Exploring Camelot - DEX on the Arbitrum Blockchain and the GRAIL

Camelot stands as one of the most prominent decentralized platforms operating on the Arbitrum blockchain, featuring its native token, GRAIL.

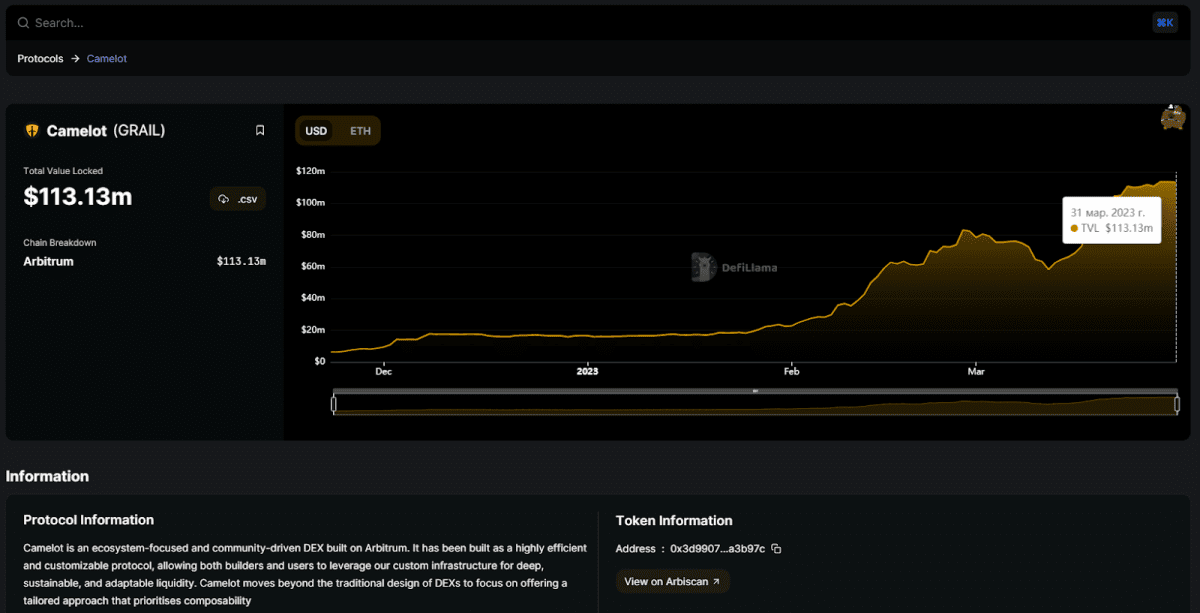

DefiLama's data indicates that more than $115 million is locked within the platform, making Camelot among the top DEXs on Arbitrum. The secret to this achievement lies in the exchange's unique development and deployment of the blockchain, rather than merely integrating a new network like most DEXs.

Camelot's TVL as per DeFiLama

In this article, we will guide you through utilizing the Camelot platform, discuss the potential of the GRAIL token, and examine why users engaging with Camelot may be rewarded with ARB tokens.

