ETH Liquid Staking: Statistics and Projects Rundown

2023 witnessed a remarkable expansion in the ETH liquid staking sphere, both in terms of TVL and the proliferation of cryptocurrency initiatives.

The rise of liquid staking marks a pivotal moment for Ethereum, complemented by last year's The Merge upgrade and the integration of ETH coin burning with every block.

Today, we'll explore ETH liquid staking, assess its data, and gauge its potential influence on the second-leading cryptocurrency.

What is Liquid Staking?

Traditional ETH staking requires one to have at least 32 ETH, valued at $57,600 at the time of this article. Liquid staking, on the other hand, offers a way to generate passive income with ETH using far less capital, as seen with just 1 ETH in platforms like Lido DAO. Such platforms pool users' coins into blocks of 32 ETH, allowing every participant to engage in the staking process.

A unique feature of liquid staking is that for the assets committed, traders receive a tokenized representation that mirrors the Ethereum price on a 1:1 basis. This means that even after staking, users can utilize their ETH for diverse activities, such as liquidity mining, cryptocurrency lending, or stablecoin borrowing.

To delve deeper into liquid staking, refer to our comprehensive article.

Statistical Overview: Lido Maintains Its Dominance

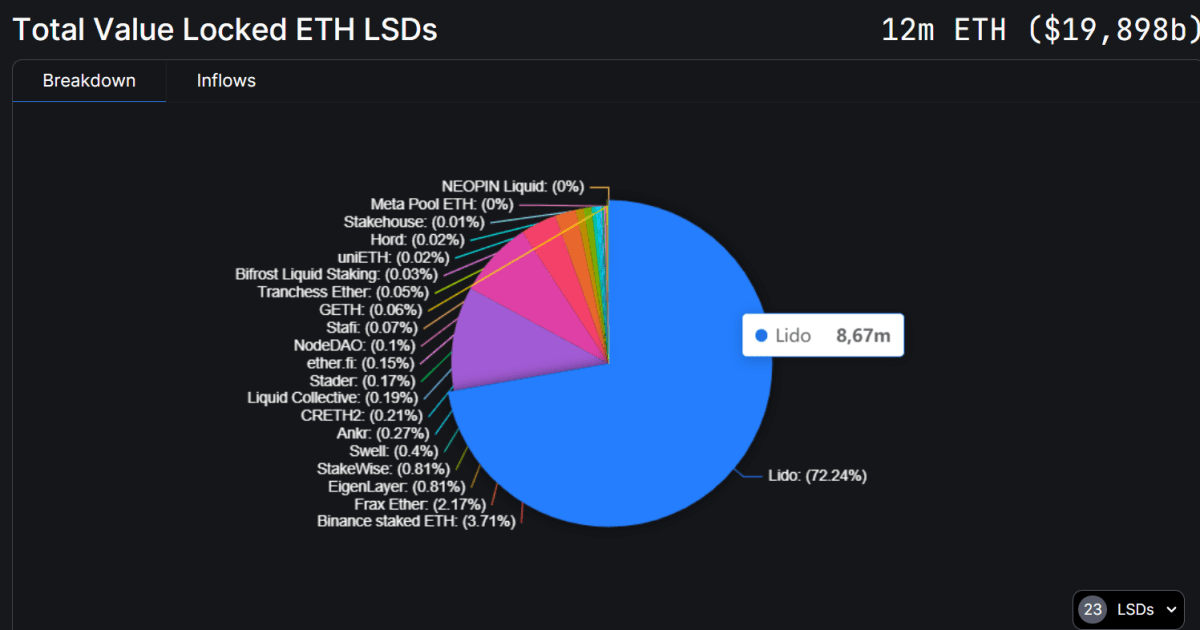

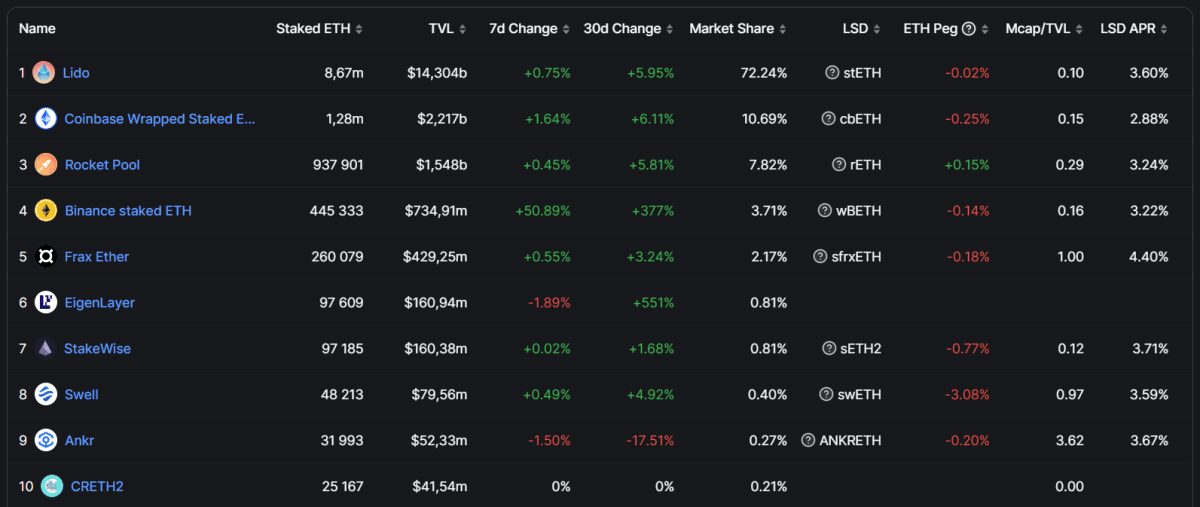

As of the article's publication, the total assets locked in Ethereum's liquid staking stands at 12 million ETH, translating to $20 billion. This approximates to about 10% of Ethereum's total market cap.

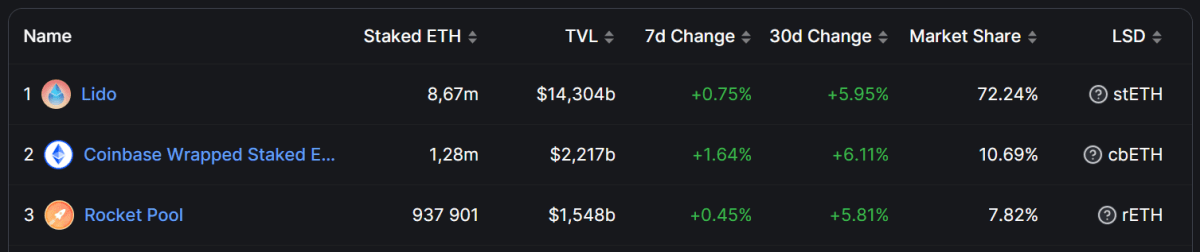

Lido DAO is the premier entity in this sector, holding a hefty 72.24% of the market, which equates to $14.3 billion. Following closely is Coinbase’s liquid staking solution, which claims a 10.7% share or $2.2 billion. Completing the top trio is Rocket Pool, securing 7.8% or $1.5 billion of the market.

