What is a crypto on-chain analysis and how to use it?

On-chain analysis is a relatively new technique for researching an asset that emerged along with cryptocurrencies. The on-chain analysis helps to obtain information about a coin using the data recorded on its blockchain.

Although technical analysis can help to predict the future movement of the asset price, experienced traders know that it doesn’t hurt to look at the on-chain performance of a coin before making a decision. This includes:

● information about completed transactions;

● amount of funds transferred;

● wallet addresses;

● amount of fees;

● the amount of money and its distribution among addresses.

Since information on the blockchain cannot be altered or deleted, all transactions inside the blockchain stay in its ledger forever.

Off-chain data are transactions that take place outside the network. This information is not recorded on the blockchain. The off-chain method involves storing data on traditional servers. Off-chain data is processed by third parties, so this information is more difficult to obtain as it is not publicly available.

The on-chain analysis is a process of data collection by examining transaction history, hashrate, and other details of the blockchain of the given cryptocurrency. It also includes the market sentiment analysis and monitoring the actions of big players.

Let's take a look at several on-chain analysis tools that help to predict future price movements more accurately.

1. Active addresses

An address becomes active as soon as it participates in a successful transaction as a sender or recipient. The number of active addresses is a good indicator showing the number of active network users.

This is an indicator of steady demand for the project’s functionality and how often people use this crypto.

2. Market Value to Realized Value (MVRV)

This indicator shows the ratio of an asset's market capitalization to its realized capitalization. It is used to determine the current market situation. MVRV helps determine the average profit or loss of investors who have bought an asset.

If MVRV is at or above 3,7, the market is most probably at its peak. If the metric is below 1, the market is most probably at the bottom.

3. Hashrate

Hashrate is the total computational power used in mining and transaction confirmations on PoW blockchains.

Hashrate is an important metric that helps to evaluate the security and efficiency of a blockchain network. Hashrate grows when a large number of miners connect to the network. The larger the hashrate, the more difficult it is to attack the network. Thus, a high hashrate is an indicator of reliable protection against hackers.

On the other hand, a decreasing hashrate means that miners are shutting down their ASICs. This makes the network more vulnerable.

Best on-chain analysis tools

There are a lot of popular platforms that provide their users with access to structured on-chain data.

1. Glassnode

Glassnode is a service that helps you monitor the market using a range of indicators. It is popular in the community due to regular publications of crypto market analysis.

