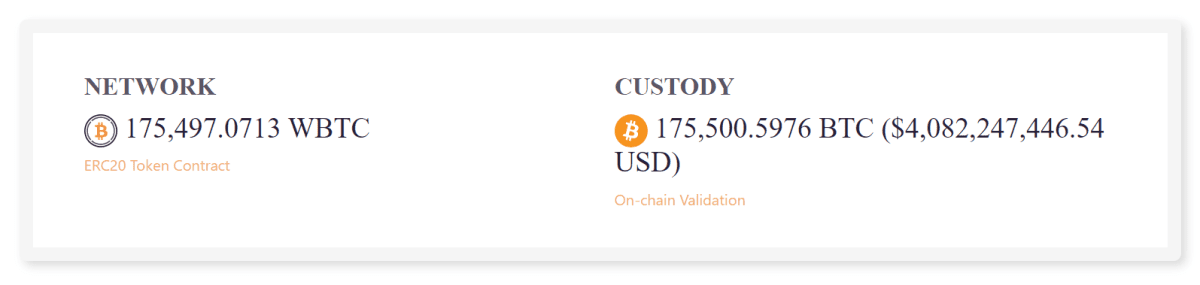

The market cap of WBTC is $4.193 billion. There are 175,597 tokens in circulation and there is no maximum supply.

Creation, acquisition, and burning of WBTC tokens: how does it work?

For a custodian to mint new WBTCs, a smart contract-based transaction must be initiated by the vendor. It solicits the desired number of wrapped bitcoins and sends the appropriate BTC value to the owner. They can also vote for adding or removing participants from the DAO.

A user can obtain WBTC in the following ways:

- Request wrapped tokens from a seller;

- Pass AML (Anti-Money Laundering) verification and KYC (Know Your Customer) verification. User identification information must be securely stored by sellers;

- Perform a trusted atomic swap: the seller receives BTC, and the user receives WBTC.

It is the seller's responsibility to securely store the information about the user.

Burning of wrapped bitcoin occurs when a vendor exchanges WBTC for Bitcoin. The necessary amount is deducted from the vendor's balance in the blockchain, and the number of Wrapped Bitcoin is reduced accordingly.

The custodian is obliged to provide quarterly proofs of how much BTC they hold, as well as mint and burn WBTC tokens.

WBTC fees and the validators' role

Once a user obtains WBTC, the token can be transferred to another person for free. However, wrapped bitcoin comes with network fees. The first type of fee is related to the minting and burning of WBTC - these are paid by vendors to the custodian. There is also a fee charged by the vendor providing the tokens to the user.

The final fee is linked to transactions in sidechains and is split equally between the companies overseeing the nodes within.

The validators who confirm transactions with WBTC are selected from partners and institutions of the WBTC DAO, maintaining a balanced distribution across different countries. They also establish the relationship between the main Ethereum chain and parallel networks, recording the amount of wrapped bitcoin using a multi-signature smart contract.

What features are available on the WBTC dashboard?

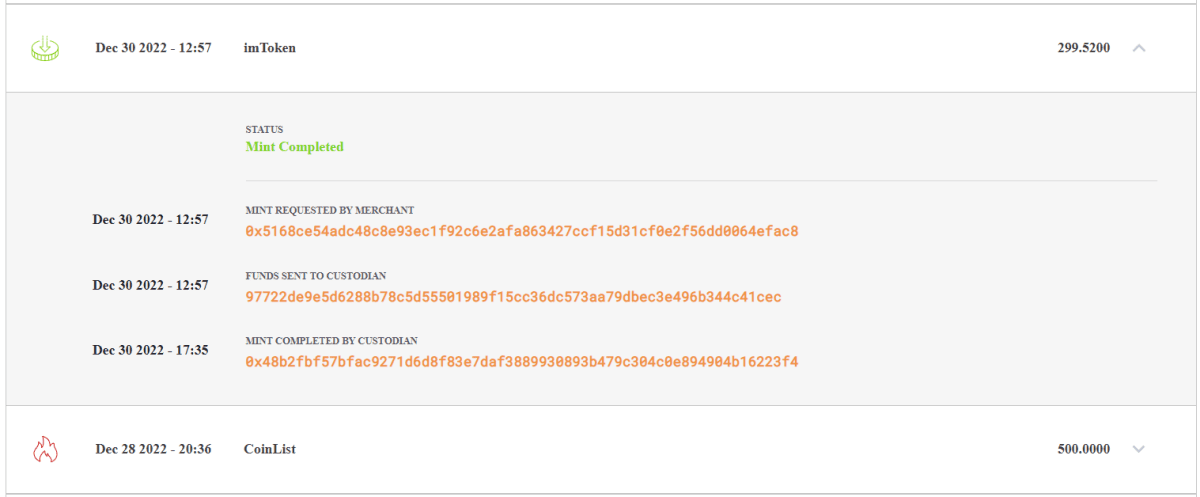

You can track all operations with WBTC on the wbtc.network dashboard. The site displays the names of vendors, their addresses, and the types of transactions with their processing status. A complete list of the WBTC minted is also provided, along with links to the contract codes on Etherscan and Tron.

The Dashboard panel displays the amount of WBTC and BTC that collateralize the tokens

Transaction details on the dashboard

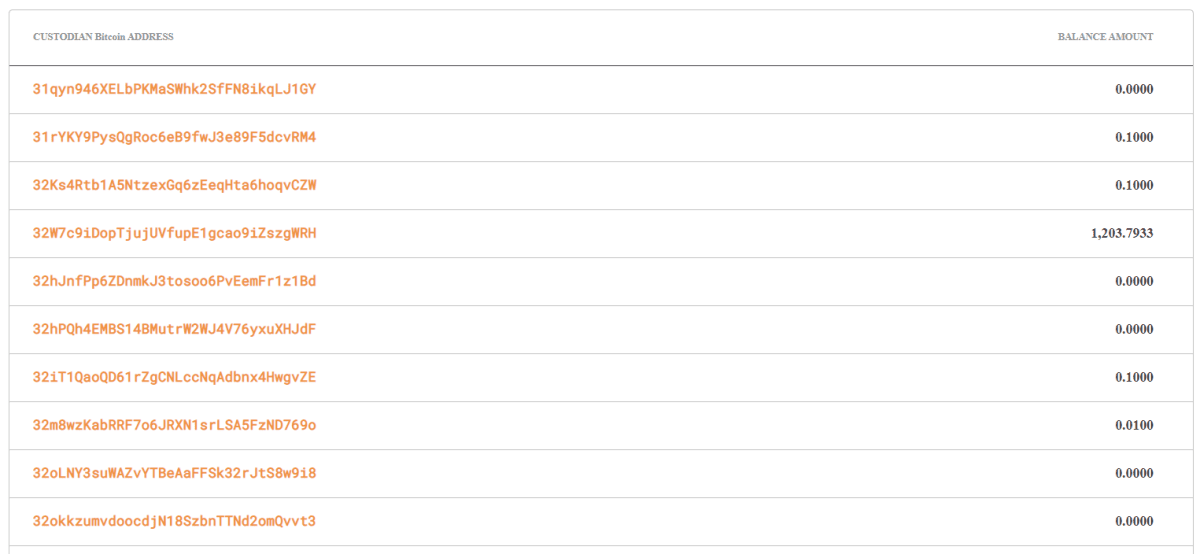

Custodian addresses on the dashboard

The Proof of Asset section displays the custodian's wallet addresses and reveals how many bitcoins are being held in each of them for collateral. Apart from that, quarterly transactions appear in the dashboard to prove that the custodian holds the keys to the available BTC.

Recommended