Technical analysis of BTC and AVAX. 26/05/23

Analysis of the current state of Bitcoin (BTC) and Avalanche (AVAX).

Bitcoin

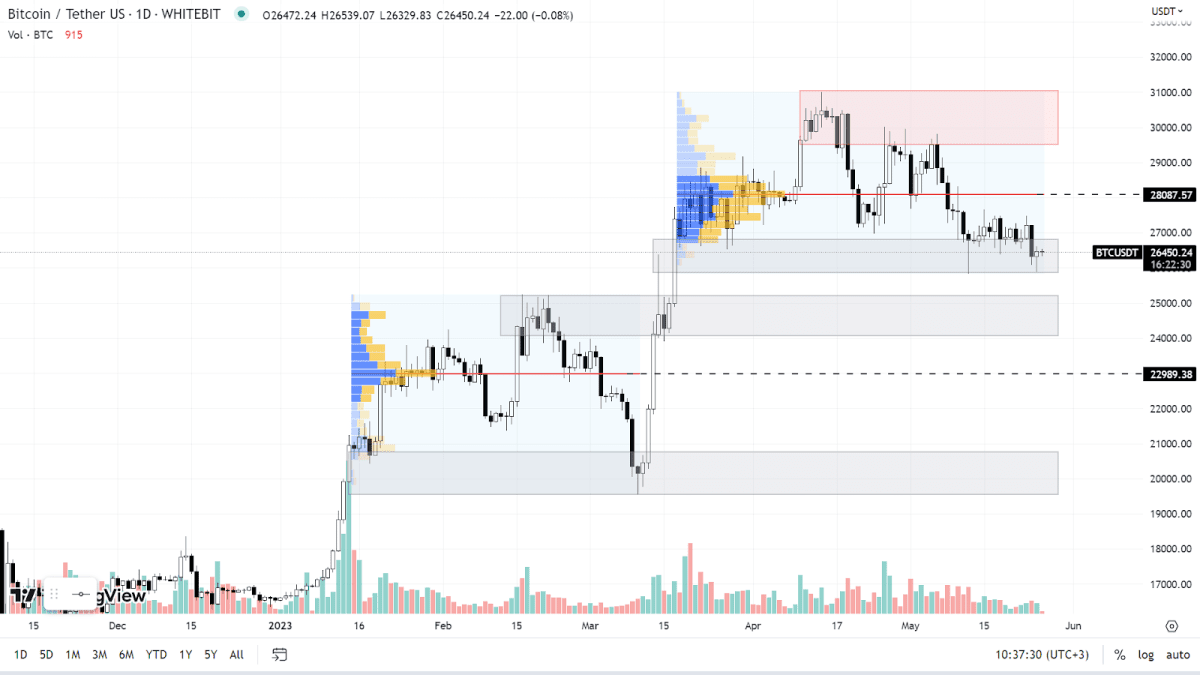

On the daily timeframe, the BTC price action remains consistent with yesterday's analysis. Bitcoin continues to trade within the support range of $25,800-$27,000, which was established nearly two weeks ago.

The relevance of all other support and resistance levels remains the same.