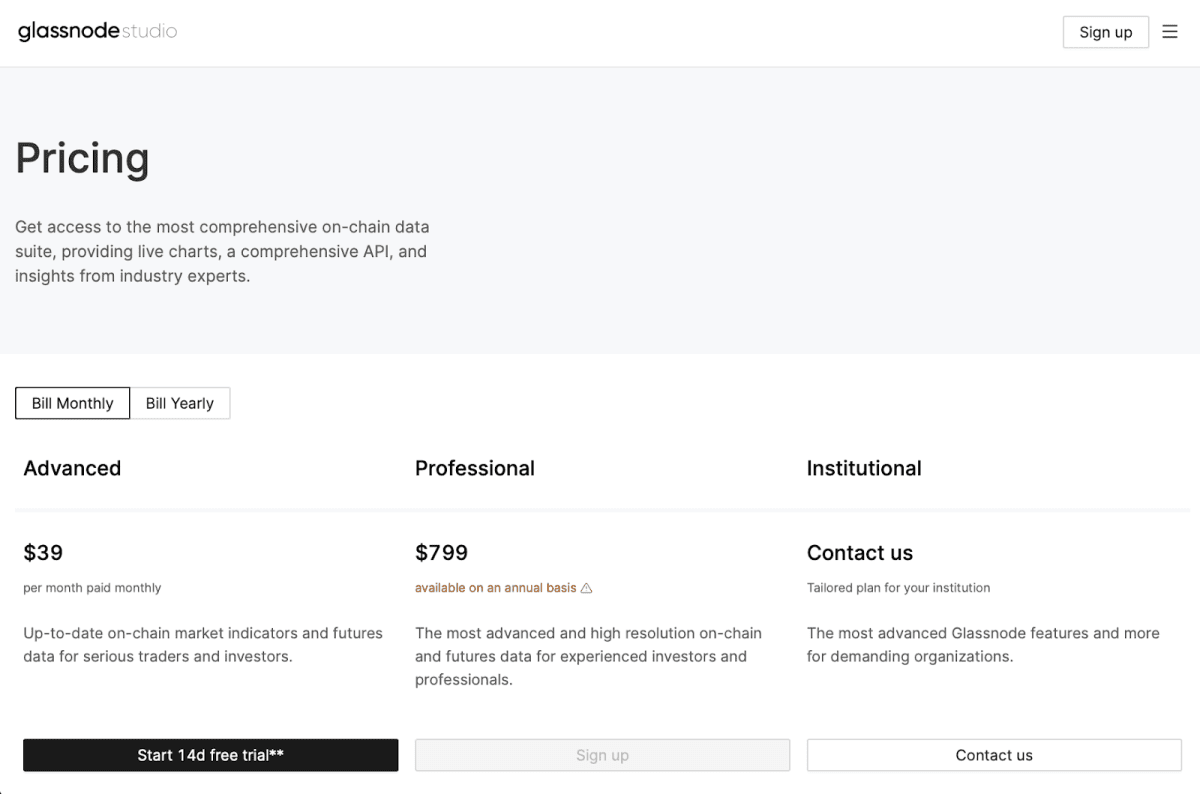

The platform allows you to view information about address activity, supply, and long-term holders in real-time. Glassnode is free to use but to get access to premium features users have to pay from $39 (for the standard package) to $799 (for the professional package) per month.

Glassnode pricing. Source: glassnode.com

Glassnode features:

● a large number of on-chain indicators for different cryptocurrencies

● Tradingview integration

● customizable dashboard with a clear interface

● over 200 metrics and indicators

2. Nansen

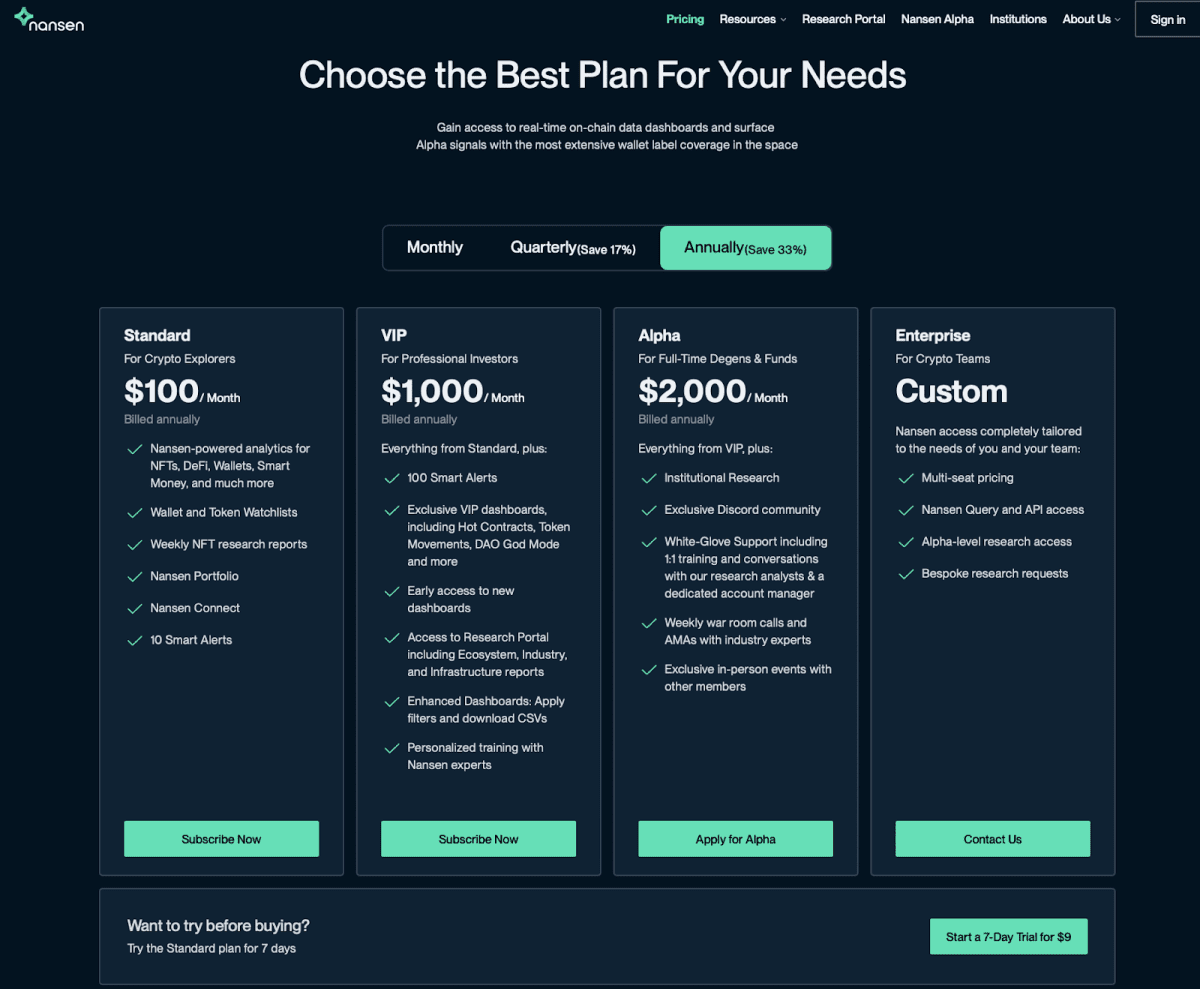

Nansen is a popular on-chain analysis platform focused primarily on the Ethereum blockchain. It is free to use, but access to advanced features will cost traders from $100 (for the standard package) to $2000 (for the Alpha package) per month.

