Aptos - project overview

Aptos is a blockchain platform for smart contracts and decentralized applications built on the AptosBFT consensus algorithm.

The project is written in the Move programming language. The founders are Mo Sheikh and Avery Ching, former employees of Meta (Facebook), who for several years were engaged in the creation of the Diem (formerly Libra) cryptocurrency platform.

Due to regulatory issues, Diem closed abruptly in 2022, assets sold off, and several former employees grouped into a new team called Aptos Labs.

Move is a unique language for writing smart contracts that underpins Aptos. With it, Aptos aims to create a secure, flexible, and scalable infrastructure that can compete with existing blockchains. Move also allows for high throughput, which, according to the creators, can provide an indicator of 100,000 transactions per second.

Early stage and funding

Aptos Devnet (test network for developers) has been operating since this year’s March, and is actively used by developers to create and test their own dApps.

Also in March, Aptos raised $200 million from the venture arm of Andreessen Horowitz, Tiger Global, FTX, Coinbase, 3AC, and several other funds. In July, another round of funding was raised, resulting in an additional $150 million. The round was led by FTX Ventures and Jump Crypto.

Tweet from Aptos CEO Mo Sheikh about the funding round closure

Blockchain architecture

Main features of the AptosBFT consensus algorithm:

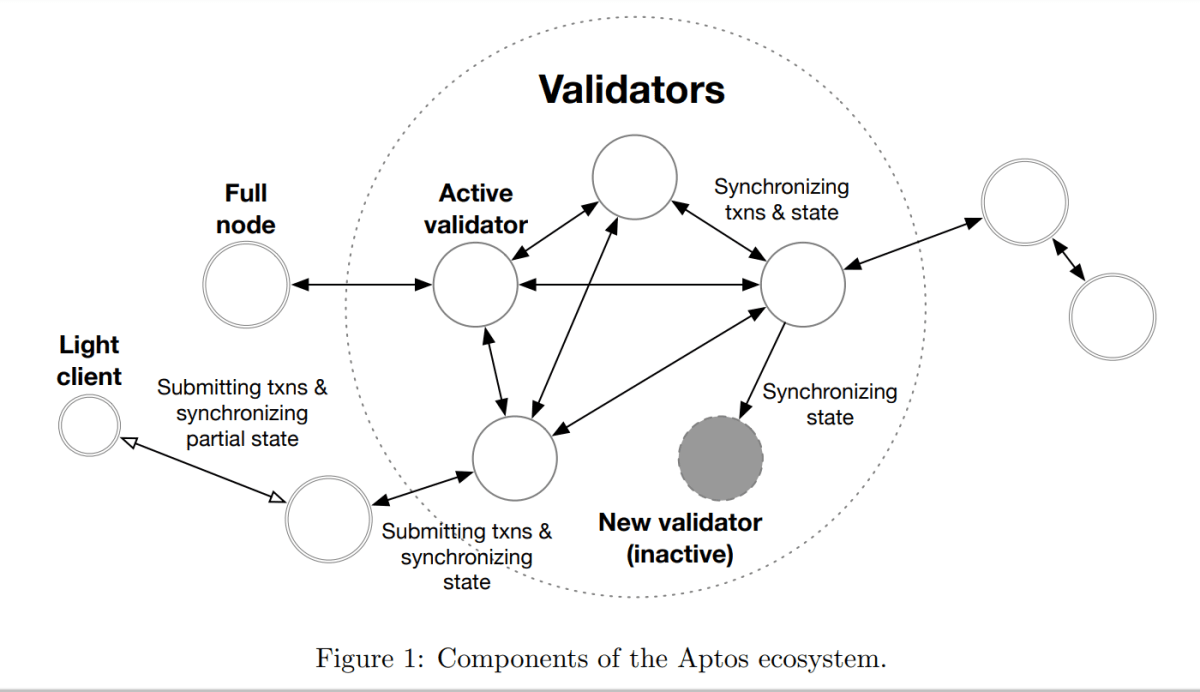

There are 5 actors involved in processing transactions: validators, coin owners, clients (anyone who makes transactions), light clients and full-fledged nodes. The team described the full functioning of the network in a Whitepaper.

Working Components of the Aptos Ecosystem (Whitepaper)

The main feature of the Move language is the ability to define custom resource types, which statistically guarantees the movement of an asset only between program storage locations (and the resource cannot be cloned or deleted). This implementation greatly improves security by effectively preventing vulnerabilities and exploit opportunities.

Mainnet and Aptos cryptocurrency

The APT coin is used to pay transaction fees, and gives voice to determine the direction of the protocol's development. As with other networks that include the presence of validators, APT holders will be able to use the token to generate income through staking.

Based on tokenomics, APT's initial supply is one billion tokens. 51% (510 million) will be shared among community members, 19% (190 million) are dedicated to the team and core developers. Investors will receive 13.48% (134.8 million) and Aptos Foundation - 16.5% (165 million). Preliminarily, the purchase price of the coin by investors is in the range of $2.5-$3.0, and the annual inflation will not exceed 7%.

APT went live on all the leading cryptocurrency exchanges on October 19th. A week earlier, the main blockchain network was launched. Many users have received large rewards for their actions on the network - installing a node, testnet or NFT mint. In total, the team distributed 20 million coins among over 100,000 participants. The current value of APT is $9, and the circulation of 130 million tokens gives a capitalization of $1.2 billion, which is why Aptos is ranked 43rd in the ranking of crypto assets according to Coingecko.

Cryptocurrency exchanges where APT is available for trading, deposits and withdrawals (Coinmarketcap)

How to earn now?

Early users were able to get $2000-5000 for 1 account, which resulted in the Aptos hype quickly spreading on the Internet. Many projects that were launched in March-April on Devnet are gradually moving to Mainnet, often rewarding platform testers. Good strategies right now are:

Most projects can be found on Aptos social networks, such as Twitter, as well as on the official Aptos website. Risks need to be taken into account, as many applications are already running on the Mainnet, which means that their use requires monetary costs.

It will be possible to determine whether Aptos is undervalued or overvalued only after a year or two of the network’s stable operation. The Move programming language is too young and not tested enough in practice, placing its perspectives only into a theoretical plane so far.

Recommended