Beyond Borders with UMA: Trade Anything Anywhere

UMA is a crypto initiative that excels in recording data on the blockchain and aids other projects in streamlining DAO management.

UMA stands as an oracle, facilitating swift and secure access to DeFi protocols and synthetic assets without compromising scalability. This adaptability is achievable via smart contracts on any given blockchain, giving rise to the project’s title: UMA, or Universal Market Access.

In this piece, we'll explore the workings of the UMA initiative, spotlight its core features, and introduce the project's native token, UMA.

Origin

The development of the UMA protocol commenced in 2018. The brains behind this venture were software engineer Hart Lambur and entrepreneur Allison Lu. The duo first collaborated while they were both employed at Goldman Sachs.

Their primary motivation for the UMA project was to devise a tool that would facilitate instant market access and streamline the integration of DeFi across various networks. Instead of carving out a new blockchain, they chose to roll out the entire protocol on Ethereum.

Investment Rounds

According to Crunchbase, UMA underwent three rounds of funding. Notable investors included Two Sigma Ventures, IOSG Ventures, and Placeholder. While specific investment figures haven't been shared, Crunchbase analytics suggests a total fundraising sum of $2.6 million from an array of investors, with names like Blockchain Capital, Miranda Ventures, Amber Group, and Wintermute making the list.

UMA made its debut on the decentralized exchange Uniswap in 2020. During this phase, 2 million tokens (roughly accounting for 1.8% of the max supply) were also offered to DEX users. The token sale was executed in a 'First Come — First Served' manner. The precise average token purchase cost remains undisclosed.

A tweet celebrating UMA's successful IDO on the Uniswap platform Source: Twitter.com/UMAprotocol

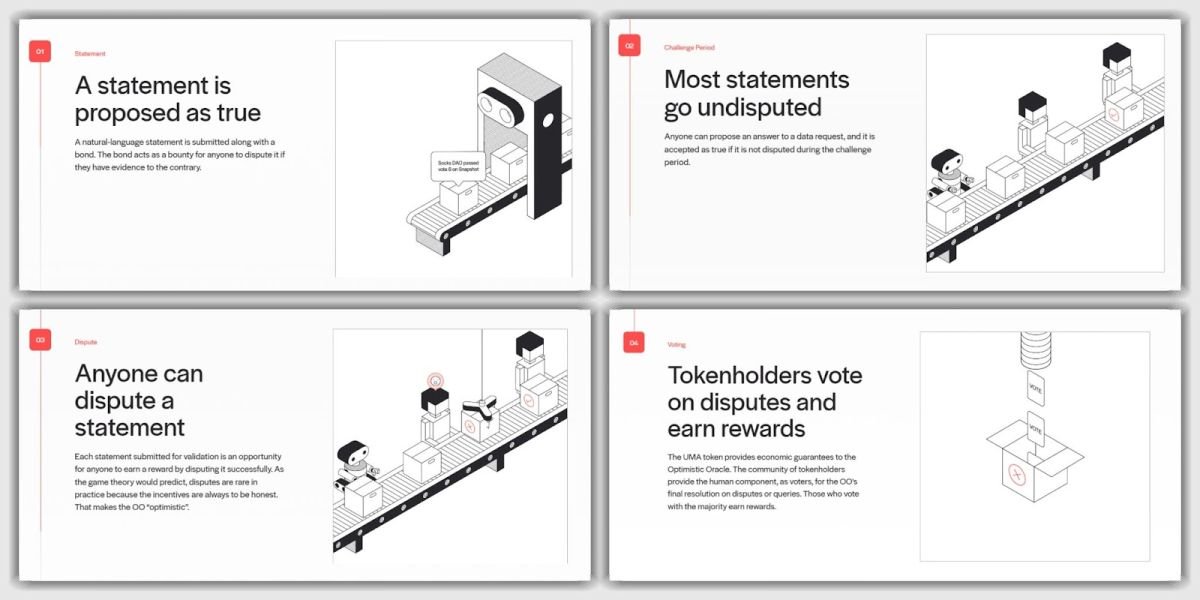

UMA's Operating Mechanism

UMA enables users to engage with synthetic assets that are linked to other financial tools. This mirrors a derivative contract, which can be purchased regardless of one's physical location or direct access to the underlying asset.

