The NFT Effect on Art Markets: A Movement or A Moment?

Cryptocurrencies have made their mark in diverse sectors, from coffee supply chains to agriculture, construction, and healthcare. Blockchain's adaptability is remarkable, but how has it woven itself into the world of art?

The magnetic pull of cryptocurrency has attracted a diverse group of creative minds. The combination of financial incentives, intricate coding, and a tidal wave of excitement has played a pivotal role in drawing in a dynamic community of artists. But what specific elements of cryptocurrencies have captured their imagination? For instance, Takashi Murakami was particularly intrigued by the opportunity to cultivate entirely digital art in his unique Superflat style. This illustrates that NFTs, in particular, have resonated deeply with artists, appealing not only for their creative possibilities but also because of the advent of non-fungible token technology. This groundbreaking innovation provides a means to authenticate ownership rights in an entirely anonymous landscape.

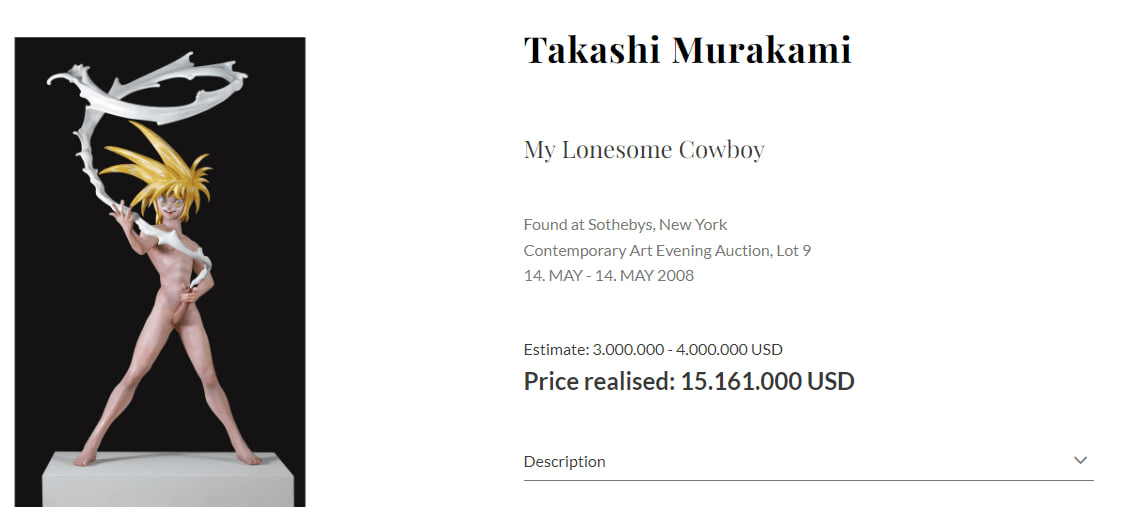

It's crucial to underscore the striking parallels between NFTs and traditional art. Consider, for instance, the action figure crafted by Takashi Murakami, as depicted in the screenshot below, which commanded $15 million at auction back in 2008. This unique style, known as Superflat, offers a moment for contemplation. It serves as a reminder that, no matter how unconventional you may feel your pursuits are, there are realms of investment that can appear even more unconventional.

My Lonesome Cowboy, Takashi Murakami | Source: art.salon, sothebys.com.

Fast forward to March 11, 2021, and we witness a monumental event at Christie's, an auction house with a remarkable 250-year history and responsible for 90% of global antique and art sales. Here, a piece created by Beeple achieved $69 million in a sale. The artwork, aptly named "Everydays: The First 5000 Days," not only shattered existing perceptions of NFTs but also propelled Mike Winkelmann to the status of the world's most valuable artist.

The concept behind NFTs was initially hailed as a means for artists to bypass intermediaries, enabling them to directly benefit from their creations and earn royalties on subsequent sales by other traders. In theory, this was an ideal scenario, empowering artists with a potent tool to showcase their work. So, what could have possibly gone wrong?

