#huobi

15 articles found

Latest

Leaders within India's crypto community have largely welcomed the country's decision to block websites of international crypto exchanges, including Binance, Huobi, and KuCoin. Nischal Shetty, the CEO of Indian exchange WazirX, has labeled this step as a move “towards greater regulatory clarity and control”.

Leaders within India's crypto community have largely welcomed the country's decision to block websites of international crypto exchanges, including Binance, Huobi, and KuCoin. Nischal Shetty, the CEO of Indian exchange WazirX, has labeled this step as a move “towards greater regulatory clarity and control”.  Several iToken wallet users found their private keys and secret phrases exposed because of a Trojan virus created by a former Huobi employee.

Upon this unsettling discovery, iToken's team swiftly notified the endangered users, making them aware of possible wallet risks.

The investigation has kicked off, focusing on Huobi employee's involvement.

Several iToken wallet users found their private keys and secret phrases exposed because of a Trojan virus created by a former Huobi employee.

Upon this unsettling discovery, iToken's team swiftly notified the endangered users, making them aware of possible wallet risks.

The investigation has kicked off, focusing on Huobi employee's involvement.  Renowned business analyst Adam Cochran recently shared insights concerning Huobi's financial state and its potential insolvency.

Key takeaways from Adam's analysis:

Investigation Underway: Both Huobi and Tron are facing scrutiny, with their staff being questioned by the police.

Unusual Asset Distribution: After Justin Sun's introduction of wrapped USDT (stUSDT), a whopping 98% of user assets intended for Tether bond redemptions ended up in the wallets of Huobi and Justin Sun.

Discrepancy with USDT Balance: Huobi's reported USDT balance is just $63 million, but their users hold a staggering $631 million worth of USDT. Something doesn't add up here.

ETH Holdings in Question: It appears that Huobi is holding all of its users' ETH as stETH, raising eyebrows about their handling of customer assets.

Binance Making Moves: Meanwhile, Binance is actively selling USDT and purchasing DAI, possibly indicating a shift in market dynamics.

Outdated Reserves Page: It's been a whole month since Huobi last updated its reserve page, and discrepancies between the reported figures and wallet balances need clarification.

Renowned business analyst Adam Cochran recently shared insights concerning Huobi's financial state and its potential insolvency.

Key takeaways from Adam's analysis:

Investigation Underway: Both Huobi and Tron are facing scrutiny, with their staff being questioned by the police.

Unusual Asset Distribution: After Justin Sun's introduction of wrapped USDT (stUSDT), a whopping 98% of user assets intended for Tether bond redemptions ended up in the wallets of Huobi and Justin Sun.

Discrepancy with USDT Balance: Huobi's reported USDT balance is just $63 million, but their users hold a staggering $631 million worth of USDT. Something doesn't add up here.

ETH Holdings in Question: It appears that Huobi is holding all of its users' ETH as stETH, raising eyebrows about their handling of customer assets.

Binance Making Moves: Meanwhile, Binance is actively selling USDT and purchasing DAI, possibly indicating a shift in market dynamics.

Outdated Reserves Page: It's been a whole month since Huobi last updated its reserve page, and discrepancies between the reported figures and wallet balances need clarification. Huobi Token's Value Drop Linked to 'Free' Acquisitions

Justin Sun, CEO of Tron (TRX) and stakeholder in Huobi, has made serious allegations against Li Wei, the brother of Huobi's founder Li Lin. Sun accuses Wei of acquiring Huobi's native token (HT) at no cost and later selling it for significant profit.

Justin Sun, CEO of Tron (TRX) and stakeholder in Huobi, has made serious allegations against Li Wei, the brother of Huobi's founder Li Lin. Sun accuses Wei of acquiring Huobi's native token (HT) at no cost and later selling it for significant profit.  Justin Sun, the hype man of the century, is on it again. His Huobi exchange announced the listing of a provocative coin FUD (FTX Users Debt). The developers promise to buy back all the tokens in the future and use these funds to cover FTX's debts.

