Staking interest calculators

Interest calculators give you access to mathematical formulas to estimate your earning potential. They are used before freezing assets in projects based on the Proof-of-Stake consensus algorithm and its varieties (LPoS, NPoS, PPoS, and PoA).

We have already reviewed staking platforms and noted their advantages and disadvantages in terms of functionality.

Today, we will focus on applications used to calculate the predicted profitability from holding assets on the blockchain.

But first, let's define some terms.

What are the types of staking?

The profit from staking depends on the percentage of income given to the validator on the PoS blockchain. This indicator is called APR – annual percentage rate.

Let's say you want to stake 100 coins “A” in a project that provides 10% per annum. You will receive 10% per annum on your asset.

In one year, your net asset will be 100+(100×10%)= 110. You will receive 0.027% on your deposit daily or 0.833% per month.

There are three types of staking:

1. Locked Staking. It refers to the process of locking your assets for a specified period to secure the network and ensure the transactions validity. The lock-up period may be different and depends on the terms of the contract. For example, in Trust Wallet, you can return your assets no earlier than 72 hours after unstake. Disadvantage: you must specify the term when signing the contract, and you’re not entitled to change it retroactively.

2. DeFi Staking. It refers to the process where your funds get locked on DEX platforms. This process often involves lending to other community members or participating in asset insurance through smart contracts. With DeFi staking, interest is paid not by the blockchain but by the other party to the smart contract. Therefore, the entry threshold is lower here, and the risk of losing funds is higher.

3. Flexible Staking. It is not bound to time. Users can withdraw their funds whenever they want (and, accordingly, lose APR). Most well-known exchanges support this type of staking.

There are dozens of cryptocurrencies on the market today that can be locked on the blockchain to keep it running. Some projects offer significantly more returns than others. And the income that staking brings is constantly changing.

It is easy to calculate the potential profit if a project offers a 10% APR and you are ready to freeze 100 coins in its network for one year. But what if you have to operate with fractional numbers, or you need to choose a platform with the most favorable conditions? In this case, it is worth using the program for calculating staking interest.

We offer several options.

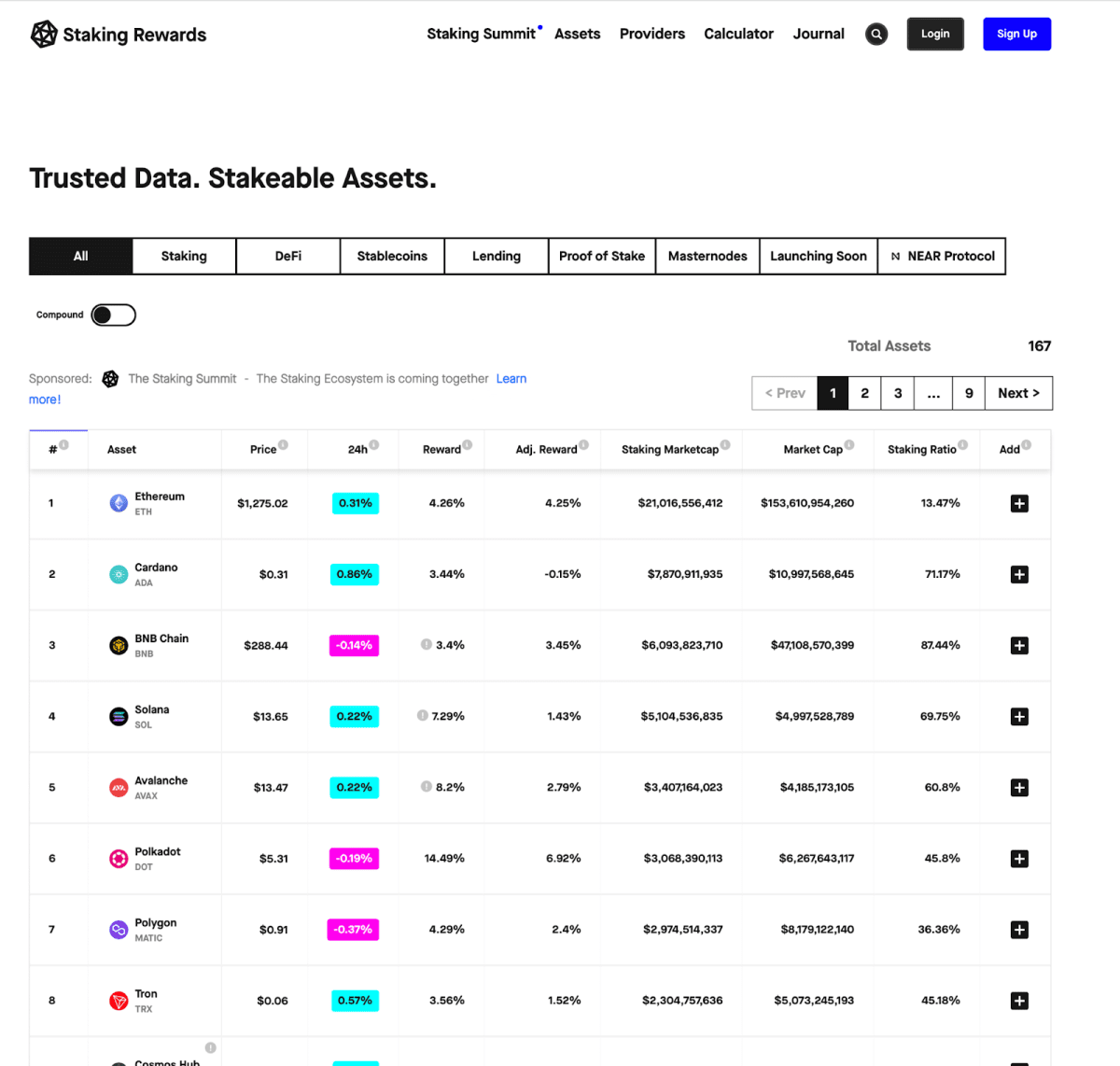

Stakingrewards.com

The service tracks 190 digital assets according to the following parameters:

- current price

- price change for the last day

- annual return (in %)

- number of coins already staked (in $)

- total capitalization

- ratio of total supply to assets in staking

Detailed information on each asset can be viewed by clicking on its ticker.