The NFT market has indeed experienced significant overheating, leading to substantial damage to its reputation and, in some cases, even being misused for money laundering. A study conducted in 2023 by dappGambl, which is basically an online crypto casino aggregator, found that 95% of NFTs had lost their value. Years earlier, NFTs had earned the moniker "JPEGs for sale," and they were often seen as speculative investments that didn't yield substantial returns. Even attempts to sell internet memes through NFTs did little to change this perception. Media outlets were quick to seize on this sensational narrative, perpetuating the idea that the NFT market had met its demise.

So, has the NFT market truly perished?

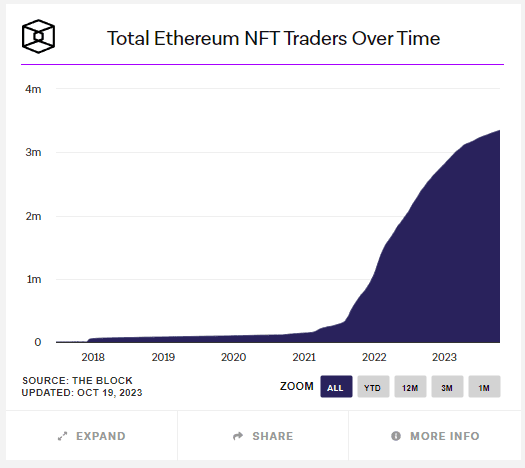

Commencing in 2021, the count of NFT traders witnessed near-exponential growth, surging to approximately 3.3 million by 2023. The market found itself inundated with participants, setting the stage for demand to potentially outstrip supply.

Total Ethereum NFT Traders | Source: TheBlock.co

Just take a look at the chart above. It vividly shows an exponential increase in the number of market players.

In terms of numbers, OpenSea, a major player in the NFT marketplace, appeared to be on track for substantial profits. One might assume that artists were set to earn a significant share of the revenue, right? In January 2022, the platform recorded $4.5 billion in trade volumes, with sports NFTs gaining traction. However, the overall sentiment among the public turned less favorable due to various global events, such as the Ever Given incident, the real estate crisis in China, unrest, a rising U.S. unemployment rate, the global pandemic, and Russia's attack on Ukraine. These factors caused a shift in people's interests away from digital art, as the world became more tumultuous.

There's a clear link between the declining interest in NFTs and the traditional art market. This trend hasn't spared digital PFP collections and has impacted classical art as well. What's interesting is that a minor crisis is unfolding: sales at the three largest auction houses have dropped by 20%, and global art sales have seen a 14% decline. The question arises: what's driving this decline? It seems that even the wealthiest individuals are facing challenges, and that's usually a concerning sign. When we look at the bigger picture, the NFT downturn seems to mirror the decreased interest in traditional art sales.

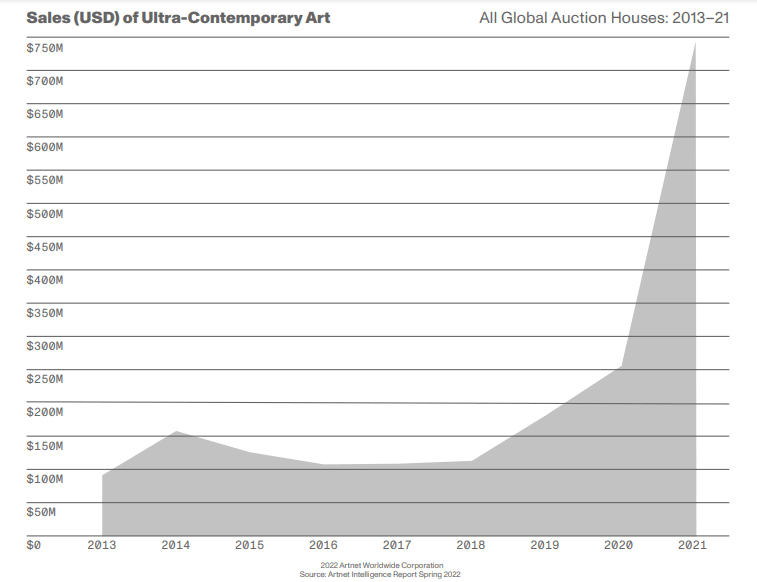

But what about the ultra-contemporary art market? It has experienced a surge due to COVID-19 – nothing boosts interest in paintings quite like staring at a blank wall every day. Moreover, it is arguably the closest in spirit to the NFT market. From the beginning of 2019 through 2021, the number of ultra-contemporary art sales increased nearly sevenfold. It’s noteworthy that this category has never enjoyed the super-popularity it has finally achieved.

