TeleportDAO (TST): A New ICO on CoinList

CoinList is becoming a hotbed for new projects shaping the narrative. The platform has launched the token sale for TeleportDAO (TST), a project that focuses on facilitating message exchanges between EVM networks and the Bitcoin blockchain.

What is TeleportDAO?

TeleportDAO is a protocol that enables seamless communication between the Bitcoin network, all its L2 solutions, and EVM blockchains. It also supports the creation of additional cross-chain bridges for transactions in the aforementioned areas.

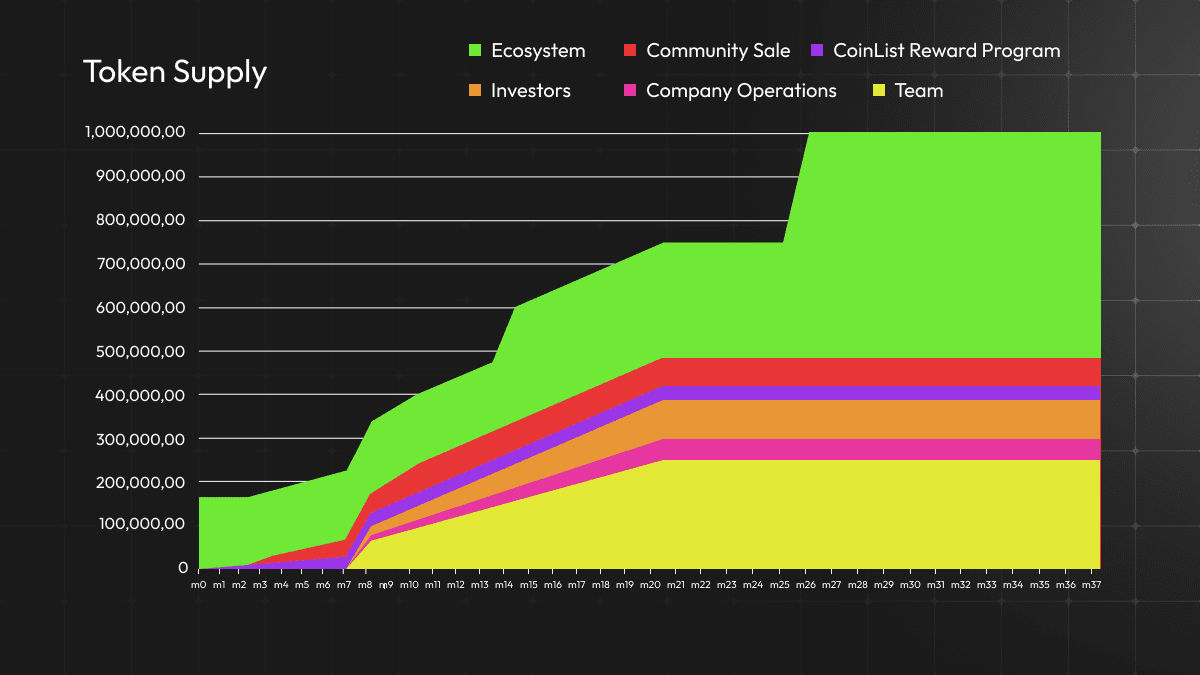

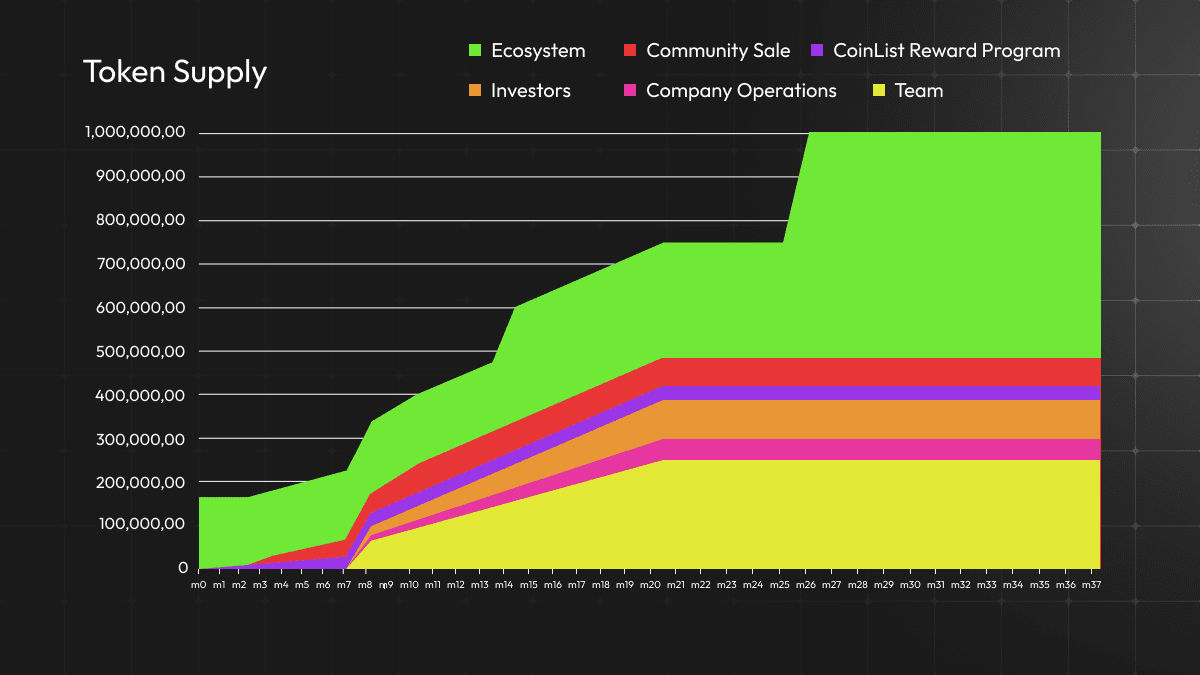

The total supply of TST tokens is capped at 1 billion. You can view the token distribution schedule below.

CoinList has updated its rules to eliminate both standard and priority queues. Allocations will now be made through a random selection process. Participants simply need to deposit the required USDT or USDC and register before the sale concludes. It should be noted that the sale is restricted to residents of certain countries, with more information available on the CoinList page.

Based on the funding and tokenomics information available, we can make educated guesses about the initial price at which early investors might have received their tokens. However, the following calculations are speculative and do not necessarily reflect actual values.