Liquid Staking Market Participants by TVL Source: defillama.com

The Leading Trio in ETH Liquid Staking Source: defillama.com

ETH Movement in Liquid Staking

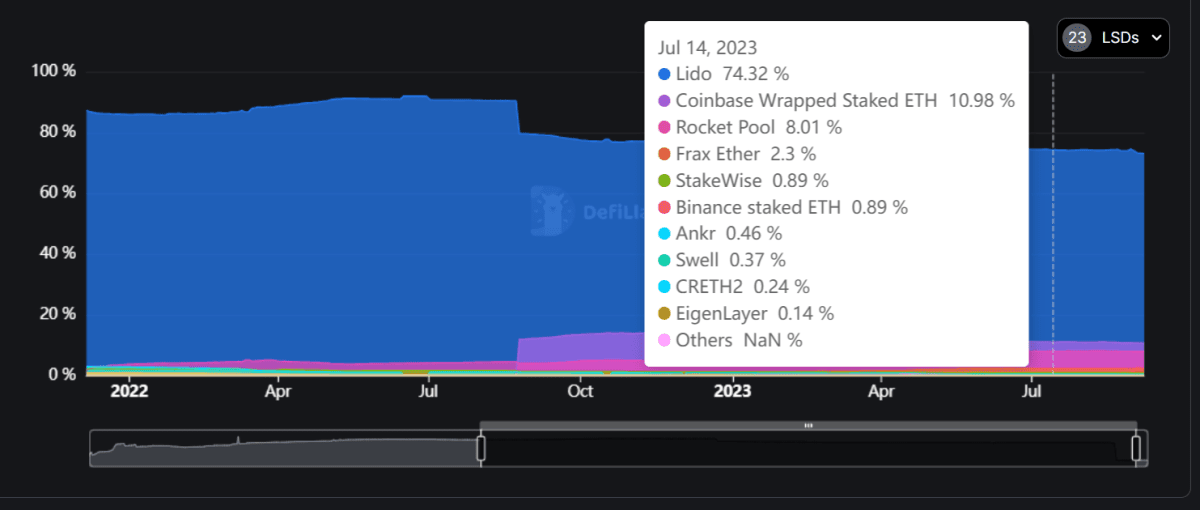

In 2022, Lido DAO maintained an overwhelming dominance, with a staggering 86-90%. However, as of September 2023, the landscape began to evolve with the introduction of several new projects to the market.

Distribution of ETH Across Diverse Liquid Staking Platforms Source: defillama.com

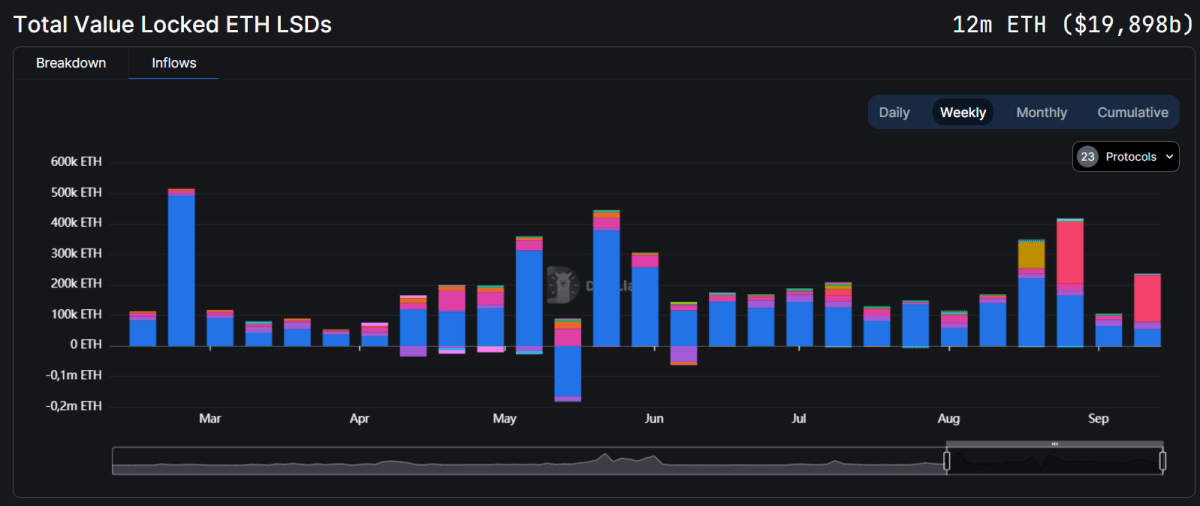

Concerning the overall trend of deposits and withdrawals, the volume of ETH commitments substantially outpaces the amount being unstaked. This phenomenon is likely tied to the attractive returns in the sector and its relatively low-risk nature.

There was a notable dip this year on May 18th when Lido DAO users withdrew 0.4 million ETH, valued at around $720 million. This move possibly correlated with a routine mechanism that allows fund extraction from the platform during certain timeframes. Despite this withdrawal, Ethereum's price remained steady that day, indicating that a significant portion of the ETH might have been reinvested into other staking ventures.

