#curve finance

8 articles found

Latest

Brian Armstrong has expressed his belief that Binance has transferred some of their USDC assets to a different stablecoin, according to anonymous sources in Cointelegraph.

NotChaseColeman, an analyst, highlights that Binance and Justin Sun are strategically moving from USDT to USDC to secure USD, which will then be invested in FDUSD and TUSD (assets controlled by the company).

Adam Cochran, a name we're familiar with, weighed in, drawing attention to the activities associated with Binance addresses. He observed:

“Even with banks open in Asia and Europe and US coming online, USDT peg is off by the deepest sustained amount since the FTX fall out. Selling pressure once again coming in from the Binance.”

Adam thinks the uncertainty surrounding USDT is at an all-time high, and the Curve Finance and Uniswap platforms are overrun with USDT.

He was optimistic about a more promising USDT horizon today, but that seems to be deferred.

BTC has touched the 28,710 threshold. Indeed, Mondays have their unique trials.

Brian Armstrong has expressed his belief that Binance has transferred some of their USDC assets to a different stablecoin, according to anonymous sources in Cointelegraph.

NotChaseColeman, an analyst, highlights that Binance and Justin Sun are strategically moving from USDT to USDC to secure USD, which will then be invested in FDUSD and TUSD (assets controlled by the company).

Adam Cochran, a name we're familiar with, weighed in, drawing attention to the activities associated with Binance addresses. He observed:

“Even with banks open in Asia and Europe and US coming online, USDT peg is off by the deepest sustained amount since the FTX fall out. Selling pressure once again coming in from the Binance.”

Adam thinks the uncertainty surrounding USDT is at an all-time high, and the Curve Finance and Uniswap platforms are overrun with USDT.

He was optimistic about a more promising USDT horizon today, but that seems to be deferred.

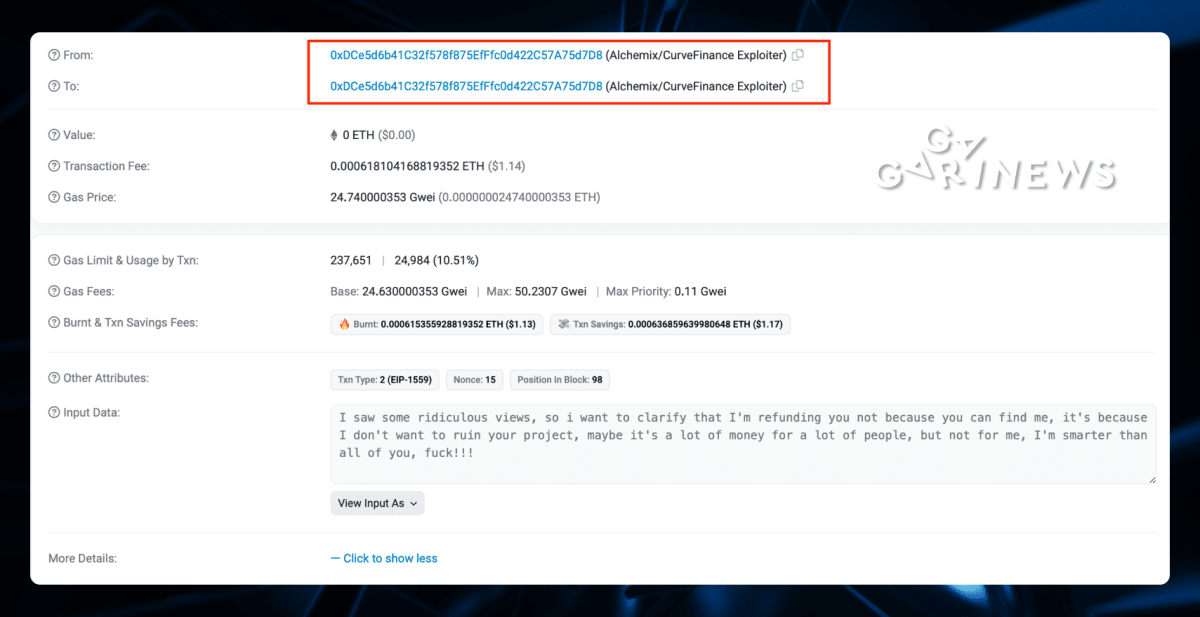

BTC has touched the 28,710 threshold. Indeed, Mondays have their unique trials.  “I saw some ridiculous views, so i want to clarify that I’m refunding you not because you can find me, it’s because I don’t want to ruin your project, maybe it’s a lot of money for a lot of people, but not for me, I’m smarter than all of you, fuck!!!”

Was this hack simply for the thrill of causing disorder? Or was there a message he was trying to convey?

Given the thorough preparation that spanned weeks or perhaps even months, it's a thought-provoking consideration.

“I saw some ridiculous views, so i want to clarify that I’m refunding you not because you can find me, it’s because I don’t want to ruin your project, maybe it’s a lot of money for a lot of people, but not for me, I’m smarter than all of you, fuck!!!”

Was this hack simply for the thrill of causing disorder? Or was there a message he was trying to convey?

Given the thorough preparation that spanned weeks or perhaps even months, it's a thought-provoking consideration.  A Twitter user speculates that the Curve founder may be linked to the platform exploit based on a peculiar word choice. The hacker referred to users' reactions to the recent security breach as “ridiculous,” a term frequently used by Michael Egorov.

Additionally, concerns arise over Curve founder’s collateralized loans, with potential liquidation just weeks away.

The coincidence of “ridiculous” being mentioned around 20 times in the tweet makes this theory intriguing.

Furthermore, despite the deadline for fund reimbursement passing last night, the hacker has yet to return all stolen assets from the pools.

Curve Finance is offering a $1.85 million reward for anyone who can unmask the hacker.

A Twitter user speculates that the Curve founder may be linked to the platform exploit based on a peculiar word choice. The hacker referred to users' reactions to the recent security breach as “ridiculous,” a term frequently used by Michael Egorov.

Additionally, concerns arise over Curve founder’s collateralized loans, with potential liquidation just weeks away.

The coincidence of “ridiculous” being mentioned around 20 times in the tweet makes this theory intriguing.

Furthermore, despite the deadline for fund reimbursement passing last night, the hacker has yet to return all stolen assets from the pools.

Curve Finance is offering a $1.85 million reward for anyone who can unmask the hacker.  The total loss incurred surpassed $50 million, causing the Total Value Locked (TVL) of the project to drop by over 40% following the news.

CRV price also plummeted by over 20%.

Security analysts at Beosin reported that the attacker specifically targeted Curve’s factory pools associated with several projects, including Alchemix, JPEG’d, MetronomeDAO, deBridge, and Ellipsis.

The total loss incurred surpassed $50 million, causing the Total Value Locked (TVL) of the project to drop by over 40% following the news.

CRV price also plummeted by over 20%.

Security analysts at Beosin reported that the attacker specifically targeted Curve’s factory pools associated with several projects, including Alchemix, JPEG’d, MetronomeDAO, deBridge, and Ellipsis. Curve Finance Launches Stablecoin crvUSD on Ethereum Mainnet

Curve Finance, a prominent decentralized exchange, has initiated the deployment of smart contracts for its stablecoin, crvUSD, on the Ethereum mainnet. The launch is not yet fully completed, as the user interface needed for users to interact with the crvUSD smart contracts is still being developed.

Curve Finance, a prominent decentralized exchange, has initiated the deployment of smart contracts for its stablecoin, crvUSD, on the Ethereum mainnet. The launch is not yet fully completed, as the user interface needed for users to interact with the crvUSD smart contracts is still being developed. 1 - 8 of 8 results