BTC and TRX Chart Analysis for August 24, 2023

BTC consistently trades below the $27,000 mark, maintaining minimal fluctuations. Dive into a detailed review of the market situation for Bitcoin (BTC) and Tron (TRX) as of Thursday, August 24.

Bitcoin (BTC)

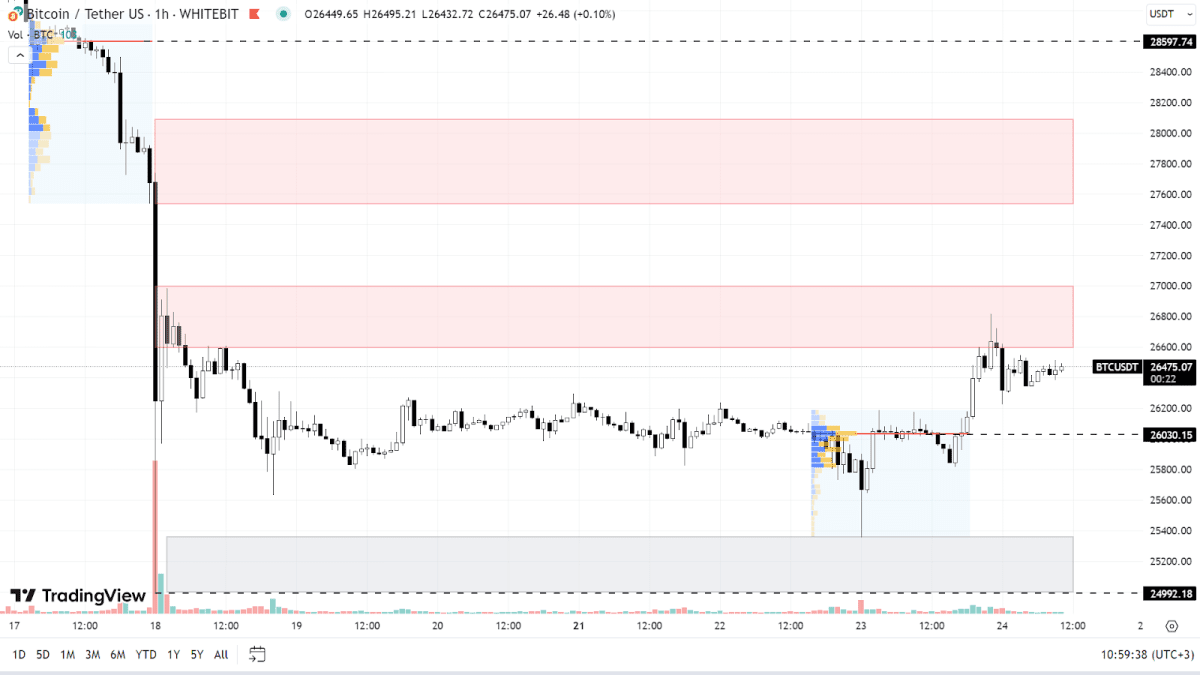

As suggested in our previous analysis, Bitcoin tested the resistance zone between $26,580 and $27,000. The earlier sideways movement is no longer in play; now, there's a consolidation range set between the current resistance and a support zone of $25,000-$25,350.

For a sustained upward trajectory, BTC needs to break through the sellers’ range of $27,500-$28,100 and target the next resistance at $28,600. Accomplishing this would counteract the prevailing downtrend.

If buyers fail to rally swiftly, BTC could gravitate towards the intermediate support of $26,030. If it breaches this level, there's a likelihood of it descending back into the $25,000-$25,350 bracket, possibly setting new lows beyond that.