Firstly, let's calculate the number of tokens designated for investors by multiplying the total token supply by the percentage allocated to investors: 1,000,000,000 TST * 8.55% equals 85,500,000 TST. Next, we divide the seed investment amount by this number of tokens: $2.5 million divided by 85.5 million TST gives approximately $0.029 per token. This estimated entry price for early investors is roughly 2.5 times lower than the price at the CoinList token sale, suggesting that these investors might find it appealing to sell their tokens at prices close to the CoinList offering price.

A key advantage for the Bitcoin-focused TeleportDAO is its launch during a period marked by the approval of spot Bitcoin ETFs in the U.S. and a strong market presence of Bitcoin. Additionally, the project’s platform, TeleOrdinal, which deals with Bitcoin NFTs (Ordinals), enhances its uniqueness. However, TeleportDAO does face competition, notably from the relatively new ZetaChain, which boasts a market capitalization of over $300 million.

TeleportDAO did not secure substantial initial backing from Tier 1 investment funds, and the details regarding expenditures on ecosystem development remain vague. This leaves unanswered questions about the scope of planned marketing efforts and overall strategic deployment of funds. Watching the evolution of this project and how the TST price reacts once it hits the market will be intriguing.

Please note: This article does not serve as financial advice. Always remember to do your own research and consider multiple sources before making any investment decisions.

TeleportDAO is a protocol that enables seamless communication between the Bitcoin network, all its L2 solutions, and EVM blockchains. It also supports the creation of additional cross-chain bridges for transactions in the aforementioned areas.