BTC chart on the Daily timeframe

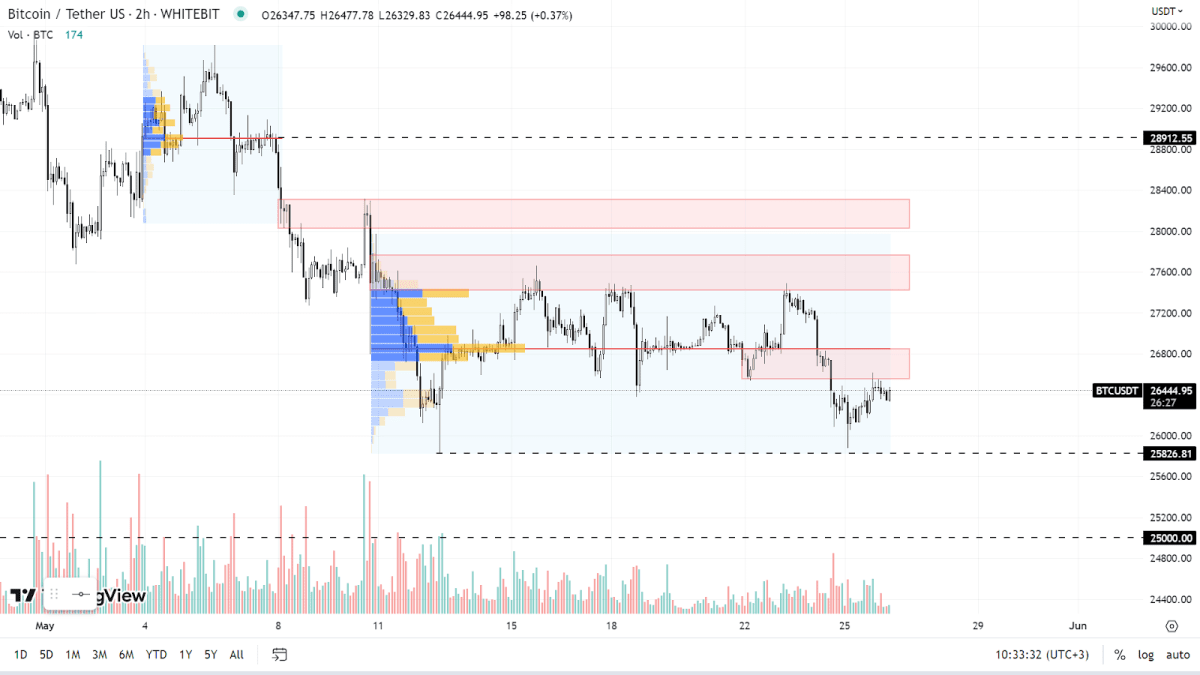

On the H2 timeframe, buyers have shown strength as its price rebounded from the $25,800 support level. Relevant resistance zones to watch are $26,500-$26,750, $27,300-$27,700, and $28,000-$28,300. Additionally, sellers have accumulated orders at the $28,900 level.

Considering the multiple resistance zones and their significance, the prevailing expectation is for a downward movement in BTC in the near term. If the $25,800 level is breached, the next significant support is at the psychological level of $25,000.

BTC chart on the H2 timeframe

Avalanche

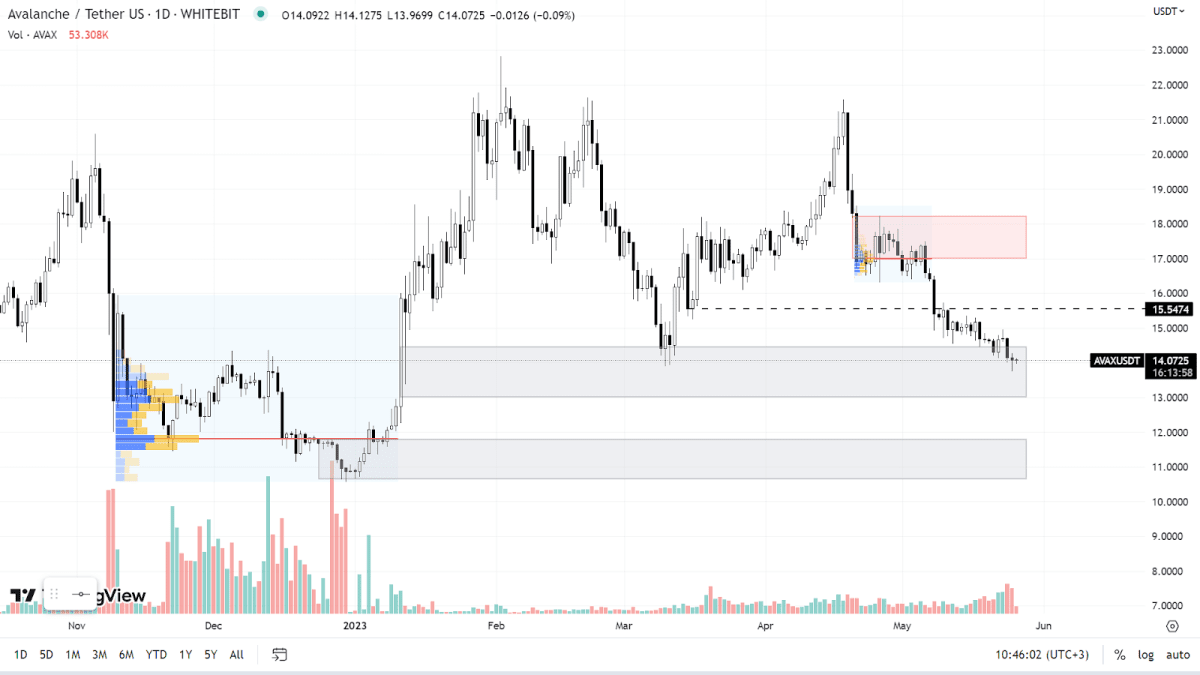

On the daily timeframe, AVAX is currently trading within a support zone between $13 and $14.4. The next range of interest, where buyers have accumulated their orders, is the zone of $10.64-$11.8.