The UMA platform operates primarily through two key components:

- Token Facility: Enables the creation of synthetic contracts.

- Data Verification Mechanism (DVM): A mechanism rooted in smart contracts that handles data verification through oracles.

Essentially, any user can craft a synthetic product and list it on UMA. Simultaneously, the platform's community dictates the liquidity, relevance, and proper pricing of the asset using a voting process. This empowers individuals to design, manage, challenge, and issue synthetic assets underpinned by their own collateral.

UMA's Oracle Functionality Source: uma.xyz

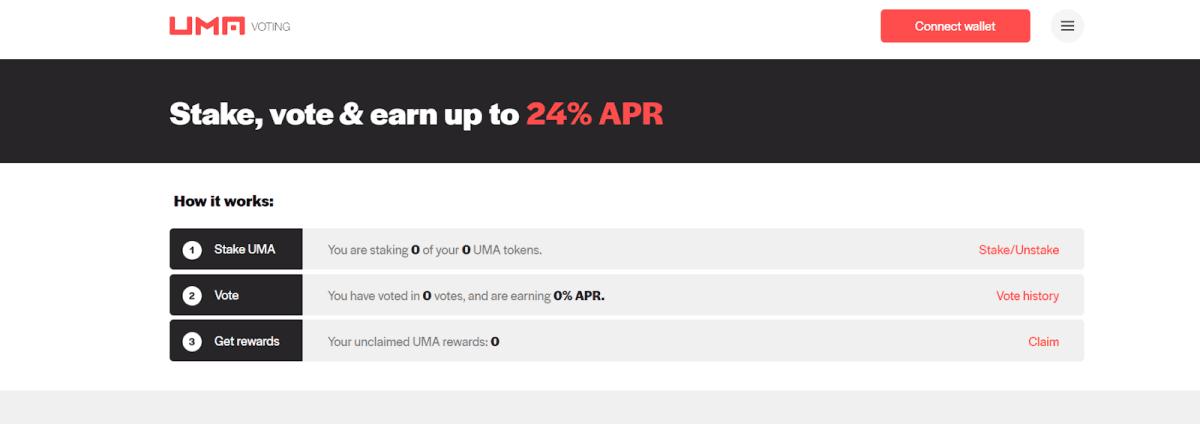

Only UMA token holders are given the privilege to vote on the UMA platform and manage synthetic assets. Yields from staking and voting can reach up to 24% annually.