For each cryptocurrency, the top 10 most profitable APR offers are displayed.

Staking Rewards homepage

The site also has an "advanced" calculator. With it, you can calculate the profitability of any asset by the number of days, taking into account service fees and reinvestment. In addition, here, you can indicate the expected price changes and observe the recalculation of profit at any time.

The key platform’s feature is a rating of profitable projects (DEXs, CEXs, and wallets), which is based on user reviews.

The disadvantage is that it lists a lot of shitcoins.

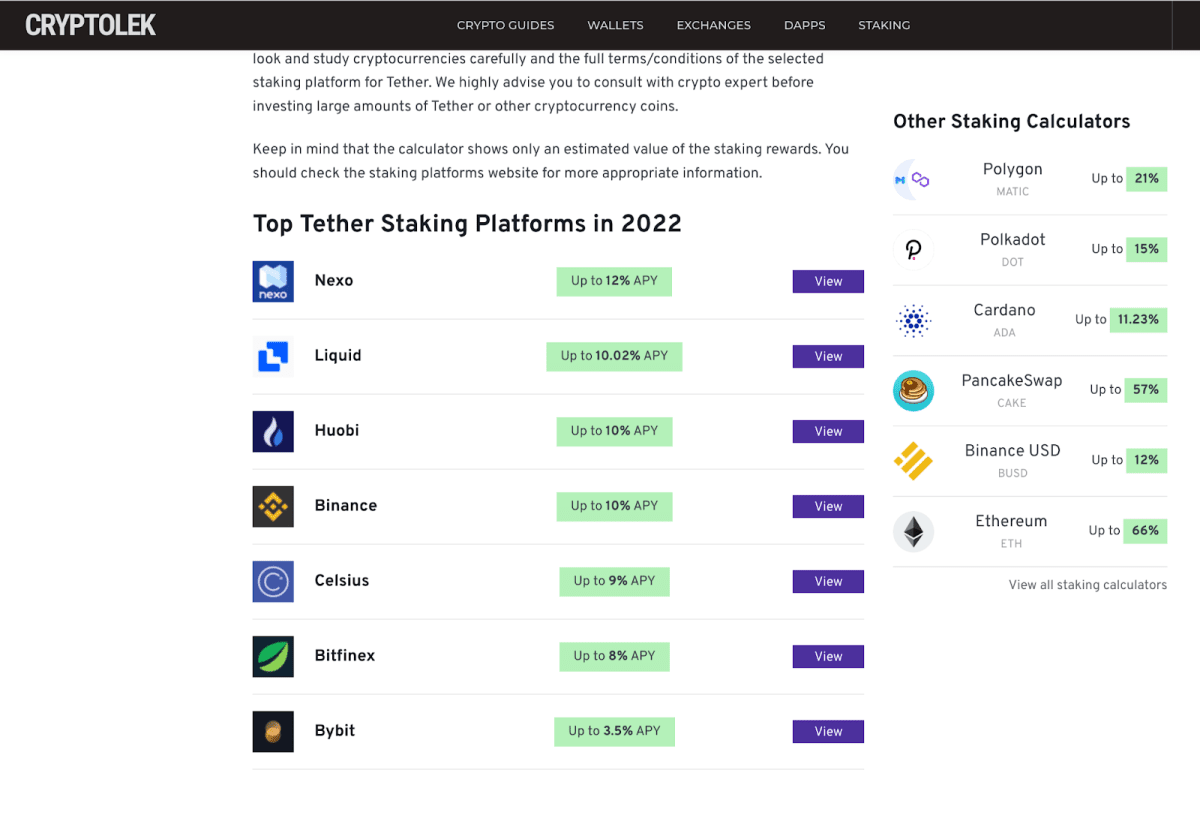

Сryptolek.com

Cryptolek provides an overview of the most popular crypto projects and allows users to estimate the staking rewards for each of them. It is easy to navigate and gives users a lot of flexibility in entering information, which helps in accurately assessing profit potential. The calculator can be accessed free of charge by going to the Stake section of the Cryptolek website.

The Cryptolek service homepage

The calculator tracks APR across 45 tickers in 12 exchanges. It is significantly less than on the Staking Rewards service, but it monitors only reliable assets. The developers of the service ignore minor or suspicious coins.

The advantages of the site include a user-friendly interface and intuitive navigation. Nothing superfluous beyond the tasks that are stated on the home page.

Individual cryptocurrency calculators

There are services for calculating staking interest for a certain cryptocurrency:

- Ethscan.org for Ethereum 2.0

- Qtum.info for Qtum

- Avax.network for Avalanche

- Atomicwallet.io for ATOM

- Adatainment.com for ADA

As a rule, individual calculators give more accurate calculations because their blockchain data is used in real-time.

Final words

When choosing a platform for staking, always consider 3 points.

1. The more reliable the asset, the lower the APR.

2. Locked Staking always offer higher interest rates.

3. For investments, select exchanges with the fastest possible profits withdrawal.

And the last thing: if you are offered APR for staking above 25%, feel free to skip it. With staking, the situation is the same as with interest on bank deposits: a high percentage indicates high asset inflation or a potential scam. Miracles don't happen.

Recommended