Real Estate vs. Crypto: What Would You Buy?

A house or BTC? What would you rather get?

A lovely house with a garden? Or some crypto? And which is a better investment?

That’s the Twitter discussion initiated by Honey, who claims to be a trader and an investor.

In her tweet, she wrote, “90% of my friends and co-workers think buying a house is a better investment than investing in crypto lol.”

Honey’s tweet. Source: Twitter

In response, some users asked her why she has co-workers if she is into crypto. Others concurred or pointed out that some investors have sold off real estate in order to buy into cryptocurrency, suggesting they support her argument.

As a result, GNcrypto decided to make a comparison of the two investments. Note that it is cursory, was primarily created for illustrative and entertainment purposes, and shouldn’t be taken as financial advice as there are many more factors to consider before investing.

In this example, we will consider the period between 2009 and 2017— from Bitcoin’s inception to the first significant pump in 2017.

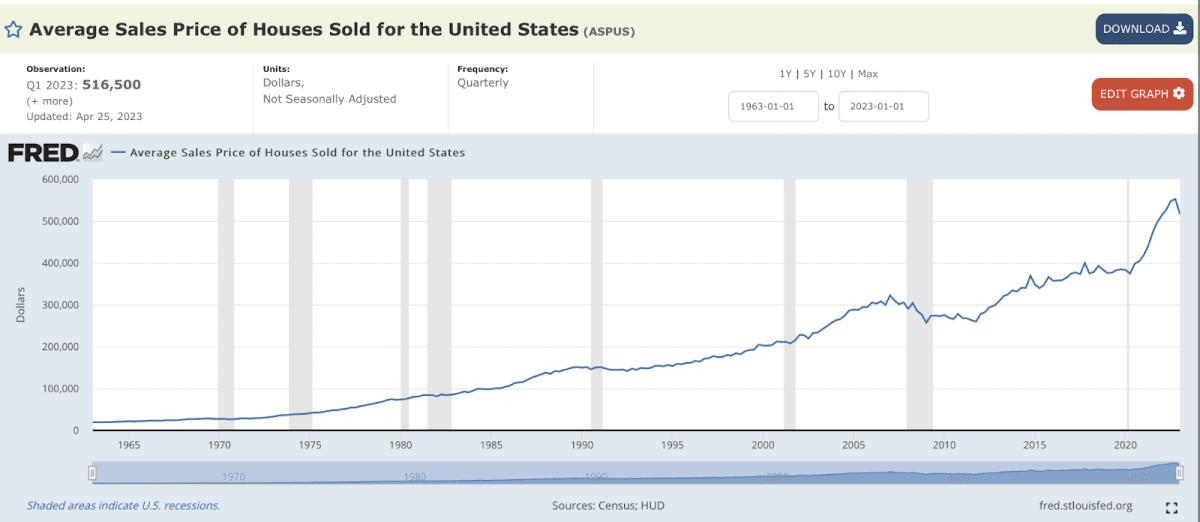

In 2009, the average price for a house in the US was $275,000. In 2017, it was $399,000. The respective numbers for Bitcoin are $0.0009 and $20,089.

Average sales price of houses sold in the United States. Source: Federal Reserve Bank of St. Louis

Accordingly, if you were to buy a house in 2009 and sell it in 2017, you’d make $124,000. The respective number for Bitcoin is $20,088.

Does that automatically make real estate a better investment than Bitcoin? Not necessarily, as much depends on who you are, what you do, what your goals are, and how lucky you are.

In hindsight, it is easy to predict that Bitcoin would one day go from $0.0009 to $20,089—a price that, according to a common consensus, was a bubble at the time.

But for an institutional investor in 2009, this scenario is unknown and rests solely on belief, meaning that real estate is a safer bet. Note that we’re talking about institutional investors, as it is challenging to assume that a private investor would buy real estate for investment purposes only and not live in it simultaneously.

That, unless we’re talking about a wealthy person. In such a case, not only do you get an increase in price over time, but there’s also a perfect chance that you’ll earn money by renting out the place.

Besides, it is common in some countries to borrow money against your property to buy even more property. So that must also be considered.

The story is slightly different for a private investor. It would have cost nothing for anyone to get one Bitcoin in 2009. However, this significant difference in returns is primarily due to the fact that 2009 was the entry point, and the market conditions at that time were extremely favorable.

Now the situation is different; the entry point is much higher, and the rewards are smaller accordingly.

Then there’s the fluctuation. Real estate prices, as visible from the graph above, are not as prone to fluctuation as Bitcoin is. But suppose you do get lucky, invest your money in favorable circumstances, and go through a bull market. In that case, you are likely to earn more in a short period of time than by buying property and paying off your mortgage, for example. That is, if you need it.

Bitcoin price dynamics over time. Source: Coinmarketcap

While based on the information above, each of us will likely reach a conclusion on our own, investing is not a one-solution-for-all activity. Before deciding on various scenarios, it is crucial to consider a range of factors. Conducting thorough research on your own, rather than relying solely on random tweets can prove to be beneficial in the long run.

Previously, GNcrypto explained what NFT lands and real estate in metaverses are.

Recommended