Amid the announcement, the price of FUD soared by several hundred percent, but it rolled back quickly. There is a probability that the FUD token may become popular.

Justin Sun, the hype man of the century, is on it again. His Huobi exchange announced the listing of a provocative coin FUD (FTX Users Debt). The developers promise to buy back all the tokens in the future and use these funds to cover FTX's debts.

Amid the announcement, the price of FUD soared by several hundred percent, but it rolled back quickly. There is a probability that the FUD token may become popular.  Yesterday, the Cyvers team raised alarms over a questionable HTX transaction. Their concerns grew when there was no communication in return.

Fast forward to today, the damage is clear: 5,000 ETH, or $7.9 million, is gone, snatched by a hacker.

The HTX team has proposed a 5% reward for the return of the funds. Should the hacker decline, they plan to engage law enforcement.

"Compared to the $3 billion in assets held by Huobi HTX users, $8 million is a small number. This is only equivalent to two weeks of revenue from the HTX platform," Justin Sun stated in X.

The underlying issue behind the breach has been eliminated, he adds, and the exchange will reimburse the lost amount.

Yesterday, the Cyvers team raised alarms over a questionable HTX transaction. Their concerns grew when there was no communication in return.

Fast forward to today, the damage is clear: 5,000 ETH, or $7.9 million, is gone, snatched by a hacker.

The HTX team has proposed a 5% reward for the return of the funds. Should the hacker decline, they plan to engage law enforcement.

"Compared to the $3 billion in assets held by Huobi HTX users, $8 million is a small number. This is only equivalent to two weeks of revenue from the HTX platform," Justin Sun stated in X.

The underlying issue behind the breach has been eliminated, he adds, and the exchange will reimburse the lost amount.  This August, Huobi bolstered its stance in the market by 2%, while MEXC followed closely with a 1.5% increase, and WhiteBit saw a boost of about 0.5%. However, the likes of Binance, Upbit, and OKX didn’t fare as well, each dropping by an average figure hovering around 1.75%.

To curb trading vulnerabilities, many are now gravitating towards alternate crypto hubs in their endeavors.

This August, Huobi bolstered its stance in the market by 2%, while MEXC followed closely with a 1.5% increase, and WhiteBit saw a boost of about 0.5%. However, the likes of Binance, Upbit, and OKX didn’t fare as well, each dropping by an average figure hovering around 1.75%.