Sales of Ultra-Contemporary Art Year Over Year / Source: Artnet Intelligence Report

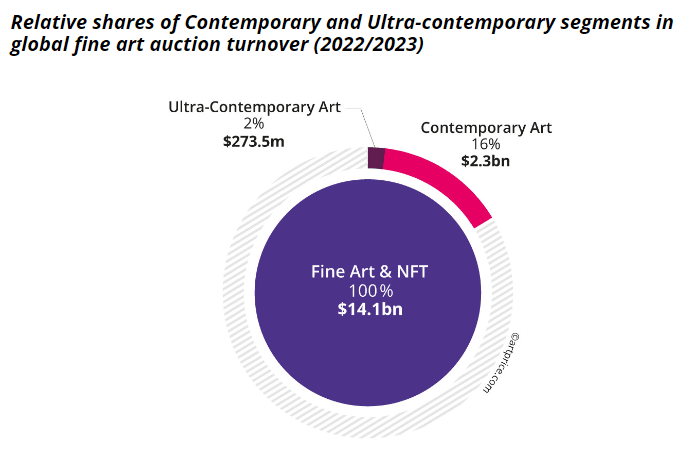

The interest in ultra-contemporary art grew exponentially for three full years, and 2022-2023 were no exception. Calculating the weekly trading volumes for 2023, we find sales totaling $6.5 billion.

Relative Trading Volumes in the Ultra-Contemporary Art Sector Including NFTs | Source: Artprice.com

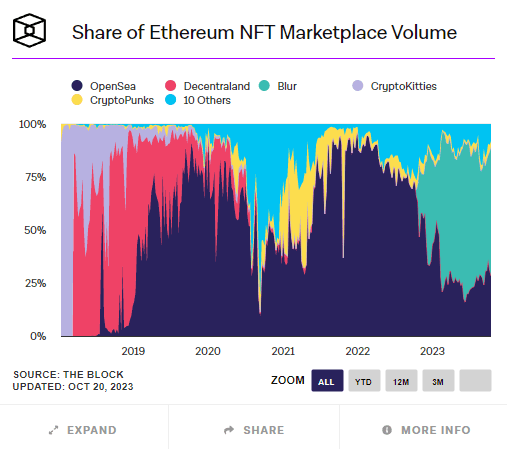

To be precise, it's not NFTs that have waned, but rather OpenSea itself. The platform didn't just lose its relevance; it severely tarnished its reputation within the art community on August 31, 2023, by making royalty payments to artists "optional." This stands in stark contrast to the core principles of NFTs, which were initially introduced as a way for artists to earn passive income from the resale of their art, ensuring direct profit transfers to the artist's wallet without intermediaries.

Later, OpenSea attempted to improve its image, but it was too late. A competitor, Blur, surged ahead and outperformed OpenSea in sales volume within a year, reaching a peak of $1 billion in trade volumes. By the time OpenSea revised its payout policies, its lead was irreversibly lost. To stay afloat, the platform adopted aggressive strategies against both competitors and artists.

Blur, surpassing Open Sea / Source: TheBlock.co

If an artist tried to sell the same NFT on both OpenSea and Blur, OpenSea took an assertive approach by making artist royalties "optional." In essence, it meant the platform was willing to waive an artist's earnings if they explored alternative blockchain access interfaces.