Information and statistics

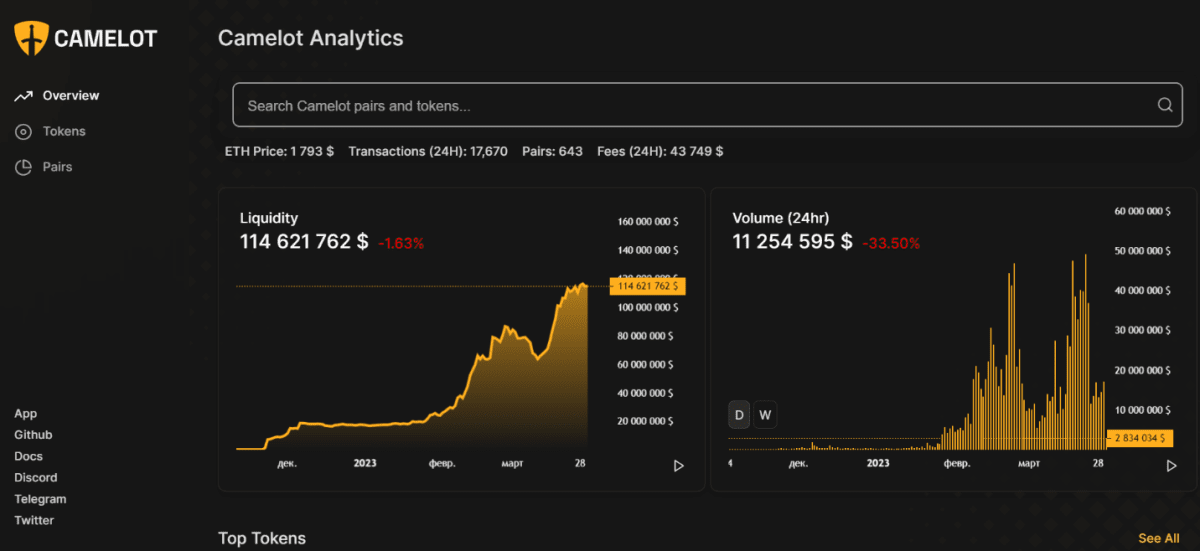

Camelot's platform data reveals that daily trading volume exceeds $11 million. The most substantial liquidity is locked in trading pairs featuring coins such as ETH, USDC, GRAIL, and ARB.

Statistics from Camelot's platform

Following the ARB token listing on the exchange, its tokenomics have been disclosed. According to Arbitrum's tokenomics, Camelot will secure a $2 million ARB allocation and will likely distribute it among platform users for a variety of activities.