BTC chart on the H1 timeframe

Tron (TRX)

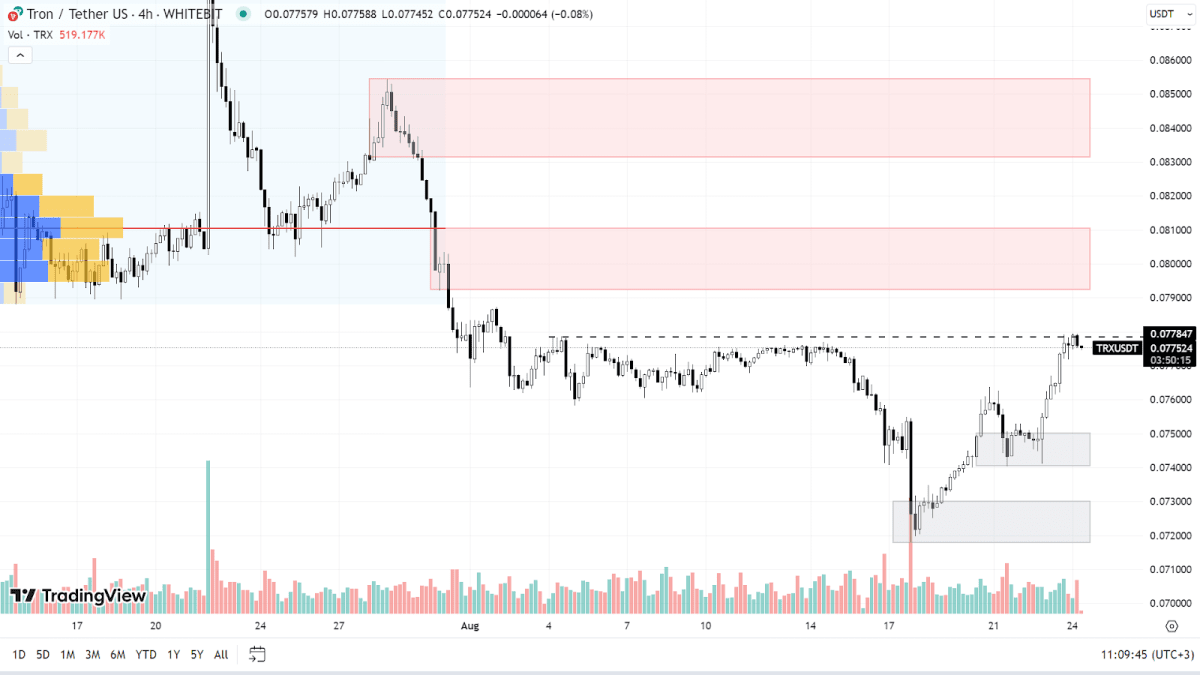

In contrast to many altcoins, TRON managed to offset the negative impact of Bitcoin's drop on August 18. The asset has now emerged from its recent downtrend and is challenging the resistance at $0.0778. If buyers can break this level, we can expect sellers to react within the $0.0792-$0.0810 and $0.0831-$0.0854 ranges.

Considering the ongoing correlation between Bitcoin and TRX, any volatility in BTC might induce fluctuations in TRON as well. The key resistance zones stand at $0.074-$0.075 and $0.0717-$0.0730. These ranges may be retested before the upward trend resumes.

TRX chart on the H4 timeframe

Check out GNcrypto for the latest cryptocurrency rates and chart analysis.

Disclaimer

Please note that the analysis provided above should not be considered a trading recommendation. These are solely the opinions of the GNcrypto editorial board regarding the market situation. Before opening any deals, we strongly advise conducting your own research and analysis.

Abbreviations

TF (Timeframe) — a chronological period equal to the time it takes to form one Japanese candle on the chart.

Horizontal channel (flat, sideways, range) — the movement of price between support and resistance levels, without going beyond the given range.

К — simplified designation of one thousand dollars of the asset price (for example, 23.4K - $23,400).

Gray range on the chart — a support zone.

Red range on the chart — a resistance zone.

Correlation — the tendency of prices of different cryptocurrencies to move in sync, often influenced by the dominance of one of the assets.

Initial materials

This analysis was informed by the following educational materials and articles from GNcrypto:

Recommended