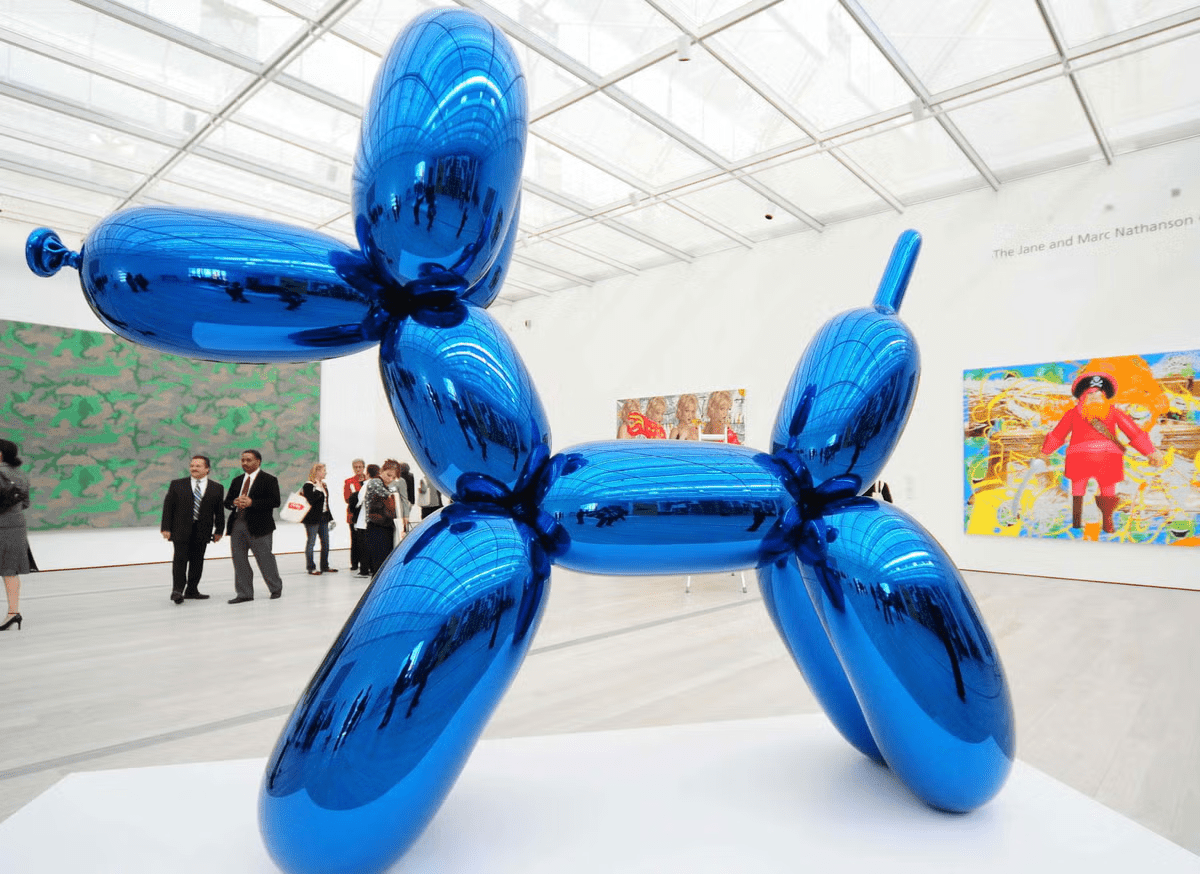

Kitsch is an art genre that aims to elevate "low-brow" artworks to a high-end, sophisticated level. It thrives on simplicity, avoids complexity, and frequently emulates the success of others to convey specific emotions or atmospheres.

The name of this genre, "Kitsch," derives from the German word, which translates to something of poor quality or in bad taste. Nevertheless, it's worth noting that Jeff Koons managed to carve out a niche for himself within this genre. He remained in the realms of kitsch throughout his career, and his artworks have found a place among the most valuable contemporary collections.

Balloon Dog (Blue) сvalued at $58 mln, Jeff Koons | Source: Google.com

The photo above showcases a balloon dog sculpture valued at $58 million. It's a glimpse into the high art world, where art simply exists, and some are willing to pay hefty sums for it. Why? Because, for those who can, that's reason enough.