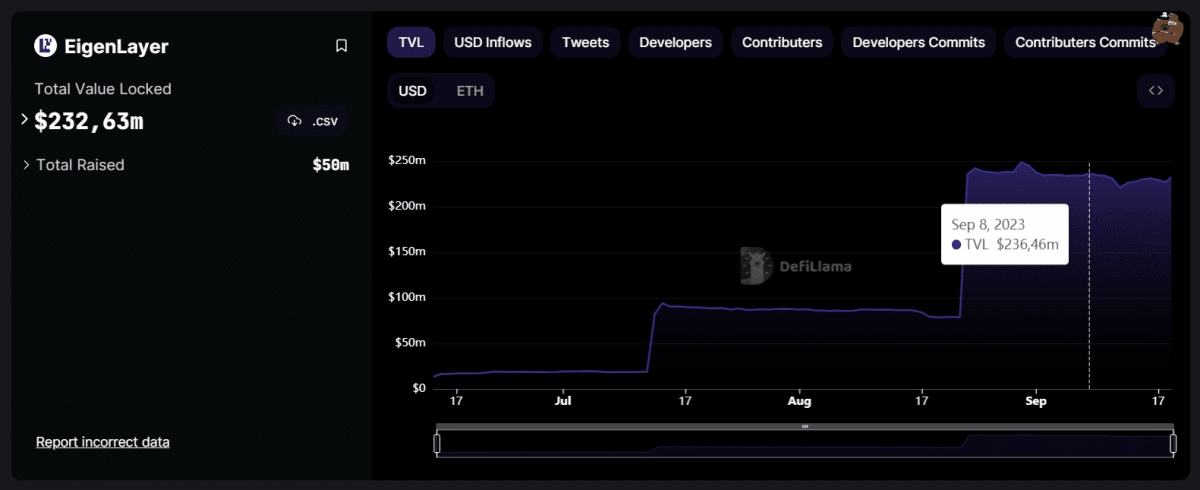

The infographic also unveils intriguing patterns. For instance, in late August, there was notable user engagement with the EigenLayer platform, while by early September, there was a marked interest in the staking pool offered by the cryptocurrency exchange, Binance.

Movement Analysis of ETH in Liquid Staking from Early March 2023 Source: defillama.com

The Leading Ten Projects

Beyond the previously mentioned three, the most prominent liquid staking protocols and their respective shares in the sector include:

- Binance Staked ETH

- Frax Ether

- EigenLayer

- StakeWise

- Swell

- Ankr

- CRETH2

EigenLayer stands out with a remarkable performance over the past three months. Within a mere two months, the protocol's TVL surged tenfold to reach $160 million. However, the project’s official site indicates an even larger locked ETH value of $240 million.

Top Ten ETH Liquid Staking Projects Source: defillama.com

EigenLayer Project Data Source: defillama.com

The growing intrigue around EigenLayer is largely due to the absence of a native token for the project. There's speculation that a token might eventually be distributed to its early adopters as a retroactive reward. This means participants could reap benefits not just from staking but potentially from a future token distribution as well.

The Sector's Potential and Challenges

Liquid staking, as a sector, offers a myriad of benefits, explaining its widespread appeal:

- The vast quantity of locked ETH mitigates downward price pressures.

- There's an observable growth in both the trade volumes and the TVL of the DeFi landscape.

- An increase in ETH being burned can be attributed to heavy network traffic and high transaction counts.

- The market is welcoming new assets, notably tokenized ETH and the native tokens associated with various liquid staking projects.

These factors collectively hint at a potential rise in the value of Ethereum's native cryptocurrency due to the augmented demand. However, it's crucial to remain aware of the accompanying risks:

- Potential vulnerabilities in smart contracts can jeopardize user assets. In such scenarios, not only can the staked ETH be at risk, but the tokenized asset's value might plummet, especially if news about a platform breach becomes public.

- Among the myriad of liquid staking projects, some might prove to be fraudulent. It's imperative to meticulously vet both the overt information and the underlying smart contracts of a protocol to safeguard against deceitful schemes.

- By its nature, liquid staking could corner a significant portion of the ETH market, inadvertently steering it toward centralization.

Engagement with liquid staking platforms should be approached with caution. A comprehensive understanding of associated risks and diligent independent research are prerequisites before considering any form of investment.