Is Binance About to Replicate FTX’s Collapse?

Changpeng Zhao, Binance CEO, says he is once again forced to respond to FUD.

On February 27th, Forbes Premium published a long read dubbed “Binance’s Asset Shuffling Eerily Similar To Maneuvers By FTX“. The article examines Binance’s financial movements, insisting that its recent actions are very much akin to those made by FTX before its collapse.

The publication also explores several areas and focuses on a transaction made last year when “the crypto markets were struggling to regain their footing.” Back then, Binance, according to Forbes, moved $1.8 billion of collateral for backing its customers’ stablecoins, putting the assets to other undisclosed uses.

Besides that, it is stressed in the article that between August 17 and early December, “holders of more than $1 billion of crypto known as B-peg USDC tokens were left with no collateral for instruments that Binance claimed would be 100% backed by whichever token they were pegged to.”

The article also notes that crypto forensics firm ChainArgos was the first to raise concerns about Binance breaking its own rules for how pegged-token backing should work. As well as a persistent lack of collateral to secure billions of dollars in tokens that the exchange issues.

According to the publication, the latest incident is just one of Binance's controversial practices. Other points include the lack of a physical headquarters; a corporate structure that appears to be designed to evade regulators; a corporate structure that appears to be designed to evade regulators; and federal investigations into money laundering and tax evasion.

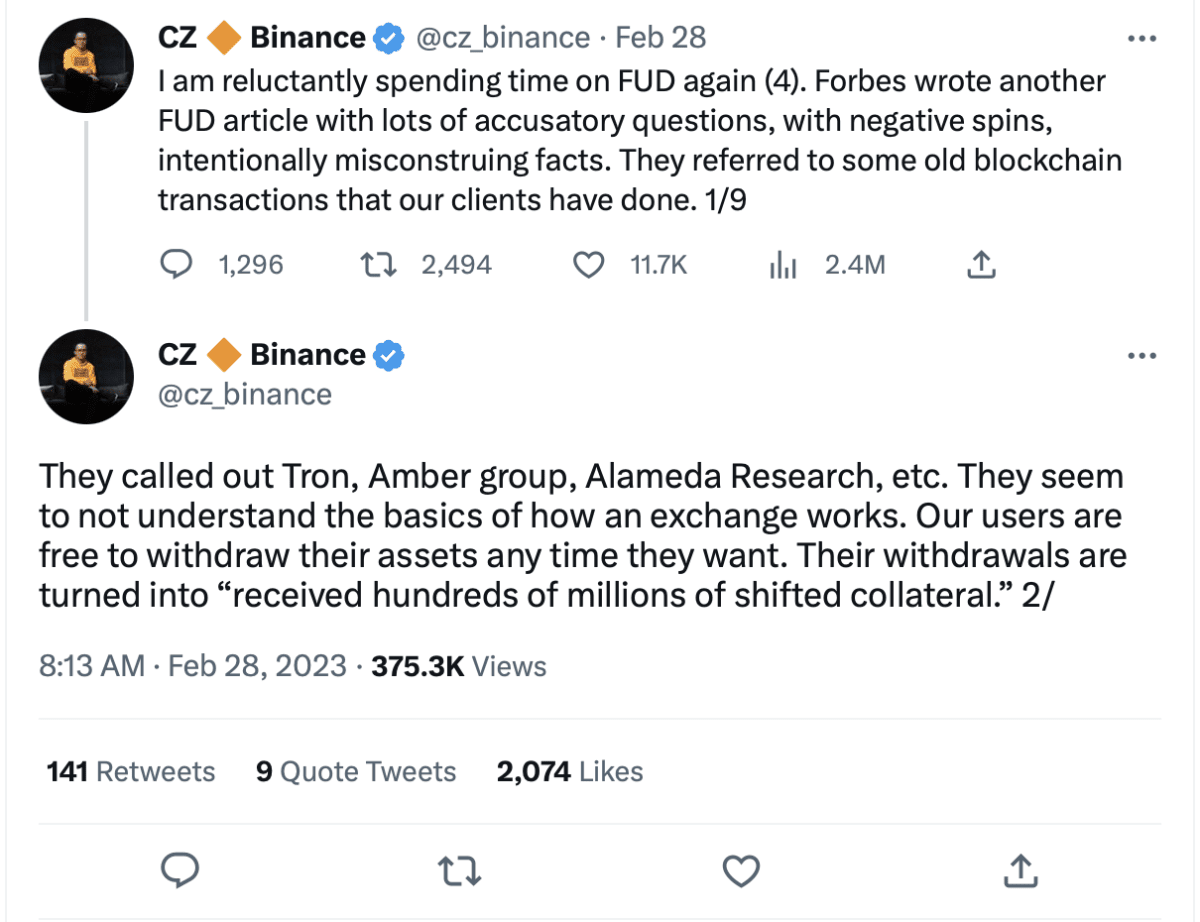

Binance CEO Changpeng Zhao has already reacted to this article, saying that it appears that Forbes does not understand how the blockchain system works.

Source: CZ’s Twitter

In his tweets, he also accused the news outlet of misrepresenting some facts.

“Our users must deposit on Binance first in order to be able to withdraw money. Those transactions are easily traceable on the blockchain. The article conveniently ignores deposit transactions,” he tweeted.

Just recently, the US Securities and Exchange Commission alleged that Binance USD is an unregistered security. As a result, Paxos Trust was ordered to stop minting the coin.

Just recently, the US Securities and Exchange Commission alleged that Binance USD is an unregistered security. As a result, Paxos Trust was ordered to stop minting the coin.

Paxos has also terminated its cooperation with Binance.

Recommended