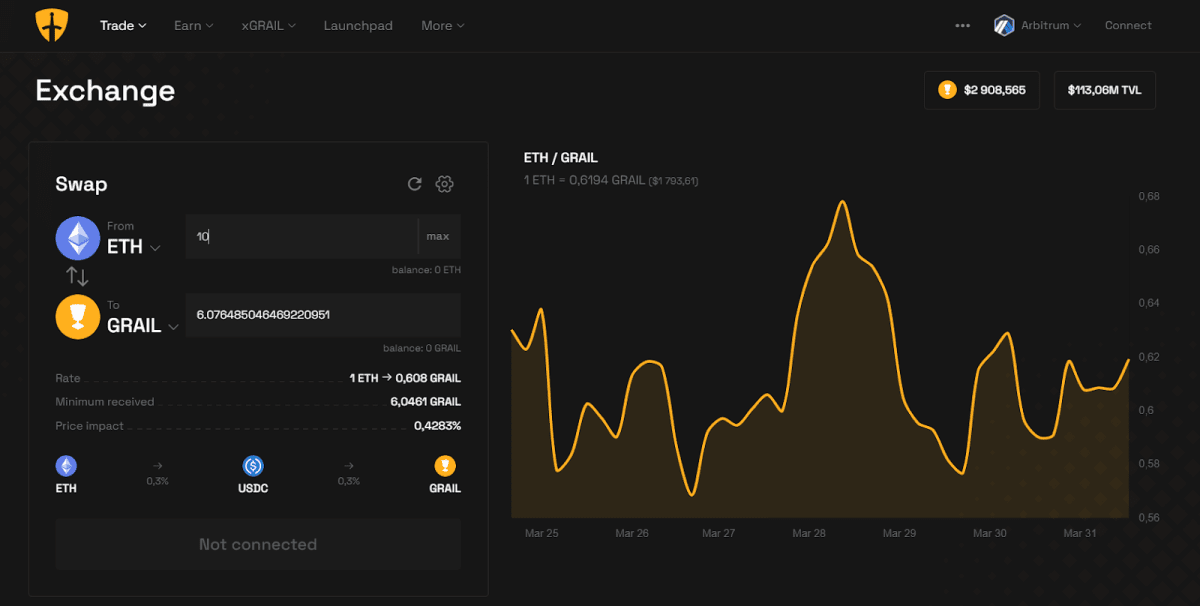

"Trade" section

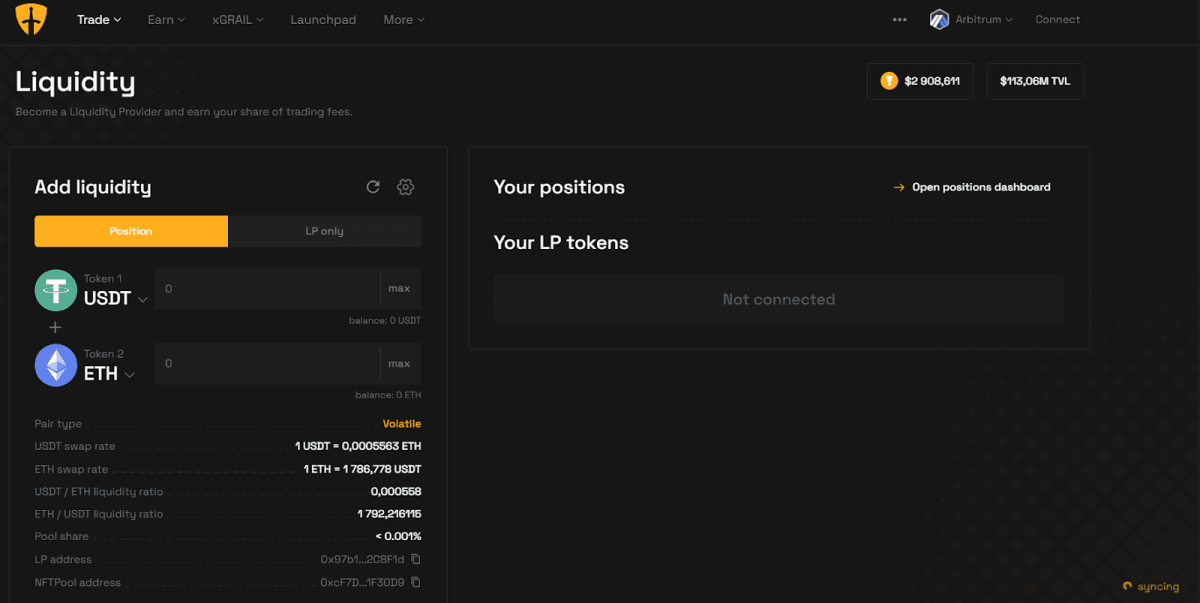

The homepage displays a "Trade" section that facilitates token exchanges. Users can contribute their liquidity here to participate in coin farming programs. The investment mechanism resembles that of most DEXs, necessitating proportional ratios of tokens invested in farming (i.e., 50/50).

Exchanging tokens on the Arbitrum network

Contributing liquidity on Camelot

"Earn" section

The "Earn" section presents information regarding all passive income activities on Camelot, in which the user is involved. These activities can include farming, staking, and voting with Grail coins. The "Earn" section is divided into four subsections:

● My Positions: The user's locked funds on Camelot and the estimated annual percentage;

● Yield farming: Information on currency pairs where users can allocate their funds;

● Nitro pools: Trading pairs with enhanced yield percentages;

● Genesis pools: Trading pairs featuring stablecoins, BTC, and ETH.