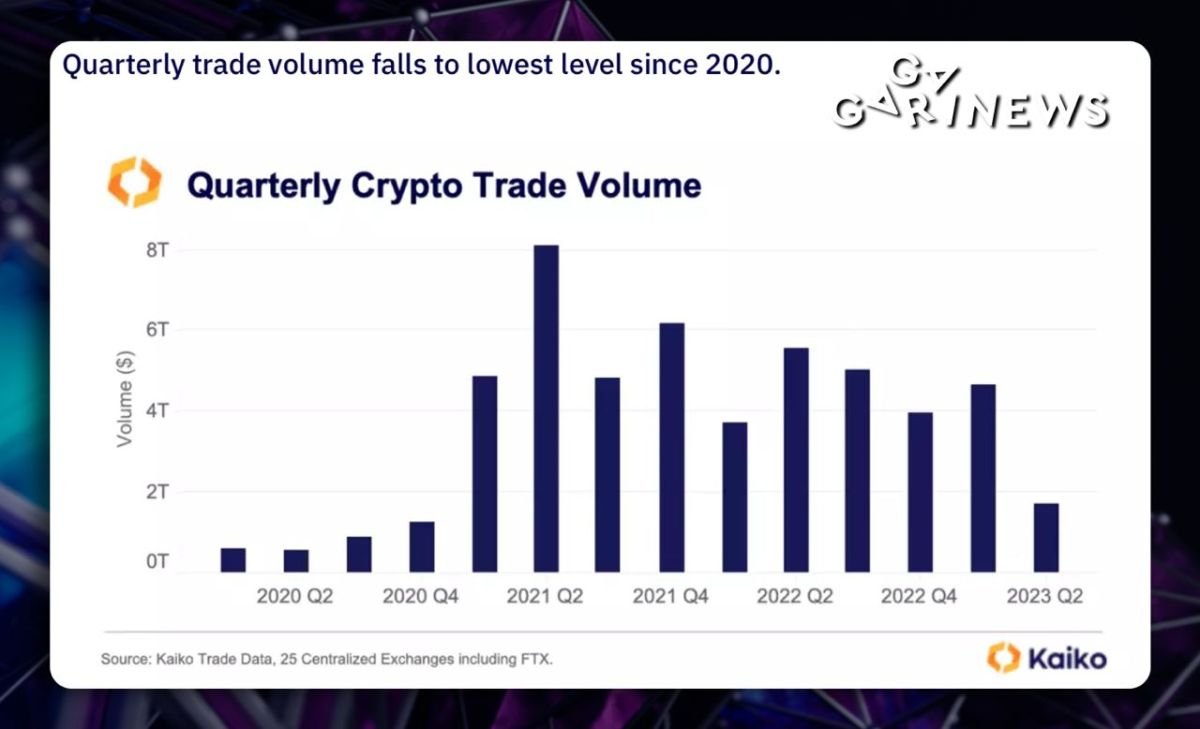

To curb trading vulnerabilities, many are now gravitating towards alternate crypto hubs in their endeavors.  Despite the ongoing rally in June, spot trade volumes in Q2 experienced a substantial decline, reaching their lowest level since 2020, according to Kaiko.

Binance saw the most significant drop in trading activity, with volumes plunging by nearly 70%.

Other exchanges such as Coinbase, Kraken, OKX, and Huobi also witnessed a decline of over 50% in trade volumes.

Despite the ongoing rally in June, spot trade volumes in Q2 experienced a substantial decline, reaching their lowest level since 2020, according to Kaiko.

Binance saw the most significant drop in trading activity, with volumes plunging by nearly 70%.

Other exchanges such as Coinbase, Kraken, OKX, and Huobi also witnessed a decline of over 50% in trade volumes. Pump and Dump of HT Token: What's Happening with Huobi?

It all started with FTX's bankruptcy, then came regulatory crackdowns on the largest CEX exchange Binance, information leaks from the SEC claiming that cryptocurrencies other than Bitcoin are "securities", and now we're seeing troubling signals from another major exchange, Huobi. What's going on over there?

It all started with FTX's bankruptcy, then came regulatory crackdowns on the largest CEX exchange Binance, information leaks from the SEC claiming that cryptocurrencies other than Bitcoin are "securities", and now we're seeing troubling signals from another major exchange, Huobi. What's going on over there?  Justin Sun, co-founder of the Huobi exchange, expressed his delight at China's decision to levy a tax on cryptocurrency transactions. He believes that this is a sure sign that China is ready to accept the existence of digital assets and ease the pressure on crypto projects.

Even the fact that fiscal authorities require crypto-markets to register users who invest in cryptocurrencies did not dim his joy.

At the same time, he claims that Huobi is registered in the Seychelles and thus is not required to provide customer information.

And Justin Sun dreams that the TRON blockchain will be adopted in China at the national level.

What else is there to say? Justin Sun is like Jean-Claude Van Damme, but for crypto.

Justin Sun, co-founder of the Huobi exchange, expressed his delight at China's decision to levy a tax on cryptocurrency transactions. He believes that this is a sure sign that China is ready to accept the existence of digital assets and ease the pressure on crypto projects.

Even the fact that fiscal authorities require crypto-markets to register users who invest in cryptocurrencies did not dim his joy.

At the same time, he claims that Huobi is registered in the Seychelles and thus is not required to provide customer information.

And Justin Sun dreams that the TRON blockchain will be adopted in China at the national level.

What else is there to say? Justin Sun is like Jean-Claude Van Damme, but for crypto. 1 - 15 of 15 results