The most noteworthy resistance zone is observed at $17-$18.21. Preceding that, attention can be given to the level at $15.54. For a more detailed analysis of sellers' levels within these price ranges, it is advisable to examine a lower timeframe.

AVAX chart on the Daily timeframe

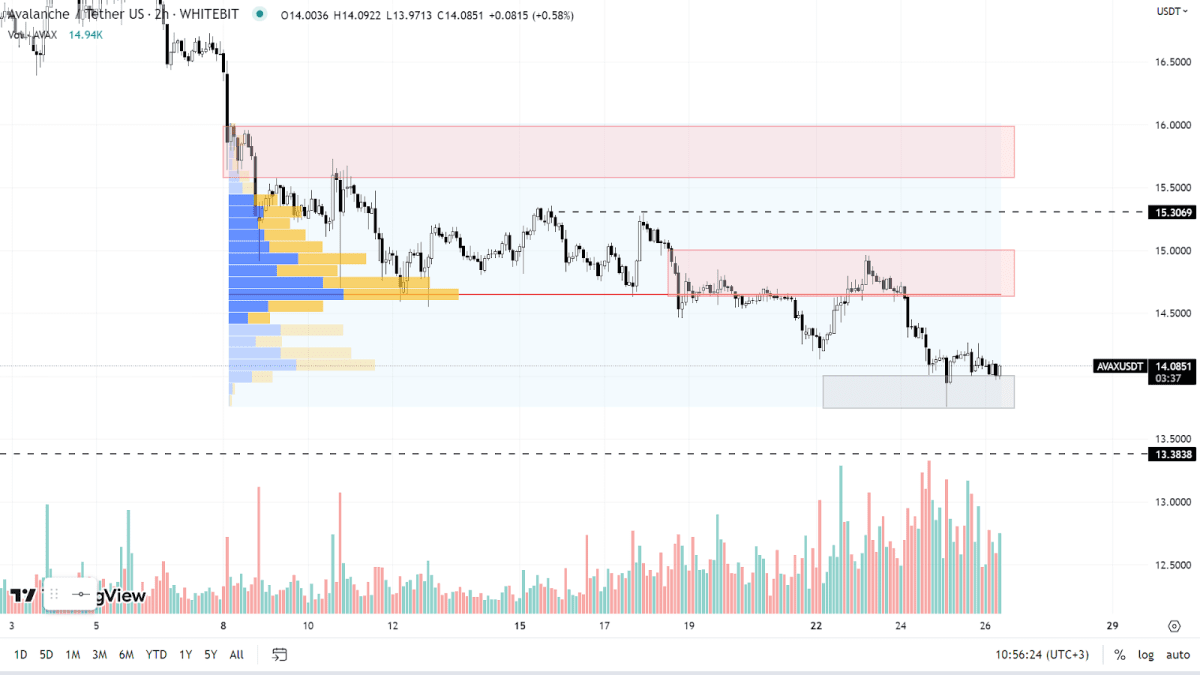

On the H2 timeframe, AVAX continues its downward movement, establishing lower lows since late April. Currently, AVAX is trading within the support zone of $13.75-$14. If these levels are breached, the next support level to monitor is around $13.38.

In terms of resistance, the notable levels to observe are the range of $14.64-$15, the level at $15.3, and the zone between $15.57 and $16. However, it is important to note that these levels have yet to be tested, so it is premature to determine higher resistance zones at this stage.

AVAX chart on the H2 timeframe

Check out GNcrypto for the latest cryptocurrency rates and chart analysis.

Disclaimer

Please note that the analysis provided above should not be considered a trading recommendation. These are solely the opinions of the GNcrypto editorial board regarding the market situation. Before opening any deals, we strongly advise conducting your own research and analysis.

Abbreviations

TF (Timeframe) — a chronological period equal to the time it takes to form one Japanese candle on the chart.

Horizontal channel (flat, sideways, range) — the movement of price between support and resistance levels, without going beyond the given range.

К — simplified designation of one thousand dollars of the asset price (for example, 23.4K - $23,400).

Gray range on the chart — a support zone.

Red range on the chart — a resistance zone.

Correlation — the tendency of prices of different cryptocurrencies to move in sync, often influenced by the dominance of one of the assets.

Initial materials

This analysis was informed by the following educational materials and articles from GNcrypto:

Recommended