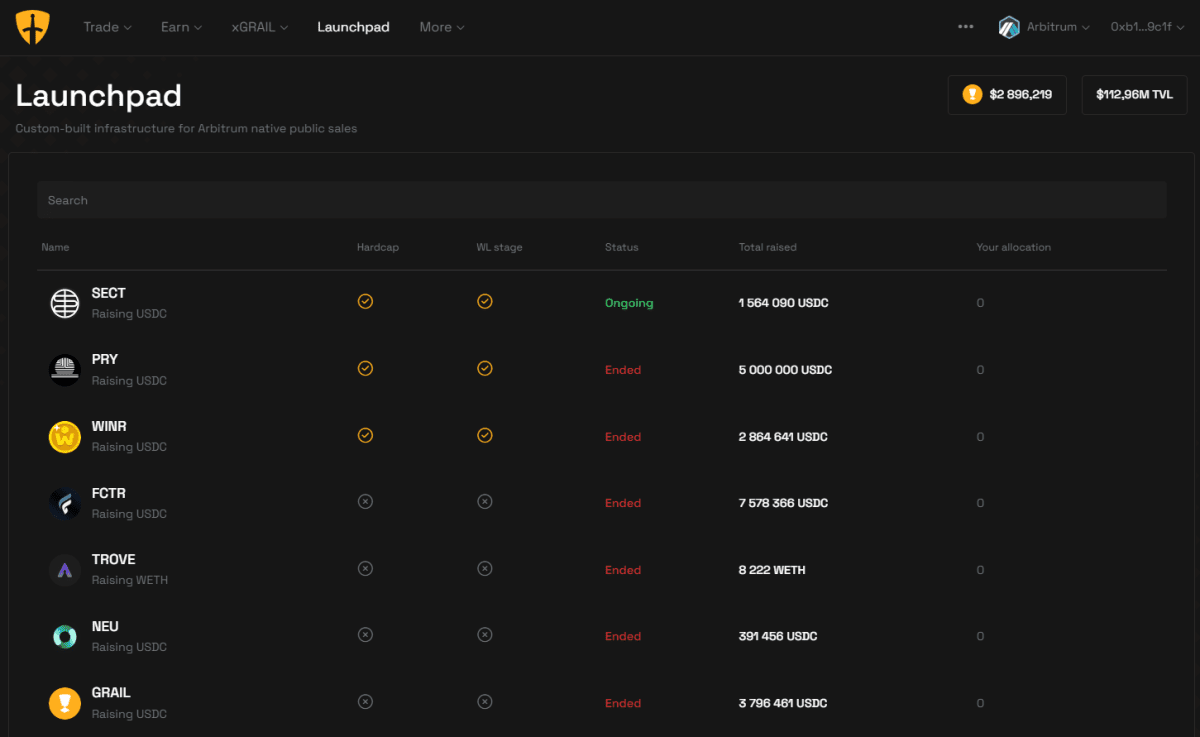

Launchpad

Camelot offers its own launchpad for incubating emerging projects on the Arbitrum blockchain. Users can invest in startups within the gaming and DeFi sectors, as well as those designed to foster the broader ecosystem. Participation can be attained through securing a Whitelist spot via lottery; if all tokens are not sold during this round, all interested parties will be able to purchase the asset.

Camelot's Launchpad section

GRAIL Token

GRAIL serves as Camelot's native token. It can be employed in a variety of activities:

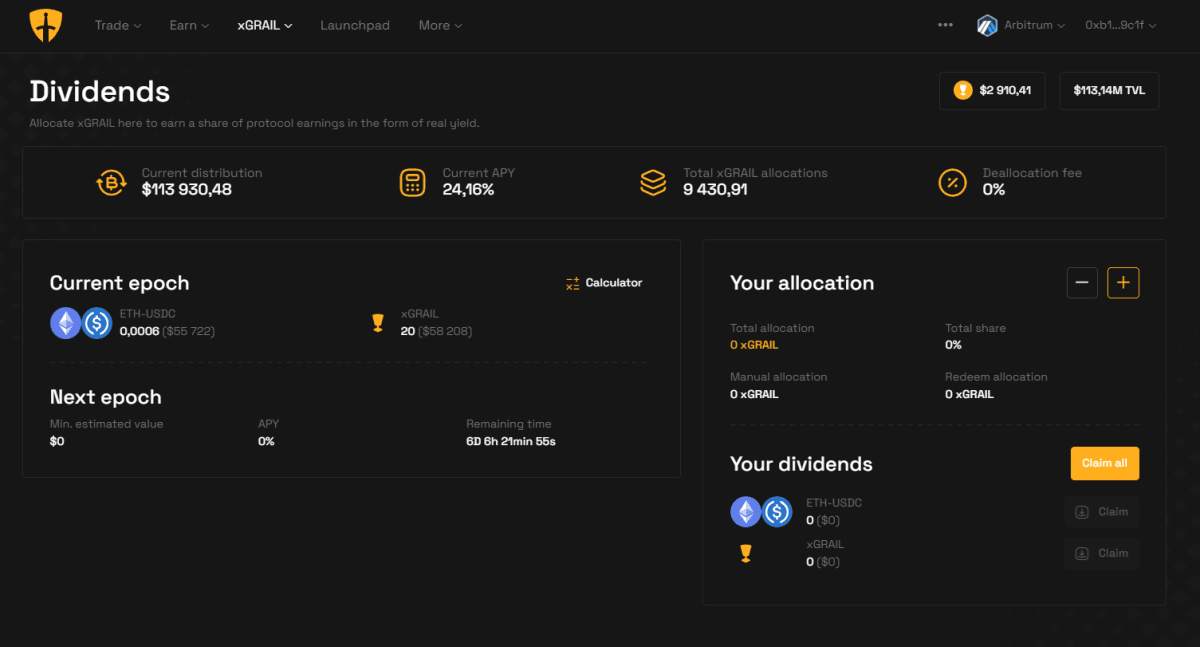

● The xGRAIL section permits users to lock their coins in staking, receiving passive income in ETH and USDC coins;

