What are leveraged tokens, and how do they work?

Leveraged tokens are derivative instruments that allow you to buy and sell an asset with the feature of leverage.

Cryptocurrency exchanges call this instrument differently: on FTX, credit tokens carried the prefix "Bull/Bear", Gate and Kucoin added the ticker X3 and the price direction (L – long, S – short) to the name of the cryptocurrency. This figure refers to the amount of leverage that the underlying asset has.

Working mechanism

Using leveraged tokens, there is no need to trade futures or margins. For example, if traders expect BTC to rise, they buy a leveraged token BTCX3L (BTC X3 Long). With the growth of Bitcoin, the token will grow 3 times if its leverage is 3.

Their main features are ease of use and lack of liquidation. There is no need to borrow, repay and return funds. If the asset moves in the opposite direction, the transaction will not be liquidated. This will only affect a significant reduction in the price of the coin.

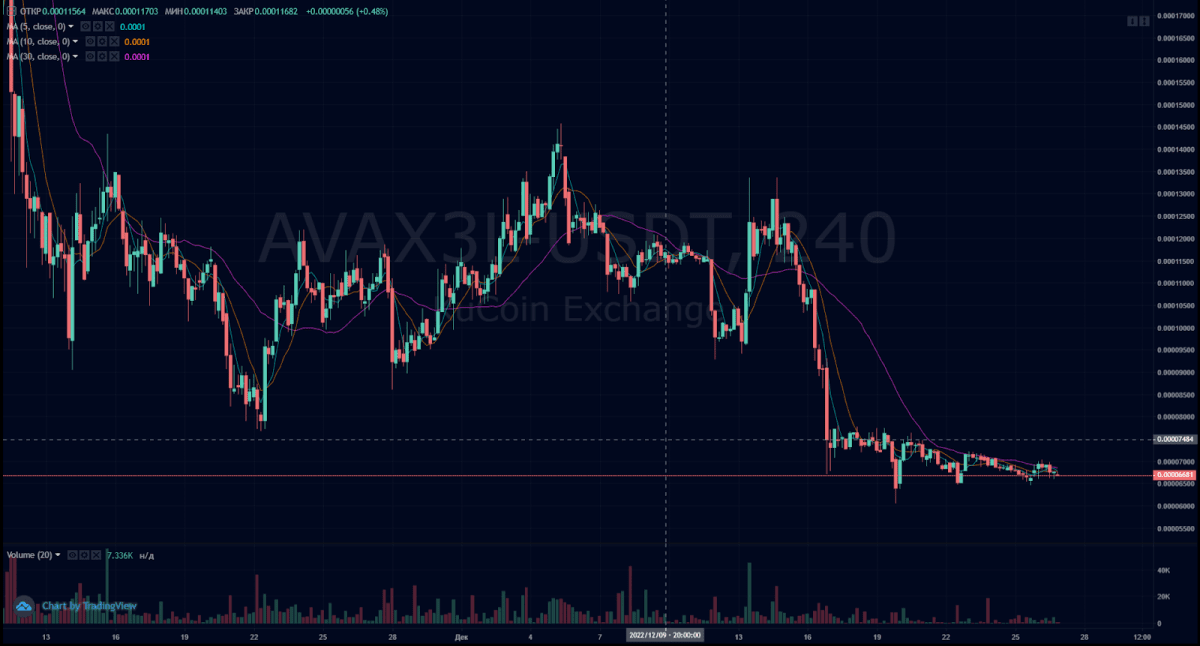

AVAX3S (Kucoin)

Different exchanges – different principle

Although the essence of a leveraged token is similar across the platforms, these assets differ on each crypto exchange, and they can have different prices. Each coin is a portfolio of contracts, and its cost is formed depending on the starting date.

For example, on the Binance exchange, leveraged tokens have an average leverage of X3, but it is not constant. Actual leverage fluctuates within the range of 1.5X-4X, which may greatly complicate your trading. It is difficult to calculate a future deal if its conditions constantly change "depending on the market".

As mentioned above, the widest variety of leveraged tokens was offered by FTX. Now this niche has been taken over by Gate along with other platforms.