Nansen pricing. Source: nansen.ai

Nansen features:

● dashboards that enable the analysis of NFTs, DeFi, and DAOs;

● regular market trend reports;

● the function of detecting graphic patterns on cryptocurrency charts.

3. Santiment

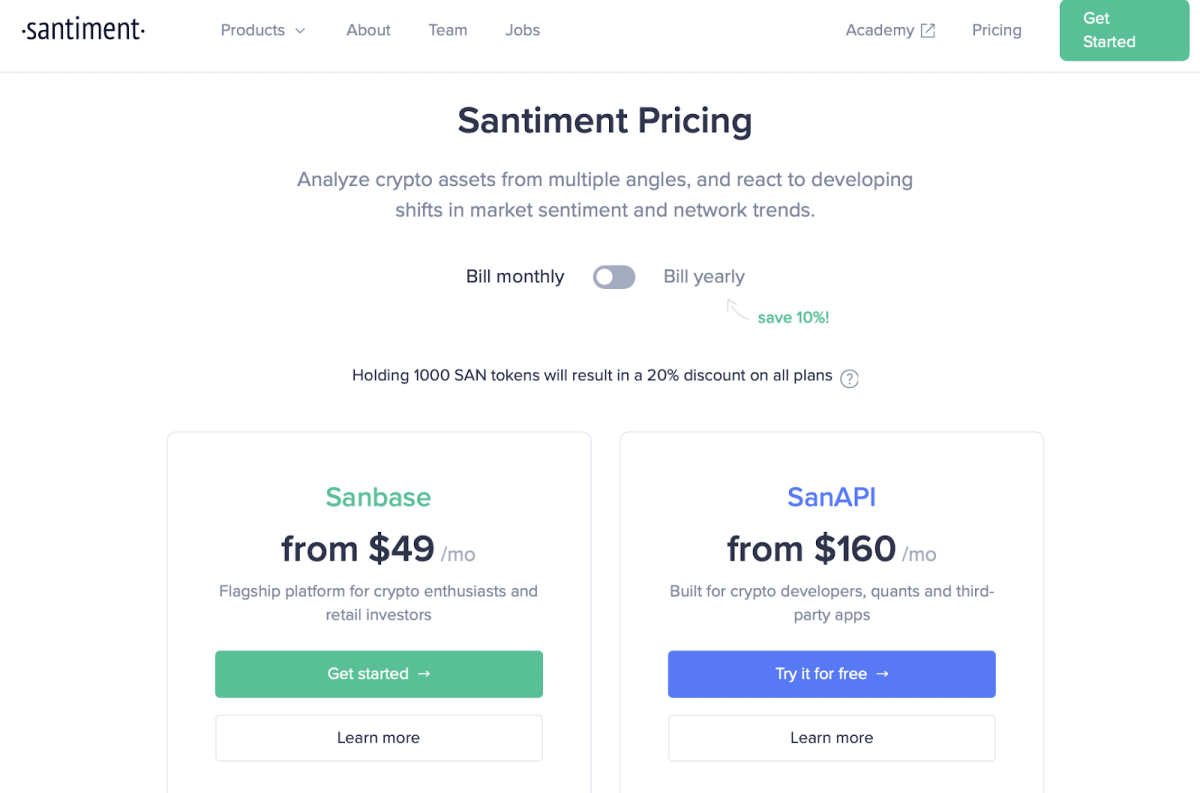

It is a market analysis tool that helps traders to gather data more efficiently. Santiment is known for its newsletters, which all registered users receive. These are overviews of the current situation and reports on major market movements. Santiment plans are available in the range of $49 to $160 per month.

Santiment pricing. Source: santiment.net

Santiment features:

● trend analysis in social networks;

● Investor behavior reports;

● personalized dashboard;

● a large number of on-chain metrics.

The on-chain analysis enables traders to receive complete data and make trading decisions, based on this data. It also helps to better evaluate the prospects of the project. Therefore, the skill of on-chain analysis is useful for both day traders and long-term investors.

Recommended