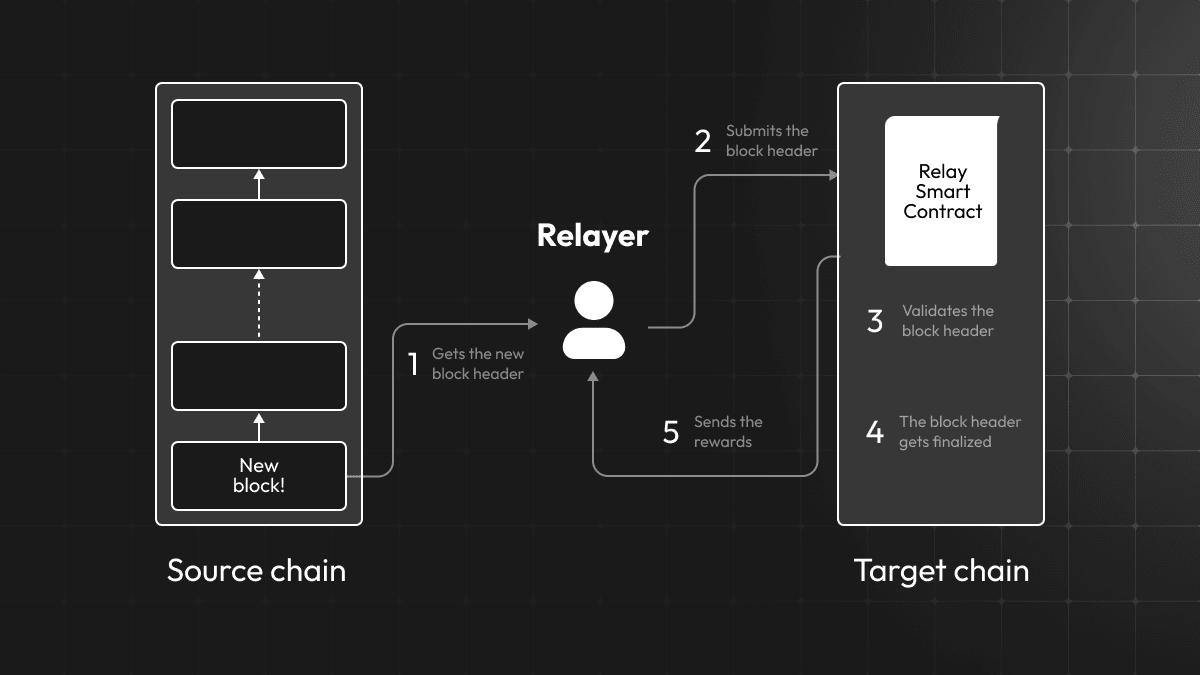

Distinct from many traditional bridges that rely on a validator-based approach, TeleportDAO implements verification through a light client. This streamlined method allows data verification via a smart contract without the need to access all blockchain data.

How the TeleportDAO Protocol Works Source: docs.teleportdao.xyz

The project has launched two proprietary platforms: TeleSwap and TeleOrdinal.

TeleSwap: a decentralized exchange designed for cross-chain trading involving BTC, BRC-20 tokens, stablecoins, and more.

TeleOrdinal: a marketplace for trading Bitcoin NFTs (Ordinals), which facilitates auction bids using stablecoins from various EVM blockchains (Ethereum, Polygon, Arbitrum, Optimism, BNB).

Funding Details

In March 2023, the project secured initial funding of $2.5 million. The investment round was led by AppWorks and DefinanceX, with contributions from Quantstamp, Coinlist, Candaq Fintech Group, SNZ Holding Limited, and Gate Labs. According to Cryptorank.io, these are mainly Tier 3 and Tier 4 funds, except for Quantstamp (Tier 2).

TST Tokenomics

TeleSwap: a decentralized exchange designed for cross-chain trading involving BTC, BRC-20 tokens, stablecoins, and more.

TeleOrdinal: a marketplace for trading Bitcoin NFTs (Ordinals), which facilitates auction bids using stablecoins from various EVM blockchains (Ethereum, Polygon, Arbitrum, Optimism, BNB).

Funding Details

In March 2023, the project secured initial funding of $2.5 million. The investment round was led by AppWorks and DefinanceX, with contributions from Quantstamp, Coinlist, Candaq Fintech Group, SNZ Holding Limited, and Gate Labs. According to Cryptorank.io, these are mainly Tier 3 and Tier 4 funds, except for Quantstamp (Tier 2).

TST Tokenomics

Details on the token sale page reveal that TST tokens are instrumental in:

- sustaining protocol operations (node operation requires locking TST tokens);

- offering transaction fee discounts to users who lock their TST tokens.

- 50.91% – allocated to the ecosystem (specific details not provided);

- 25% – reserved for the team;

- 8.55% – set aside for investors;

- 7% – designated for the public token sale;

- 5% – directed towards the company's operational expenses;

- 3.01% – intended for the CoinList rewards program;

- 0.53% – allotted to advisors.