Hyperinflation Trap

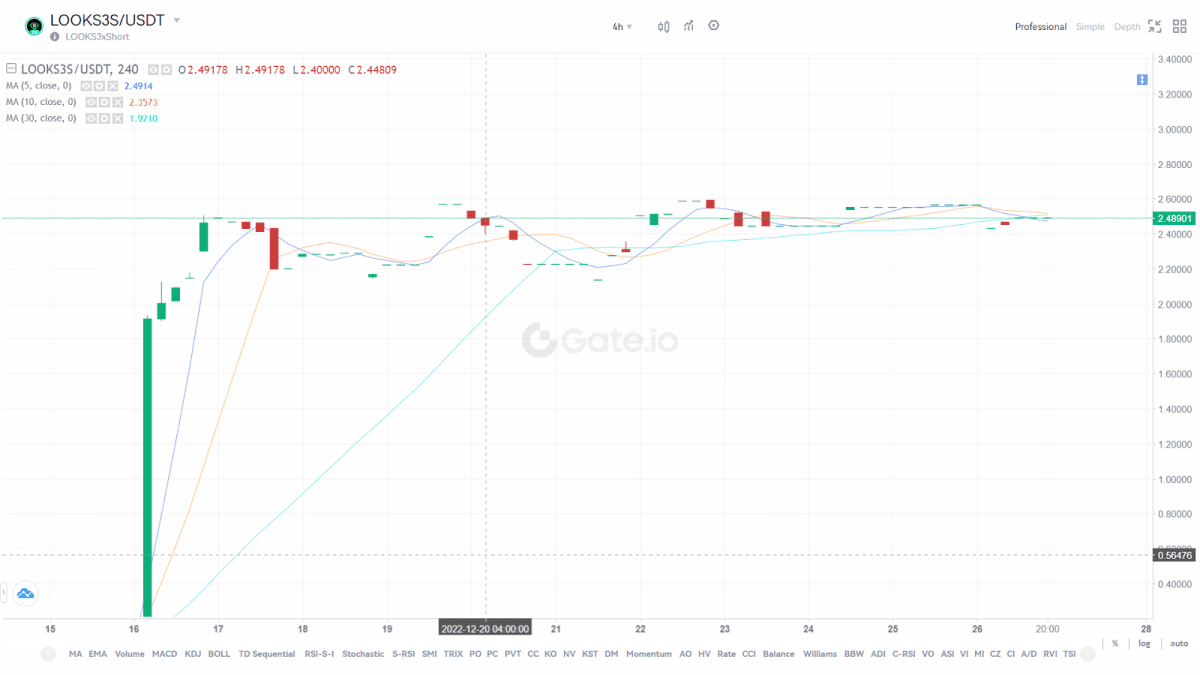

As tempting as the phrase "leverage without liquidation" may sound, leveraged tokens are, for the most part, a loss-making tool for traders. Firstly, trading volumes on such assets are minimal, which causes big problems with liquidity. They are bought and sold not at the market price, but with a spread of 10-15%, which makes an open transaction immediately unprofitable.

Liquidity issues of the Looks3S token

Secondly, due to the cryptocurrency market volatility, leveraged tokens tend to "hyperinflation". Due to the constant leverage, the token declines in value throughout the entire trading time.

For example, since June 19, BTC has fallen by 15%. It would seem that the leveraged token should go up about 45% amid a bitcoin drop, given the 3X leverage. Instead, BTC3XS has lost 50% of its value since that date. This is due to the asset's large back-and-forth fluctuations, which is why the price of the leveraged token is constantly falling.

BTC Price Drop and Corresponding BTC3XS Price Drop

Why is this happening? Let's look at an example.

● Suppose the price of the underlying asset is $1, and the price of a 3X long token is also $1;

● If the price of an asset rises by 100%, its value will reach $2. The leveraged token, respectively, will rise in price by 300% and hit the $4 mark;

● After that, the underlying asset returns to $1, having lost 50% of its value. If a trader had a 3X long, he would be liquidated. But the leveraged token cannot sink by 150% (50% * 3). Instead, it depreciates by 80-90%, and now its value is $0.75-0.70.

● We got a situation where the cryptocurrency did not lose in value. Still, the leveraged token fell due to constant fluctuations in the asset's rate.

Many traders do not understand how leveraged tokens work and consider them an alternative and "simple" alternative to futures. This tool, however, generates profits mainly for the exchange, based on the funding rate (a credit token is still a set of futures) and the specific operation of the token.