TERRA continues to buy BTC and AVAX

The market price of bitcoin continues to receive support from public adoption by large corporations and blockchain projects.

If in 2021 the biggest investment in bitcoin was the official purchases by Tesla for $1.5 billion, then in 2022 the main driver for the market can be considered a very strong long position announced by the Luna Foundation Guard (the non-profit foundation behind the TERRA project).

$10 billion worth of bitcoins will serve as security for Terra’s own algorithmic stablecoin, Terra USD (ticker: UST). Such a mechanism will be designed to maintain a stable ratio of UST to the US dollar 1:1, which was not always possible to achieve using the LUNA (TERRA native token) burn mechanism.

It is planned to diversify exchange rate risks with the AVAX token of the Avalanche platform that does not correlate with BTC. Also, about 8 million LUNA remain in the project treasury.

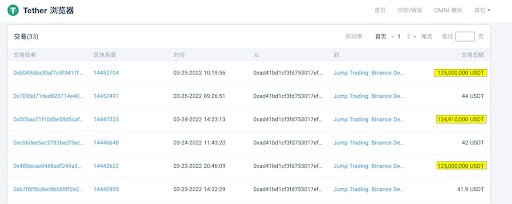

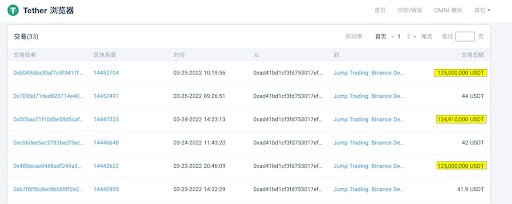

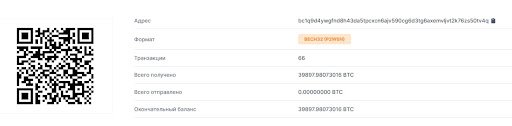

The first transactions of $125 million (in USDT) were made from a wallet allegedly owned by TERRA co-founder Do Kwon:

Later Kwon confirmed it when, after another $230 million deal, he jokingly told his followers that BTC purchase is a relatively routine activity in the middle of his ToDo list, between writing emails and cleaning the house.

The President of El Salvador Nayib Bukele had previously spoken in the same vein when wrote on his Twitter that he made purchases from the Chivo state wallet from the bathroom, and even from the toilet.

The joke was picked up by another eccentric bitcoin “wholesaler” Michael Saylor (head of MicroStrategy, another major BTC holder), advising to hire someone to clean the house to free up some more time for buying bitcoins.

Later Kwon confirmed it when, after another $230 million deal, he jokingly told his followers that BTC purchase is a relatively routine activity in the middle of his ToDo list, between writing emails and cleaning the house.

The President of El Salvador Nayib Bukele had previously spoken in the same vein when wrote on his Twitter that he made purchases from the Chivo state wallet from the bathroom, and even from the toilet.

The joke was picked up by another eccentric bitcoin “wholesaler” Michael Saylor (head of MicroStrategy, another major BTC holder), advising to hire someone to clean the house to free up some more time for buying bitcoins.

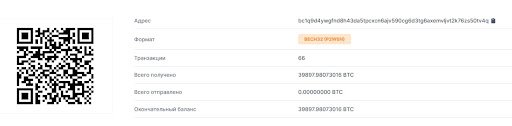

Note that only about 20% of the planned LFG funds (39,897 BTC worth $1.7 billion) have been secured to date, so markets are enthusiastically awaiting further purchases by the project. Especially in terms of bitcoin’s expected rally to the $100,000 psychological level.

Note that only about 20% of the planned LFG funds (39,897 BTC worth $1.7 billion) have been secured to date, so markets are enthusiastically awaiting further purchases by the project. Especially in terms of bitcoin’s expected rally to the $100,000 psychological level.

Recommended