Details on UMA Token Staking Source: uma.xyz

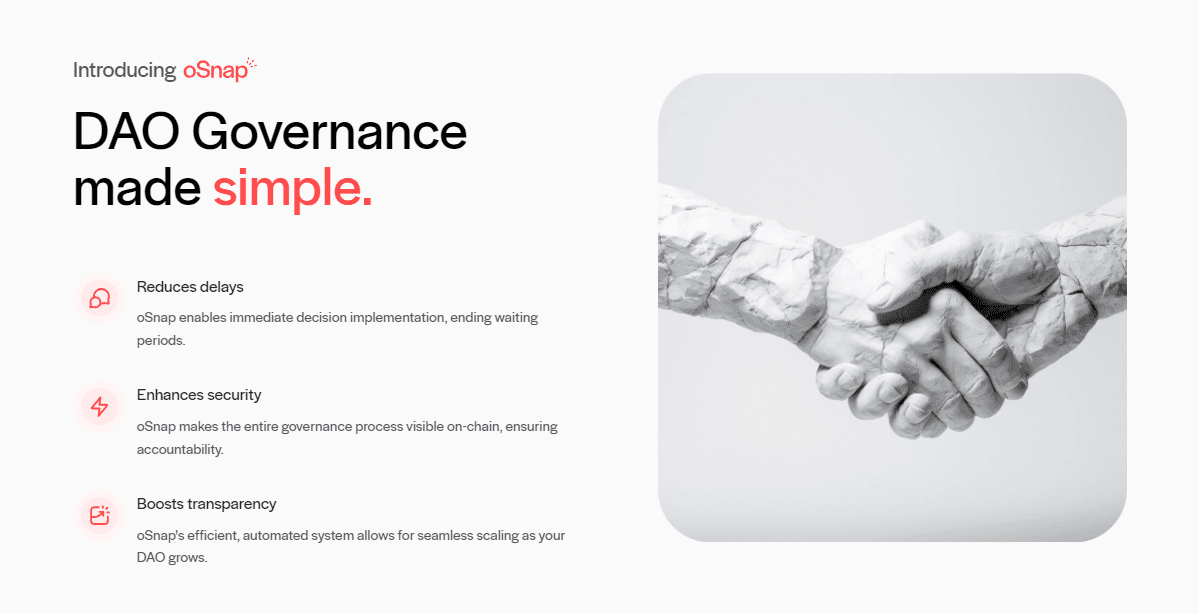

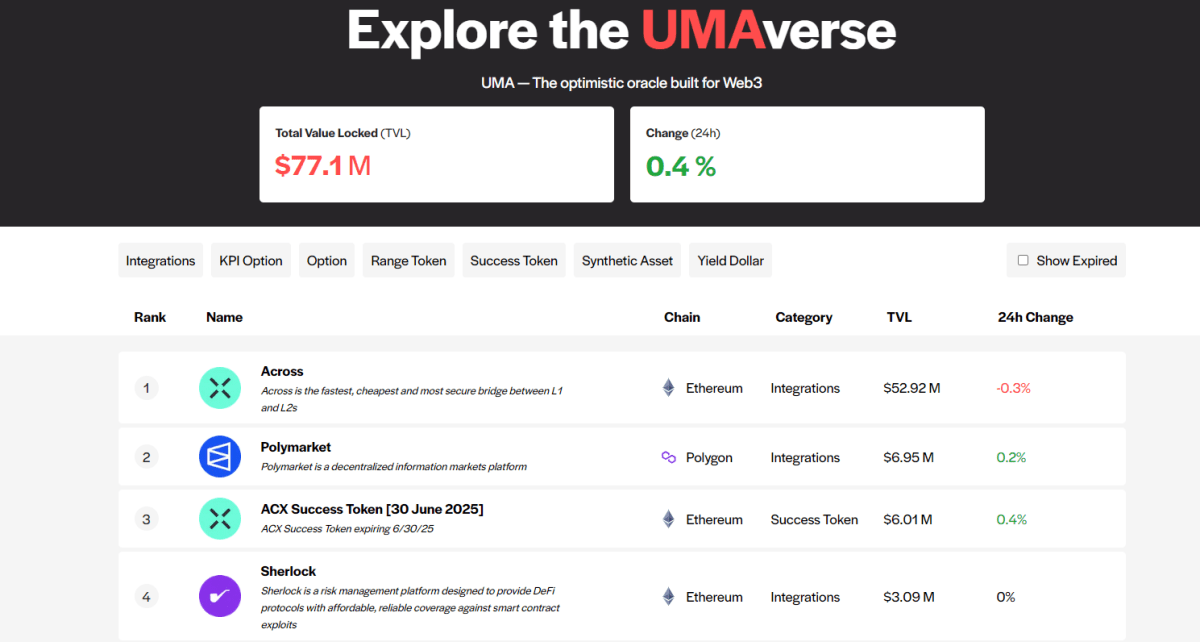

An additional feature of UMA is its capability to facilitate DAO management for various crypto projects, such as Polymarket, Across, Outcome, Rated, and more. The combined Total Value Locked (TVL) across these ventures is around $77 million.

Overview of DAO Management through UMA Source: uma.xyz

UMA Protocol's TVL and Affiliated Project List Source: uma.xyz

UMA Cryptocurrency

Holding UMA tokens grants users access to all features of the platform, such as staking, voting, earning passive income, and generating synthetic assets.