● GRAIL facilitates the opportunity to acquire a whitelist position for projects launching on Camelot's launchpad;

● Possessing GRAIL coins may increase yield in trading pairs where funds are dedicated to liquidity farming.

To utilize the coin on the platform, users must convert GRAIL into a wrapped xGRAIL token.

Details on the dividend volume for GRAIL staking:

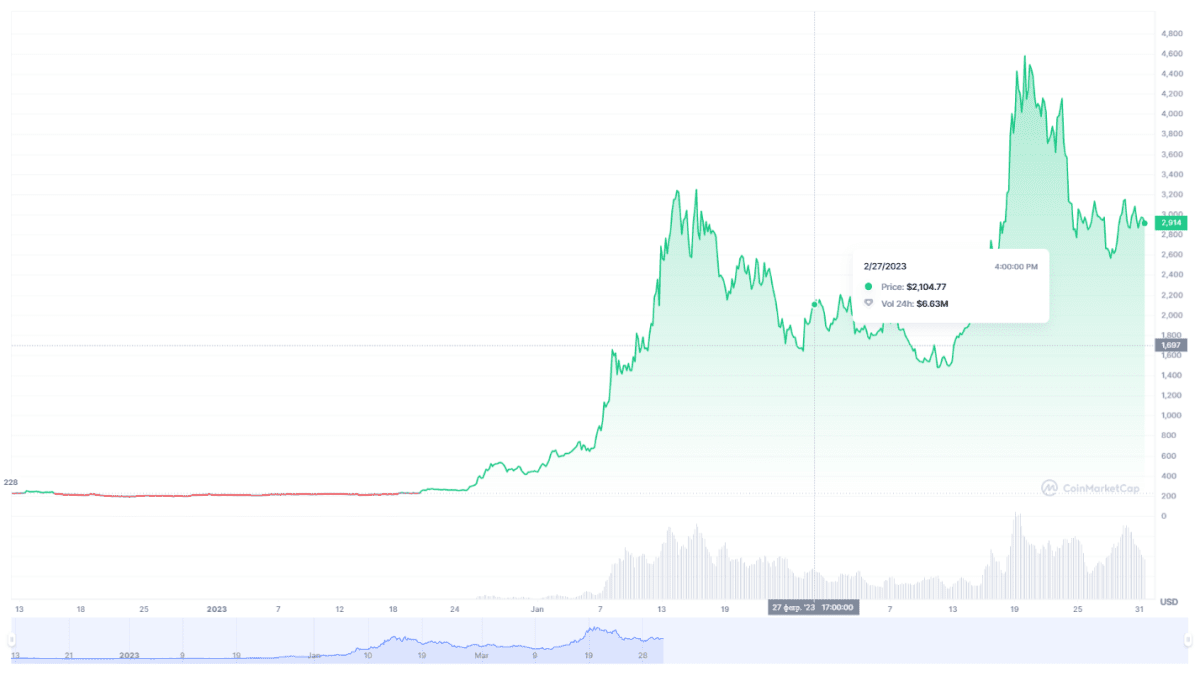

Here is some general information about the GRAIL token:

- Market capitalization: $27 million

- Maximum emission: 100,000 coins

- In circulation: 9,416 coins

- Average daily trading volume: $4.3 million

- Maximum price: $4,315

- Minimum price: $210

GRAIL can be purchased on exchanges such as KuCoin, MEXC, HUOBI, Gate, and directly on the Camelot platform. CoinGecko and CoinMarketCap websites have a full list of trading platforms under the "Markets" section.

Price dynamics of the GRAIL token (CoinMarketCap):

If the Arbitrum ecosystem continues to develop at a high pace, Camelot could significantly improve its statistical indicators, which could also impact the price dynamics of the GRAIL token, which has various applications on the platform.

Recommended