The total supply of TST tokens is capped at 1 billion. You can view the token distribution schedule below.

Token Distribution Schedule Source: coinlist.co/teleportdao

TeleportDAO Token Sale Details on CoinList

- Duration: The token sale runs from April 11 through April 18, ending at 17:00 UTC.

- Token Price: $0.075 per token.

- Token Quantity: 70,000,000 TST (7% of the total supply).

- Additional Tokens: Up to 25,000,000 TST (2.5% of total supply) may be released if agreed upon by the project.

- Purchase Limits: Minimum $100, maximum $2,000.

- Vesting Schedule: 20% of tokens are released after 75 days (the start date for counting is unspecified), with the remaining 80% vested over 6 months.

- Expected Listing Date: Around July 17, 2024.

CoinList has updated its rules to eliminate both standard and priority queues. Allocations will now be made through a random selection process. Participants simply need to deposit the required USDT or USDC and register before the sale concludes. It should be noted that the sale is restricted to residents of certain countries, with more information available on the CoinList page.

Projections and Competitors

Based on the funding and tokenomics information available, we can make educated guesses about the initial price at which early investors might have received their tokens. However, the following calculations are speculative and do not necessarily reflect actual values.

Firstly, let's calculate the number of tokens designated for investors by multiplying the total token supply by the percentage allocated to investors: 1,000,000,000 TST * 8.55% equals 85,500,000 TST. Next, we divide the seed investment amount by this number of tokens: $2.5 million divided by 85.5 million TST gives approximately $0.029 per token. This estimated entry price for early investors is roughly 2.5 times lower than the price at the CoinList token sale, suggesting that these investors might find it appealing to sell their tokens at prices close to the CoinList offering price.

A key advantage for the Bitcoin-focused TeleportDAO is its launch during a period marked by the approval of spot Bitcoin ETFs in the U.S. and a strong market presence of Bitcoin. Additionally, the project’s platform, TeleOrdinal, which deals with Bitcoin NFTs (Ordinals), enhances its uniqueness. However, TeleportDAO does face competition, notably from the relatively new ZetaChain, which boasts a market capitalization of over $300 million.