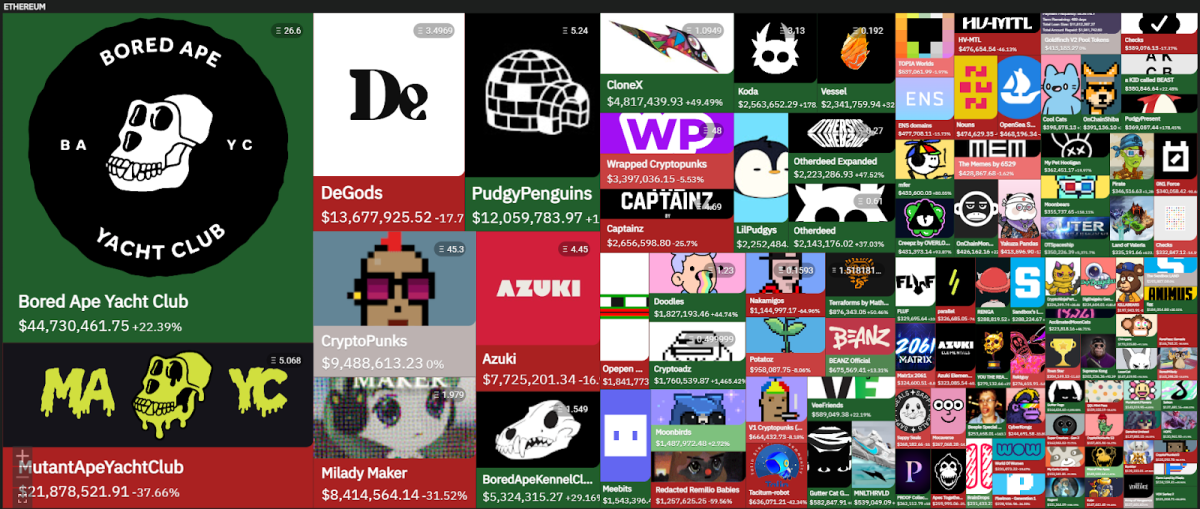

Let's be direct: 95% of the NFTs that have lost value might have been virtually worthless from the moment of creation. The market was flooded with attempts to replicate someone else's success, with the image created by CryptoPunks becoming a perceived "safe" formula for success.

Unique NFTs continue to be traded | Source: Coin360.com

The “profile face” theme, supplemented with trinkets and “mutations,” became a foundation. However, this only spawned a flood of kitsch NFTs trying to capitalize on nostalgia and parasitize on someone else’s success.

Why put effort into creating something valuable when you can mass-produce images from a single template and pass it off as creativity? This brute-force approach and the flood of new NFTs could only lead to one outcome – the devaluation of art in an oversaturated market filled with trinkets. A similar fate befalls NFTs created solely for quick profits, as they become irrelevant due to their lack of purpose, absence of meaningful ideas, or a compelling narrative behind the token.

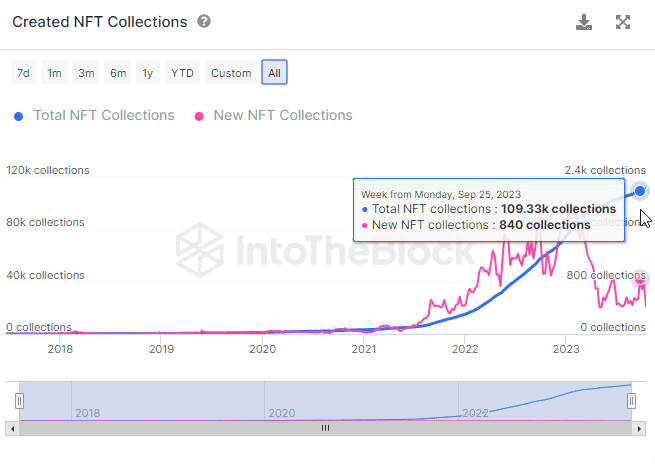

Statistics of created NFT collections | Source: IntoTheBlock.com

Interest in NFTs is undeniably showing signs of decline, possibly reflecting reduced enthusiasm for creating new tokens in the face of market oversaturation. Buyers now have a staggering choice of 110 thousand collections across more than 10 different blockchain networks.

The current state of the NFT market appears more like a correction. Demand still outpaces supply, but this cannot be a perpetual state. The peaks experienced in previous years must be balanced by phases of decline.

Recommended