At the time of this article, UMA exhibits the following market data:

- Asset price: $1.38

- Market capitalization: $101 million

- Circulating supply: 73.6 million

- Max supply: 115,000,000

- Average daily trade volume: $3.4 million

- All-time high: $41.56

- All-time low: $0.30

UMA tokens are available on several exchanges like WhiteBIT, Gate, KuCoin, Mexc, and Coinbase. For a comprehensive list of platforms, consult platforms such as CoinGecko and CoinMarketCap under the “Markets” section.

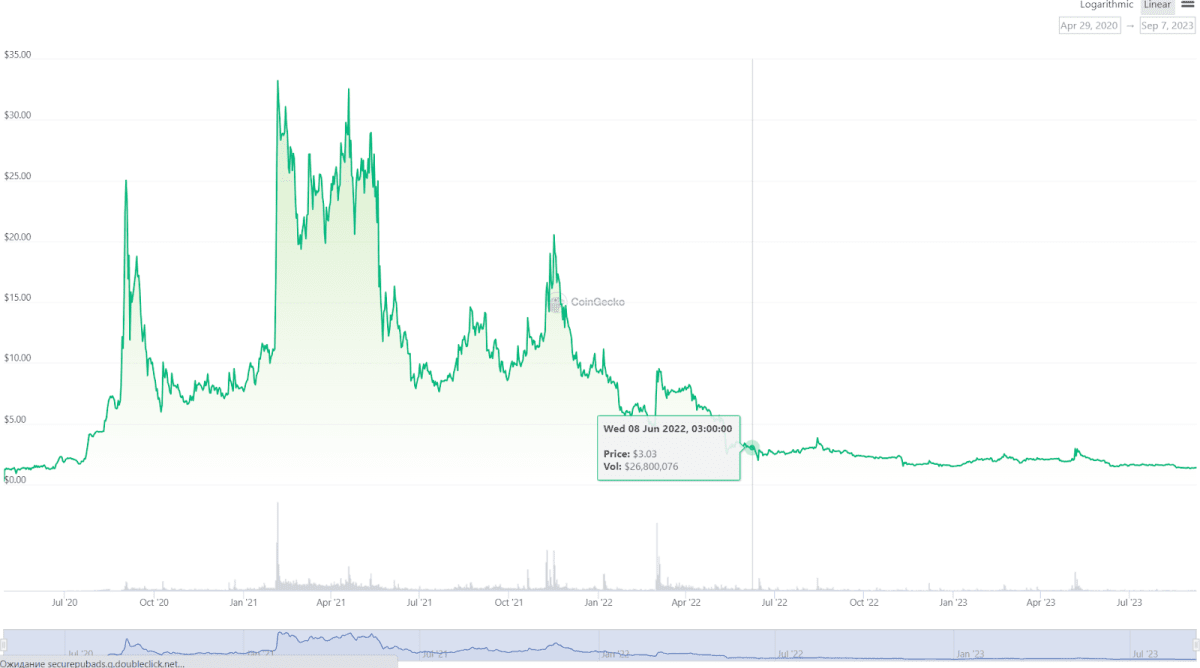

Historical Price Trends of UMA Source: coingecko.com

Overview

UMA is a cornerstone in the Web3 landscape, offering robust management of synthetic assets and its own DAO system. Nevertheless, its intricate workings might be daunting for those new to the scene. It's advisable to familiarize oneself with UMA's unique attributes and operational principles before investing in or utilizing its services.

Interesting Facts

- UMA incorporates the Ticker Symbol Oracle, enabling users to predict prices for stocks, commodities, indices, and cryptocurrencies, effectively facilitating decentralized crypto bets.

- The progression of the UMA initiative is spearheaded by its token holders, who can influence the project's development through the DAO.

- To guarantee price stability and liquidity of its financial assets, UMA adopts a Collateralization Ratio system in tandem with its distinct asset insurance strategy.

Recommended