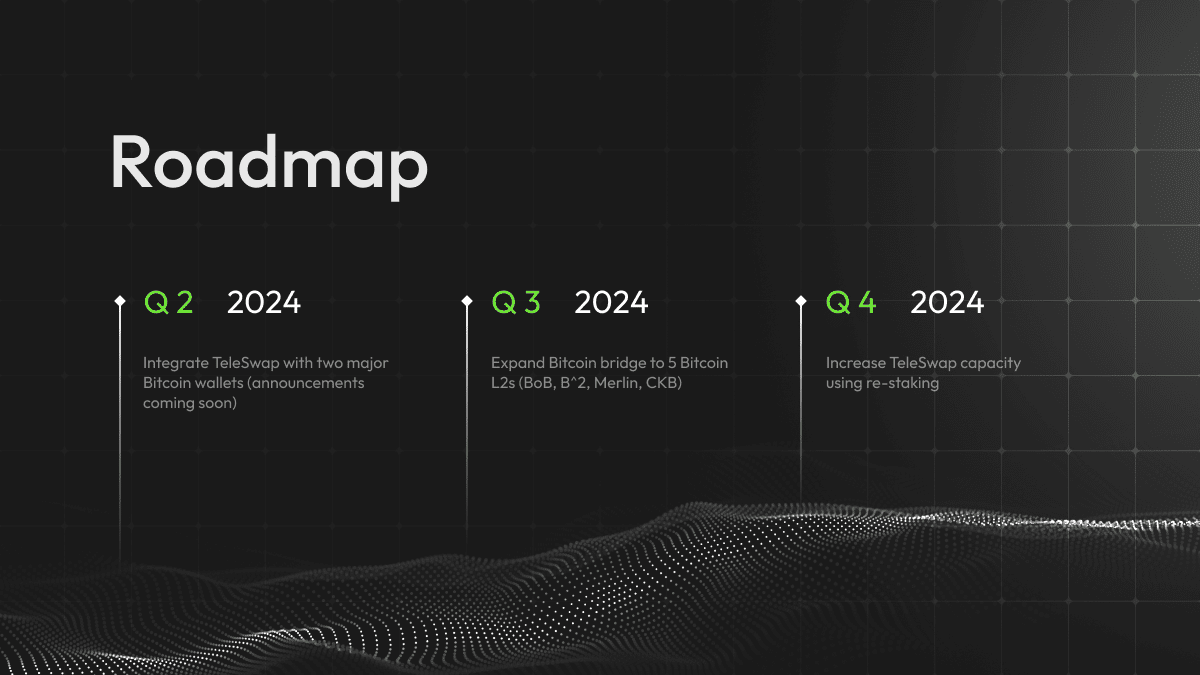

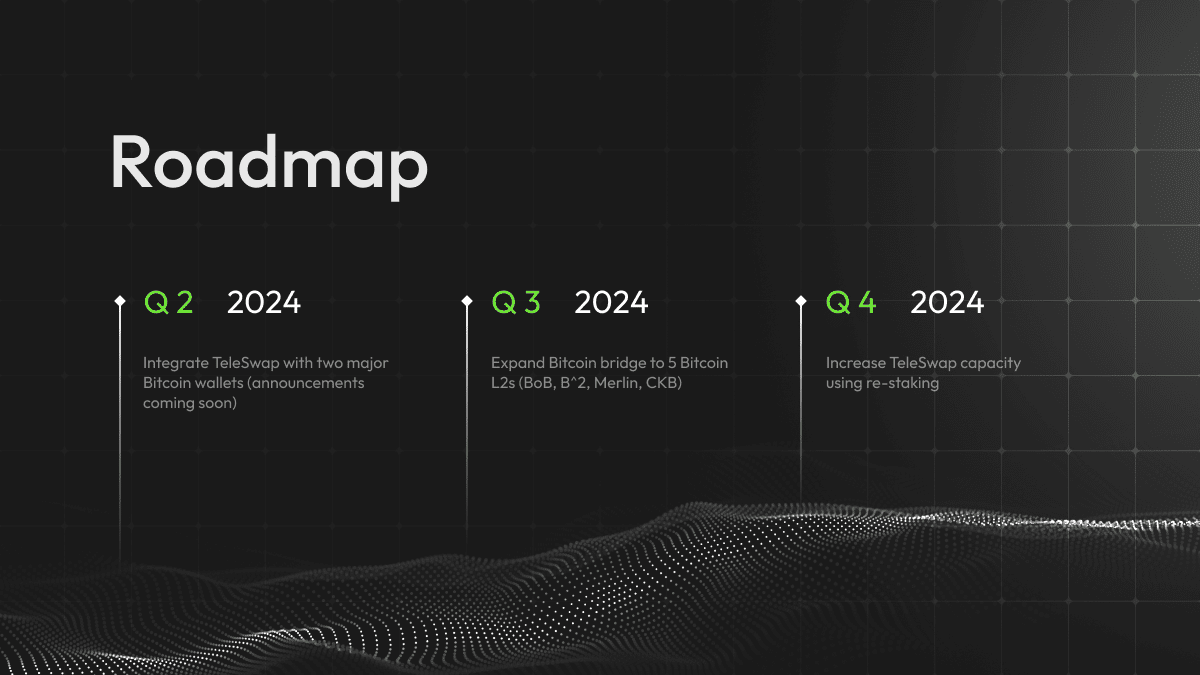

Roadmap

The roadmap outlined on CoinList’s page indicates some upcoming developments. By the second quarter of 2024, the TeleSwap platform is expected to be integrated with two major Bitcoin wallets. In the third quarter, the project aims to expand its support for Bitcoin L2 networks to five, and in the fourth quarter, enhance TeleSwap’s capacity through restaking.

The roadmap outlined on CoinList’s page indicates some upcoming developments. By the second quarter of 2024, the TeleSwap platform is expected to be integrated with two major Bitcoin wallets. In the third quarter, the project aims to expand its support for Bitcoin L2 networks to five, and in the fourth quarter, enhance TeleSwap’s capacity through restaking.

TeleportDAO Roadmap Source: coinlist.co/teleportdao

Final Words

TeleportDAO did not secure substantial initial backing from Tier 1 investment funds, and the details regarding expenditures on ecosystem development remain vague. This leaves unanswered questions about the scope of planned marketing efforts and overall strategic deployment of funds. Watching the evolution of this project and how the TST price reacts once it hits the market will be intriguing.

Please note: This article does not serve as financial advice. Always remember to do your own research and consider multiple sources before making any investment decisions.

Recommended